Question: Hello, I am doing an exponential smoothing and adjusted exponential smoothing for this stock. I have trouble understanding which alpha and beta is better for

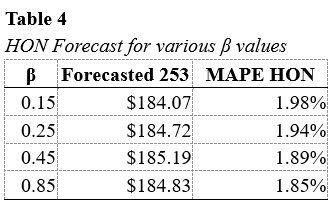

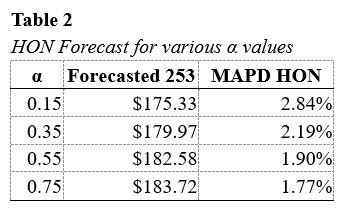

Hello, I am doing an exponential smoothing and adjusted exponential smoothing for this stock. I have trouble understanding which alpha and beta is better for my model, since the forecasted value did not reach the actual value not even closely. Are you able to explain me how to pick the best value? The actual value for Honeywell stock on 11/09/2020 was $196.99. For the adjusted exp smoothing table, the alpha was defined as 0.55. Thank you in advance!

\f\f

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts