Question: hello, i already submitted this question once and the answer was incorrect. the question is asking for monthly cash flow. there are a lot of

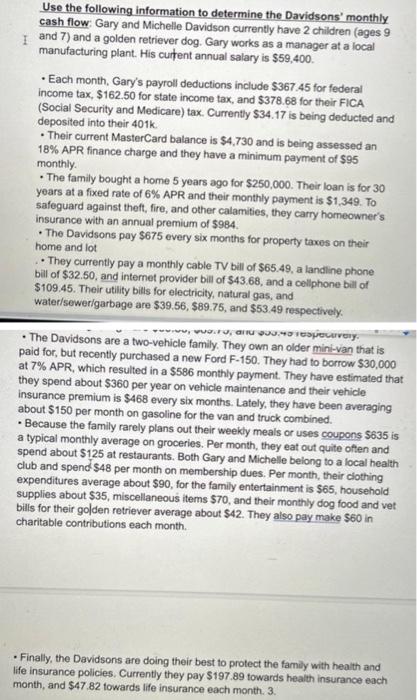

Use the following information to determine the Davidsons' monthly cash flow: Gary and Michelle Davidson currently have 2 children (ages 9 and 7 ) and a golden retriever dog. Gary works as a manager at a local manufacturing plant. His curtent annual salary is $59,400. - Each month, Gary's payroll deductions include $367.45 for federal income tax, $162.50 for state income tax, and $378.68 for their FICA (Social Security and Medicare) tax. Currently $34.17 is being deducted and deposited into their 401k. - Their current MasterCard balance is $4,730 and is being assessed an 18% APR finance charge and they have a minimum payment of $95 monthly. - The family bought a home 5 years ago for $250,000. Their loan is for 30 years at a fixed rate of 6% APR and their monthly payment is $1.349. To safeguard against theft, fire, and other calamities, they carry homeowner's insurance with an annual premium of $984. - The Davidsons pay $675 every six months for property taxes on their. home and lot - They currently pay a monthly cable TV bill of $65.49, a landine phone bill of $32.50, and internet provider bill of $43.68, and a cellphone bill of $109.45. Their utility bills for electricity, natural gas, and water/sewerigarbage are $39.56,$89.75, and $53.49 respectively. - The Davidsons are a two-vehicle family. They own an older mini-van that is paid for, but recently purchased a new Ford F-150. They had to borrow $30,000 at 7% APR, which resulted in a $586 monthly payment. They have estimated that they spend about $360 per year on vehicle maintenance and their vehicle insurance premium is $468 every six months. Lately, they have been averaging about $150 per month on gasoline for the van and truck combined. - Because the family rarely plans out their weekly meals or uses coupons $635 is a typical monthly average on groceries. Per month, they eat out quite often and spend about $125 at restaurants. Both Gary and Michelle belong to a local health club and spend $48 per month on membership dues. Per month, their clothing expenditures average about $90, for the family entertainment is $65, household supplies about $35, miscellaneous items $70, and their monthly dog food and vet bills for their golden retriever average about $42. They also pay make $60 in charitable contributions each month. - Finally, the Davidsons are doing their best to protect the family with health and life insurance policies. Currently they pay $197.89 towards health insurance each month, and $47.82 towards life insurance each month. 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts