Question: Hello Good day. I'm in rush right now I need this in 35 mins. Please answer this thank you! Please submit your answer as soon

Hello Good day. I'm in rush right now I need this in 35 mins. Please answer this thank you!

Please submit your answer as soon as possible thanks

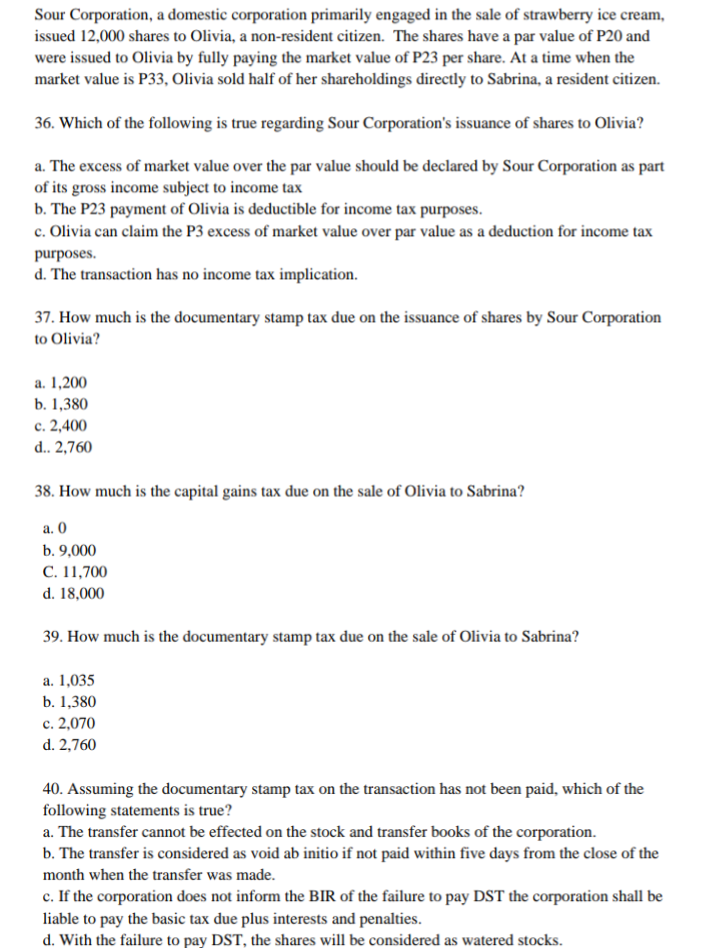

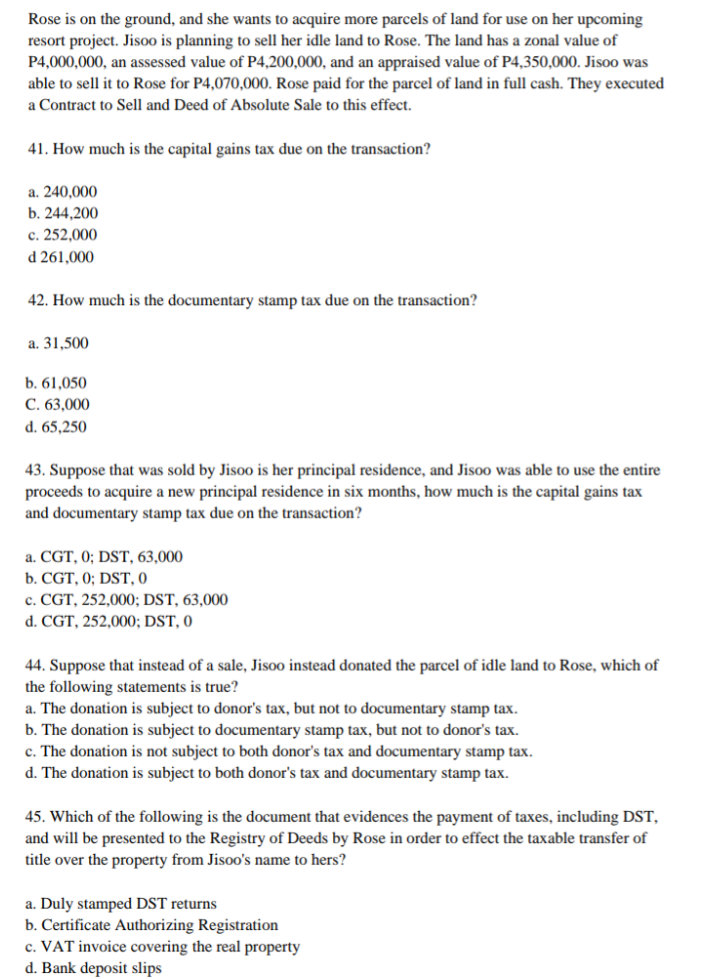

Sour Corporation, a domestic corporation primarily engaged in the sale of strawberry ice cream, issued 12,000 shares to Olivia, a non-resident citizen. The shares have a par value of P20 and were issued to Olivia by fully paying the market value of P23 per share. At a time when the market value is P33, Olivia sold half of her shareholdings directly to Sabrina, a resident citizen. 36. Which of the following is true regarding Sour Corporation's issuance of shares to Olivia? a. The excess of market value over the par value should be declared by Sour Corporation as part of its gross income subject to income tax b. The P23 payment of Olivia is deductible for income tax purposes. c. Olivia can claim the P3 excess of market value over par value as a deduction for income tax purposes. d. The transaction has no income tax implication. 37. How much is the documentary stamp tax due on the issuance of shares by Sour Corporation to Olivia? a. 1,200 b. 1,380 c. 2,400 d.. 2,760 38. How much is the capital gains tax due on the sale of Olivia to Sabrina? a. 0 b. 9,000 C. 11,700 d. 18,000 39. How much is the documentary stamp tax due on the sale of Olivia to Sabrina? a. 1,035 b. 1,380 c. 2,070 d. 2,760 40. Assuming the documentary stamp tax on the transaction has not been paid, which of the following statements is true? a. The transfer cannot be effected on the stock and transfer books of the corporation. b. The transfer is considered as void ab initio if not paid within five days from the close of the month when the transfer was made. c. If the corporation does not inform the BIR of the failure to pay DST the corporation shall be liable to pay the basic tax due plus interests and penalties. d. With the failure to pay DST, the shares will be considered as watered stocks.Rose is on the ground, and she wants to acquire more parcels of land for use on her upcoming resort project. Jisoo is planning to sell her idle land to Rose. The land has a zonal value of P4,000,000, an assessed value of P4,200,000, and an appraised value of P4,350,000. Jisoo was able to sell it to Rose for P4,070,000. Rose paid for the parcel of land in full cash. They executed a Contract to Sell and Deed of Absolute Sale to this effect. 41. How much is the capital gains tax due on the transaction? a. 240,000 b. 244,200 c. 252,000 d 261,000 42. How much is the documentary stamp tax due on the transaction? a. 31,500 b. 61,050 C. 63,000 d. 65,250 43. Suppose that was sold by Jisoo is her principal residence, and Jisoo was able to use the entire proceeds to acquire a new principal residence in six months, how much is the capital gains tax and documentary stamp tax due on the transaction? a. CGT, 0; DST, 63,000 b. CGT, 0; DST, 0 c. CGT, 252,000; DST, 63,000 d. CGT, 252,000; DST, 0 44. Suppose that instead of a sale, Jisoo instead donated the parcel of idle land to Rose, which of the following statements is true? a. The donation is subject to donor's tax, but not to documentary stamp tax. b. The donation is subject to documentary stamp tax, but not to donor's tax. c. The donation is not subject to both donor's tax and documentary stamp tax. d. The donation is subject to both donor's tax and documentary stamp tax. 45. Which of the following is the document that evidences the payment of taxes, including DST, and will be presented to the Registry of Deeds by Rose in order to effect the taxable transfer of title over the property from Jisoo's name to hers? a. Duly stamped DST returns b. Certificate Authorizing Registration c. VAT invoice covering the real property d. Bank deposit slips

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts