Question: Hello expert tutor. Correct solutions please. Thank you A small town is served by a single funeral director. The funeral director collects corpses immediately following

Hello expert tutor. Correct solutions please. Thank you

A small town is served by a single funeral director. The funeral director collects

corpses immediately following death and stores them in a refrigerator pending

embalming. The number of deaths per day in this town has the following probability

distribution:

Number of

deaths per day Probability

0 0.497

1 0.348

2 0.122

3 0.028

4 0.005

The embalmer can embalm exactly one corpse per day. He works on a corpse from

the refrigerator if there is one, but if the refrigerator is empty he works on the first

corpse to arrive that day. Corpses are removed from the refrigerator immediately

before being embalmed and are not returned there after embalming.

The refrigerator has room for four corpses. If more space is needed, the funeral

director has to ask the local hospital if there is spare capacity in the hospital's

refrigerator.

(i) Determine the transition matrix for the number of corpses in the funeral

director's refrigerator. [3]

(ii) Calculate the long-run probability of there being 0, 1, 2, 3 and 4 corpses in the

refrigerator. [5]

(iii) Calculate the probability that the funeral director has to contact the hospital on

any given day. [2]

The embalmer has not had a day off for years. The funeral director says that from now

on the embalmer must not work on Christmas Day.

(iv) Calculate the probability that the funeral director will need to contact the

hospital on Christmas Day when the embalmer is not working.

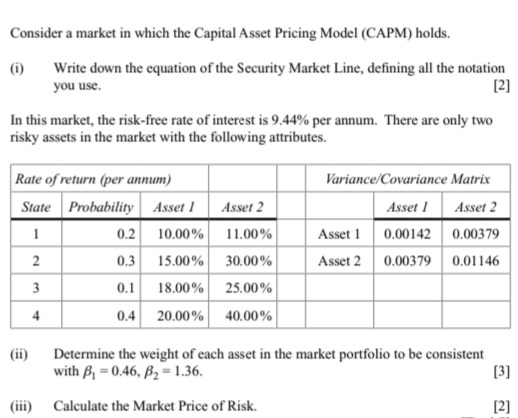

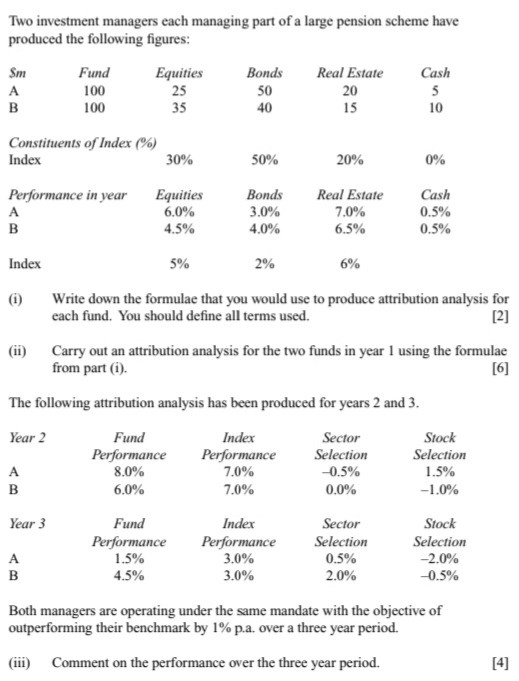

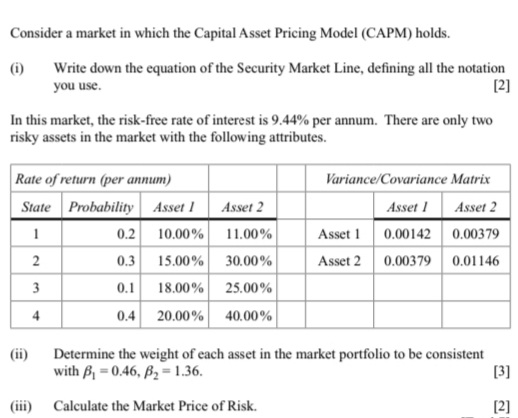

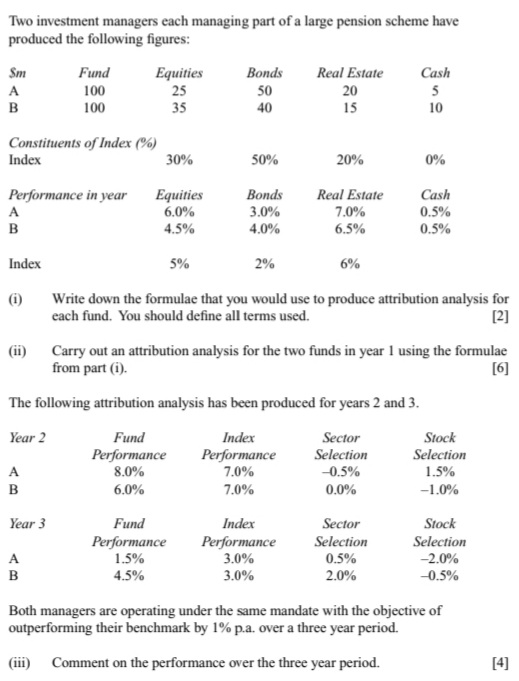

Consider a market in which the Capital Asset Pricing Model (CAPM) holds. (i) Write down the equation of the Security Market Line, defining all the notation you use. [2] In this market, the risk-free rate of interest is 9.44% per annum. There are only two risky assets in the market with the following attributes. Rate of return (per annum) Variance/Covariance Matrix State Probability Asset I Asset 2 Asset I Asset 2 0.2 10.00% 11.00% Asset 1 0.00142 0.00379 2 0.3 15.00% 30.00% Asset 2 0.00379 0.01146 3 0.1 18.00% 25.00% 0.4 20.00% 40.00% (ii) Determine the weight of each asset in the market portfolio to be consistent with B, =0.46, 62 = 1.36. [3] (iii) Calculate the Market Price of Risk. [2]Two investment managers each managing part of a large pension scheme have produced the following figures: Sm Fund Equities Bonds Real Estate Cash A 100 25 50 20 B 100 35 40 15 10 Constituents of Index (%) Index 30% 50% 20% 0% Performance in year Equities Bonds Real Estate Cash A 6.0% 3.0% 7.0% 0.5% B 4.5% 4.0% 6.5% 0.5% Index 5% 2% 6% (i) Write down the formulae that you would use to produce attribution analysis for each fund. You should define all terms used. [2] (ii) Carry out an attribution analysis for the two funds in year 1 using the formulae from part (i). [6] The following attribution analysis has been produced for years 2 and 3. Year 2 Fund Index Sector Stock Performance Performance Selection Selection A 8.0% 7.0% -0.5% 1.5% B 6.0% 7.0% 0.0% -1.0% Year 3 Fund Index Sector Stock Performance Performance Selection Selection A 1.5% 3.0% 0.5% -2.0% B 4.5% 3.0% 2.0% -0.5% Both managers are operating under the same mandate with the objective of outperforming their benchmark by 1% pa. over a three year period. (iii) Comment on the performance over the three year period. [4]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts