Question: Hello expert, please help me with this question. Metro Bank plc was launched on 29 July 2010 with four branches in London. It was the

Hello expert, please help me with this question.

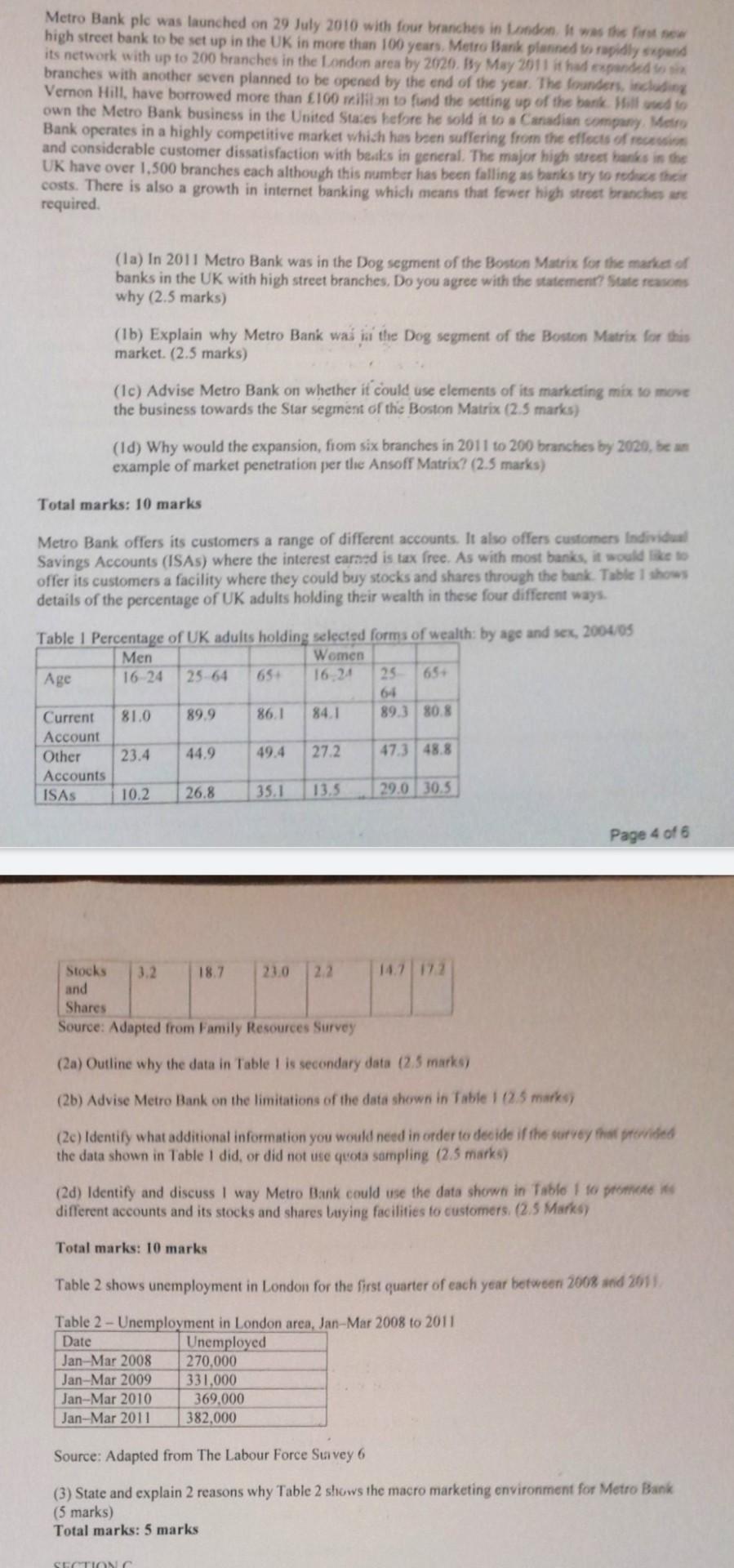

Metro Bank plc was launched on 29 July 2010 with four branches in London. It was the first new high street bank to be set up in the UK in more than 100 years. Metro Bank planned to rapidly expand its network with up to 200 branches in the London area by 2020. By May 2011 it had expanded to six branches with another seven planned to be opened by the end of the year. The founders, including Vernon Hill, have borrowed more than 100 milion to fund the setting up of the bank Hill used to own the Metro Bank business in the United States before he sold it to a Canadian company, Metro Bank operates in a highly competitive market which has been suffering from the effects of recession and considerable customer dissatisfaction with beaks in general. The major high street hanks in the UK have over 1,500 branches each although this number has been falling as banks try to reduce their costs. There is also a growth in internet banking which means that fewer high street branches are required. (la) In 2011 Metro Bank was in the Dog segment of the Boston Matrix for the market of banks in the UK with high street branches. Do you agree with the statement? State reasons why (2.5 marks) (lb) Explain why Metro Bank was in the Dog segment of the Boston Matrix for this market. (2.5 marks) (1c) Advise Metro Bank on whether it could use elements of its marketing mix to move the business towards the Star segment of the Boston Matrix (2.5 marks) (Id) Why would the expansion, from six branches in 2011 to 200 branches by 2020, be an example of market penetration per the Ansoff Matrix? (2.5 marks) Total marks: 10 marks Metro Bank offers its customers a range of different accounts. It also offers customers Individual Savings Accounts (ISAS) where the interest earned is tax free. As with most banks, it would like to offer its customers a facility where they could buy stocks and shares through the bank. Table I shows details of the percentage of UK adults holding their wealth in these four different ways. Table 1 Percentage of UK adults holding selected forms of wealth: by age and sex, 2004/05 Men Women Age 16-24 25-64 65+ 16,24 25 65+ 64 Current 81.0 89.9 86.1 84.1 89.3 80.8 Account Other 23.4 44.9 49.4 27.2 47.3 48.8 Accounts ISAs 10.2 26.8 35.1 13.5 29.0 30.5 Page 4 of 6 Stocks 3.2 18.7 23.0 2.2 and EPPTPTT Shares Source: Adapted from Family Resources Survey (2a) Outline why the data in Table 1 is secondary data (2.5 marks) (2b) Advise Metro Bank on the limitations of the data shown in Table 1 (2.5 marks) (2c) Identify what additional information you would need in order to decide if the survey that provided the data shown in Table I did, or did not use quota sampling (2.5 marks) (2d) Identify and discuss I way Metro Bank could use the data shown in Table 1 to promote different accounts and its stocks and shares buying facilities to customers. (2.5 Marks) Total marks: 10 marks Table 2 shows unemployment in London for the first quarter of each year between 2008 and 2011. Table 2-Unemployment in London area, Jan-Mar 2008 to 2011 Date Unemployed Jan-Mar 2008 270,000 Jan-Mar 2009 331,000 Jan-Mar 2010 Jan-Mar 2011 382,000 Source: Adapted from The Labour Force Survey 6 (3) State and explain 2 reasons why Table 2 shows the macro marketing environment for Metro Bank (5 marks) Total marks: 5 marks SECTION C 369,000Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock