Question: Hello, I am having difficulty figuring out these problems for my case study. Can anyone help and explain how to do the calculations? Especially for

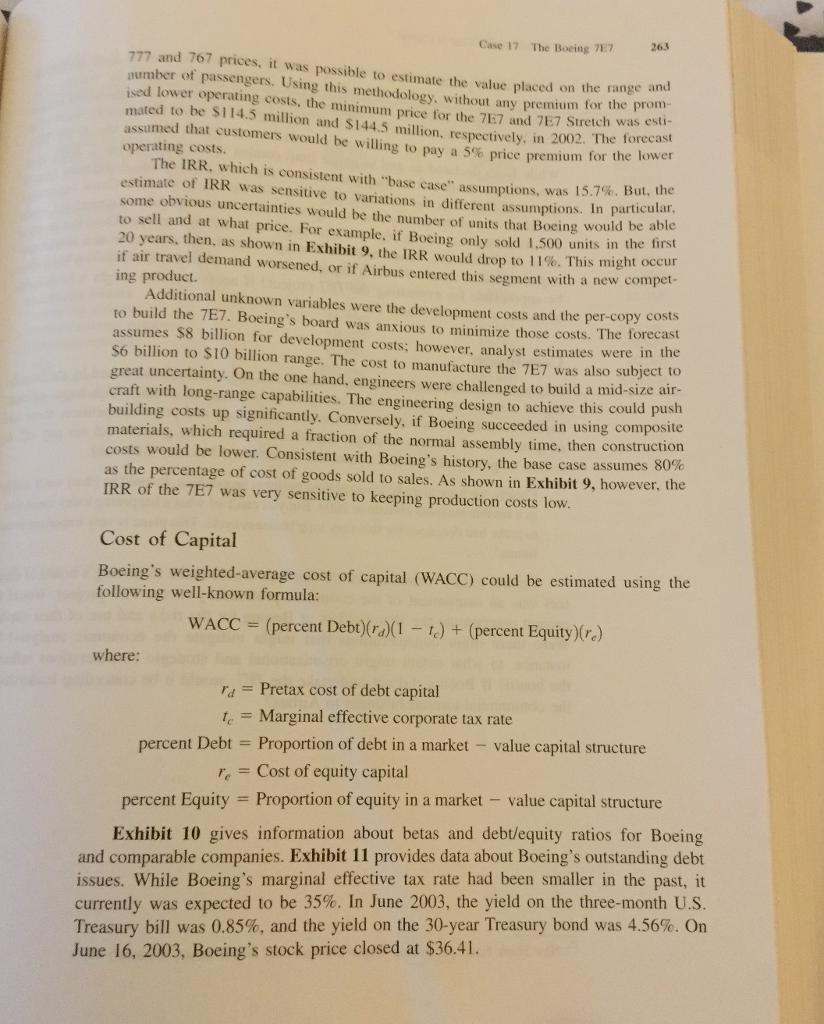

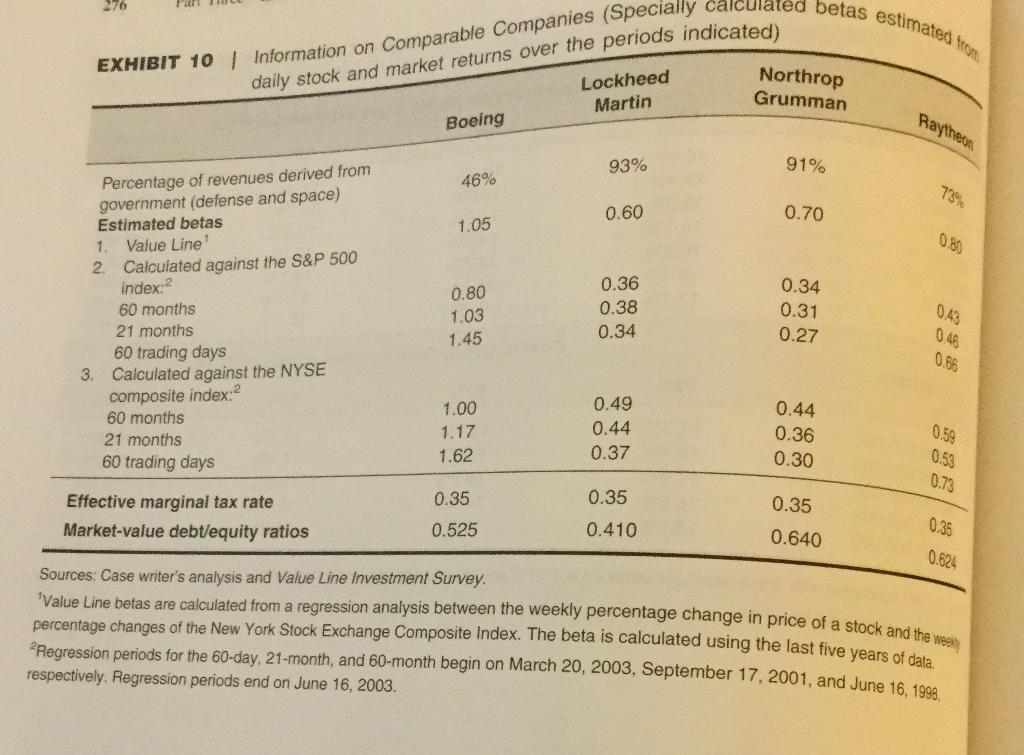

Hello, I am having difficulty figuring out these problems for my case study. Can anyone help and explain how to do the calculations? Especially for Part A to C? I can't seem to determine the beta and risk free rate and market return to figure out the market risk premium for the Cost of Equity Equation. And I am not sure how I would estimate WACC since I believe I need the Cost of Equity in there? I am having a hard time figuring out what numbers goes into the equation.

Also, I don't quite understand what Part C is asking for.?

Lastly, my professor said Rm can be 10.5%.?

1. Let’s examine the details of how to estimate the WACC. Let’s go step-by-step. Where shall we get started?

2. The weighted-average cost of capital is a simple formula. Yet it seems that reasonable people can disagree about the estimates. How can there be such a range of cost of capital estimates? Please summarize the issues.

3. What is an appropriate required rate of return against which to evaluate the prospective IRRs from the Boeing 7E7?

According to the case study, it is stated that the computer internal rate of return (IRR) should be equal to 16%. If NPV > 0, the project should be taken, if less than 0, the project should be rejected, if NPV = 0, the project should be taken with caution.

A. Please use the capital asset pricing model to estimate the cost of equity. At the date of the case, the 74-year equity market risk premium (EMRP) was estimated to be ___. Which beta and risk-free rate did you use? Why?

B. When you used the capital asset pricing model, which risk-premium and risk-free rate did you use? Why?

C. Which capital-structure weights did you use? Why?

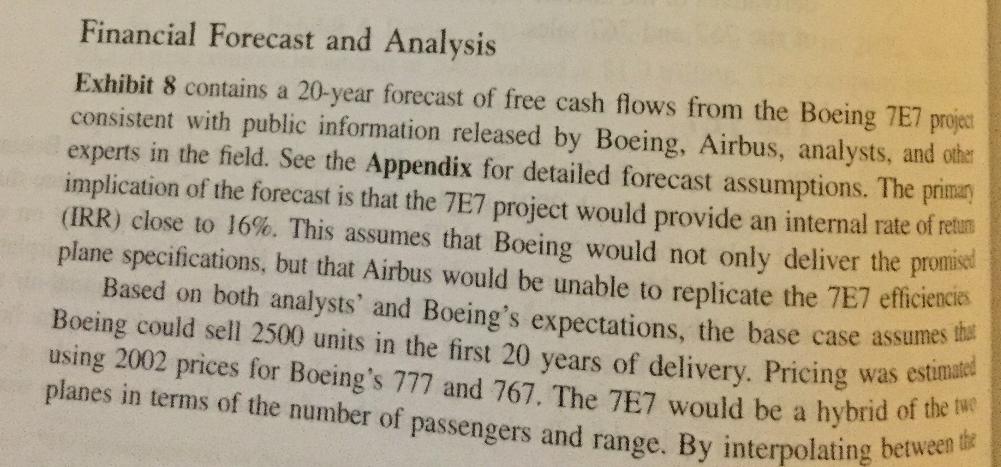

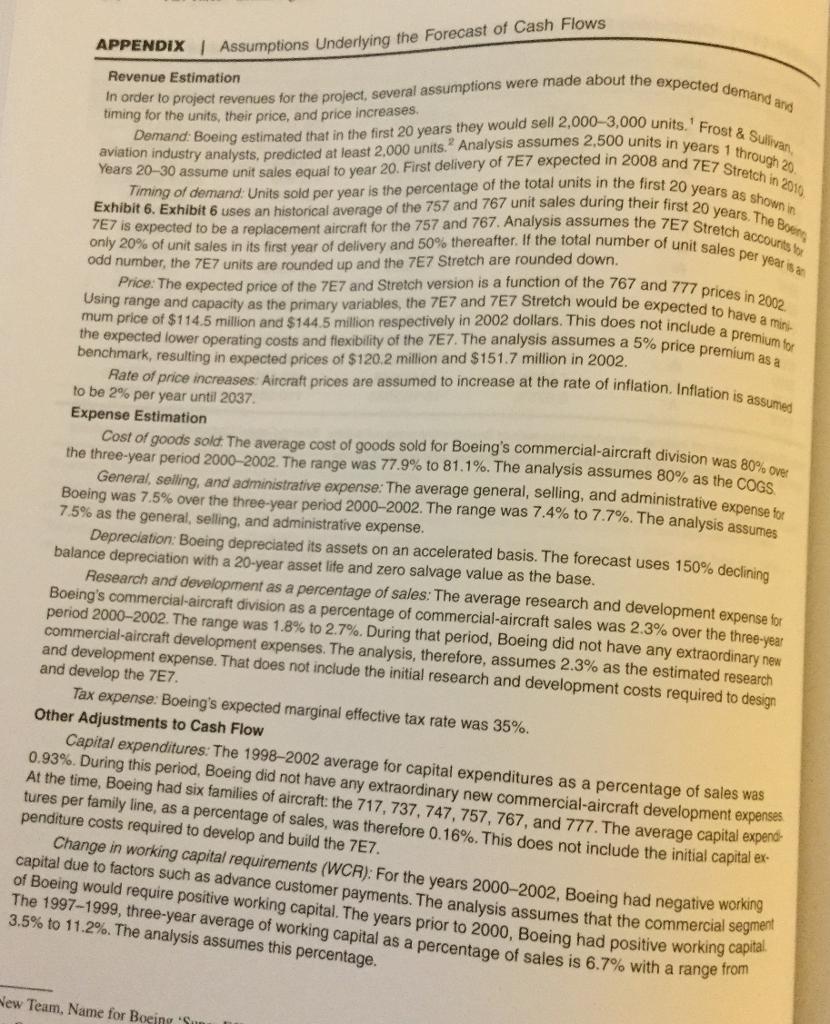

Financial Forecast and Analysis Exhibit 8 contains a 20-year forecast of free cash flows from the Boeing 7E7 project consistent with public information released by Boeing, Airbus, analysts, and other experts in the field. See the Appendix for detailed forecast assumptions. The primary implication of the forecast is that the 7E7 project would provide an internal rate of retur (IRR) close to 16%. This assumes that Boeing would not only deliver the promised plane specifications, but that Airbus would be unable to replicate the 7E7 efficiencies Based on both analysts' and Boeing's expectations, the base case assumes that Boeing could sell 2500 units in the first 20 years of delivery. Pricing was estimated using 2002 prices for Boeing's 777 and 767. The 7E7 would be a hybrid of the twe planes in terms of the number of passengers and range. By interpolating between the

Step by Step Solution

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts