Question: Hello Experts! This is only ONE question with a multistep (3 multisteps part a & b and the other picture shows part c). Thank you

Hello Experts! This is only ONE question with a multistep (3 multisteps part a & b and the other picture shows part c). Thank you Experts!

Hello Experts! This is only ONE question with a multistep (3 multisteps part a & b and the other picture shows part c). Thank you Experts!

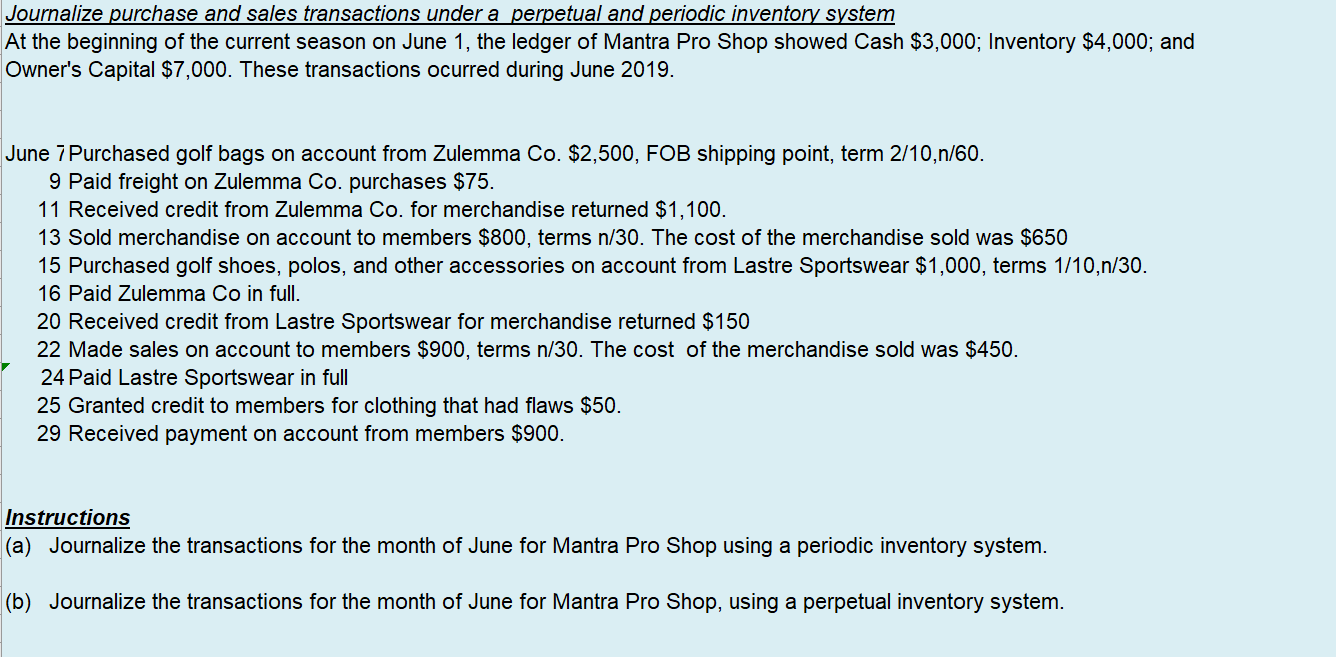

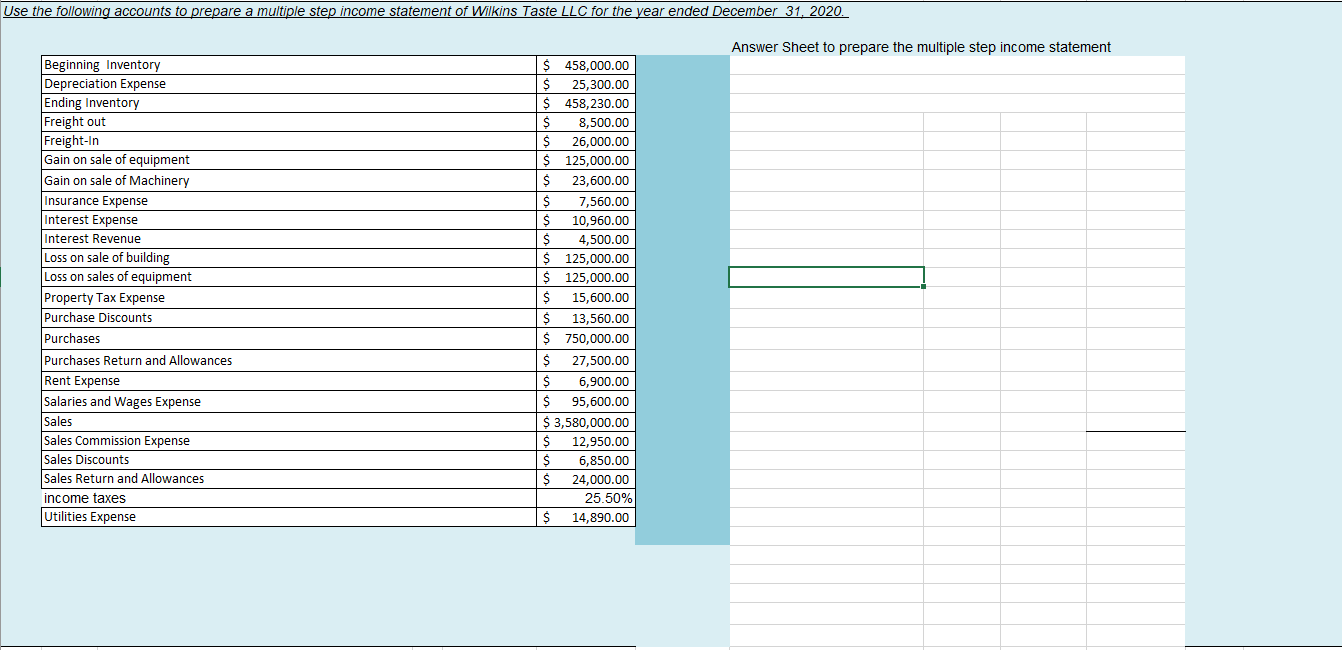

Journalize purchase and sales transactions under a perpetual and periodic inventory system At the beginning of the current season on June 1, the ledger of Mantra Pro Shop showed Cash $3,000; Inventory $4,000; and Owner's Capital $7,000. These transactions ocurred during June 2019. June 7 Purchased golf bags on account from Zulemma Co. $2,500, FOB shipping point, term 2/10,n/60. 9 Paid freight on Zulemma Co. purchases $75. 11 Received credit from Zulemma Co. for merchandise returned $1,100. 13 Sold merchandise on account to members $800, terms n/30. The cost of the merchandise sold was $650 15 Purchased golf shoes, polos, and other accessories on account from Lastre Sportswear $1,000, terms 1/10,n/30. 16 Paid Zulemma Co in full. 20 Received credit from Lastre Sportswear for merchandise returned $150 22 Made sales on account to members $900, terms n/30. The cost of the merchandise sold was $450. 24 Paid Lastre Sportswear in full 25 Granted credit to members for clothing that had flaws $50. 29 Received payment on account from members $900. Instructions (a) Journalize the transactions for the month of June for Mantra Pro Shop using a periodic inventory system. (b) Journalize the transactions for the month of June for Mantra Pro Shop, using a perpetual inventory system. Use the following accounts to prepare a multiple step income statement of Wilkins Taste LLC for the year ended December 31, 2020. Answer Sheet to prepare the multiple step income statement Beginning Inventory Depreciation Expense Ending Inventory Freight out Freight-In Gain on sale of equipment Gain on sale of Machinery Insurance Expense Interest Expense Interest Revenue Loss on sale of building Loss on sales of equipment Property Tax Expense Purchase Discounts Purchases Purchases Return and Allowances Rent Expense Salaries and Wages Expense Sales Sales Commission Expense Sales Discounts Sales Return and Allowances income taxes Utilities Expense $ 458,000.00 S 25,300.00 $ 458,230.00 $ 8,500.00 S 26,000.00 $ 125,000.00 $ 23,600.00 $ 7,560.00 $ 10,960.00 $ 4,500.00 $ 125,000.00 $ 125,000.00 $ 15,600.00 $ 13,560.00 $750,000.00 $ 27,500.00 S 6,900.00 $ 95,600.00 $ 3,580,000.00 $ 12,950.00 $ 6,850.00 $ 24,000.00 25.50% $ 14,890.00 Journalize purchase and sales transactions under a perpetual and periodic inventory system At the beginning of the current season on June 1, the ledger of Mantra Pro Shop showed Cash $3,000; Inventory $4,000; and Owner's Capital $7,000. These transactions ocurred during June 2019. June 7 Purchased golf bags on account from Zulemma Co. $2,500, FOB shipping point, term 2/10,n/60. 9 Paid freight on Zulemma Co. purchases $75. 11 Received credit from Zulemma Co. for merchandise returned $1,100. 13 Sold merchandise on account to members $800, terms n/30. The cost of the merchandise sold was $650 15 Purchased golf shoes, polos, and other accessories on account from Lastre Sportswear $1,000, terms 1/10,n/30. 16 Paid Zulemma Co in full. 20 Received credit from Lastre Sportswear for merchandise returned $150 22 Made sales on account to members $900, terms n/30. The cost of the merchandise sold was $450. 24 Paid Lastre Sportswear in full 25 Granted credit to members for clothing that had flaws $50. 29 Received payment on account from members $900. Instructions (a) Journalize the transactions for the month of June for Mantra Pro Shop using a periodic inventory system. (b) Journalize the transactions for the month of June for Mantra Pro Shop, using a perpetual inventory system. Use the following accounts to prepare a multiple step income statement of Wilkins Taste LLC for the year ended December 31, 2020. Answer Sheet to prepare the multiple step income statement Beginning Inventory Depreciation Expense Ending Inventory Freight out Freight-In Gain on sale of equipment Gain on sale of Machinery Insurance Expense Interest Expense Interest Revenue Loss on sale of building Loss on sales of equipment Property Tax Expense Purchase Discounts Purchases Purchases Return and Allowances Rent Expense Salaries and Wages Expense Sales Sales Commission Expense Sales Discounts Sales Return and Allowances income taxes Utilities Expense $ 458,000.00 S 25,300.00 $ 458,230.00 $ 8,500.00 S 26,000.00 $ 125,000.00 $ 23,600.00 $ 7,560.00 $ 10,960.00 $ 4,500.00 $ 125,000.00 $ 125,000.00 $ 15,600.00 $ 13,560.00 $750,000.00 $ 27,500.00 S 6,900.00 $ 95,600.00 $ 3,580,000.00 $ 12,950.00 $ 6,850.00 $ 24,000.00 25.50% $ 14,890.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts