Question: Hello everyone, Can someone help me please and solve this problem, I traid solved it but I don't know if my solution is correct. I

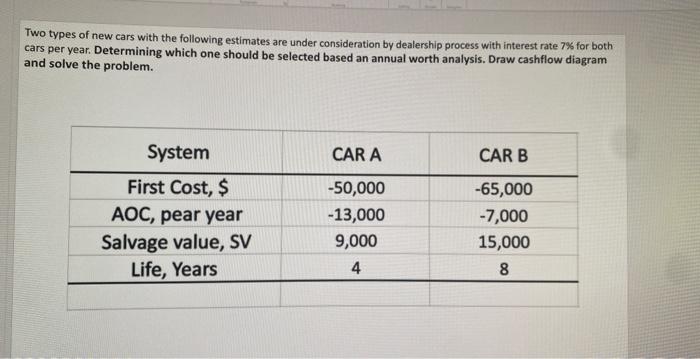

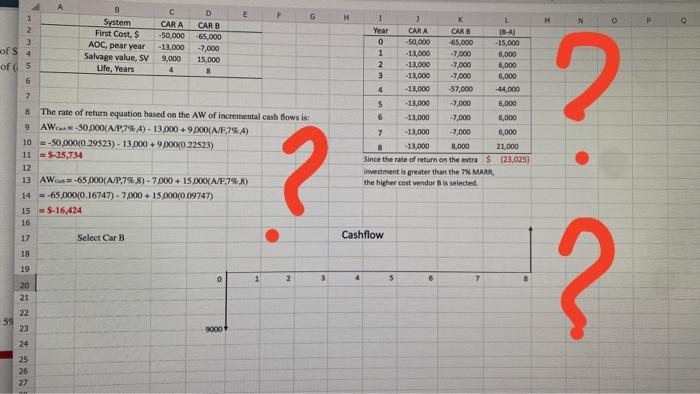

Two types of new cars with the following estimates are under consideration by dealership process with interest rate 7% for both cars per year. Determining which one should be selected based an annual worth analysis. Draw cashflow diagram and solve the problem. The rate of return equation based on the AW of incremental cash flows is:AWrat =50,000(A,P,7%,4)13,000+9,000( A.F. 7%,4) =50,000(0.29523)13,000+9,0000.22523)=$25,734 AWa=65,000(AP7%,8)7,000+15,000(AN,7%,8)=65,000(0,16747)7,000+15,000(0,09747)=$16,424 Two types of new cars with the following estimates are under consideration by dealership process with interest rate 7% for both cars per year. Determining which one should be selected based an annual worth analysis. Draw cashflow diagram and solve the problem. The rate of return equation based on the AW of incremental cash flows is:AWrat =50,000(A,P,7%,4)13,000+9,000( A.F. 7%,4) =50,000(0.29523)13,000+9,0000.22523)=$25,734 AWa=65,000(AP7%,8)7,000+15,000(AN,7%,8)=65,000(0,16747)7,000+15,000(0,09747)=$16,424

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts