Question: Hello, I am struggling on this assignment and would be great to be shown the work/answers to these problems. Feel free to present an excel

Hello,

I am struggling on this assignment and would be great to be shown the work/answers to these problems. Feel free to present an excel screenshot if easiest. Thank you very much in advance.

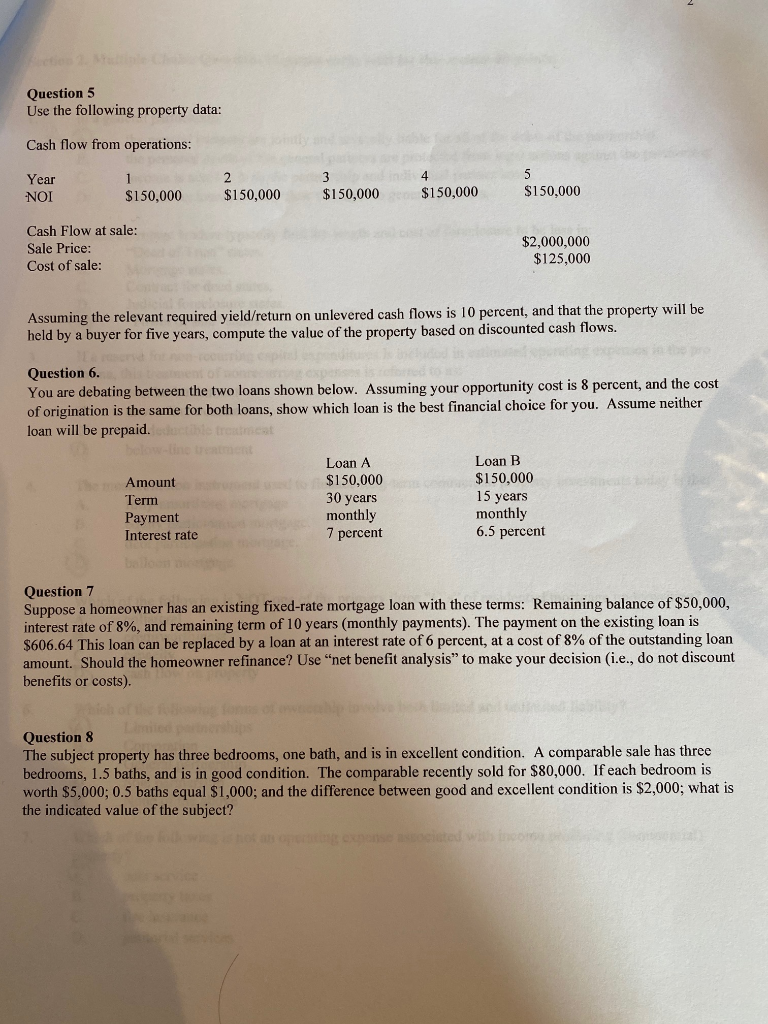

Question 5 Use the following property data: Cash flow from operations: Year NOI $150,000 $150,000 $150,000 $150,000 $150,000 Cash Flow at sale: Sale Price: Cost of sale: $2,000,000 $125,000 Assuming the relevant required yield/return on unlevered cash flows is 10 percent, and that the property will be held by a buyer for five years, compute the value of the property based on discounted cash flows. Question 6. You are debating between the two loans shown below. Assuming your opportunity cost is 8 percent, and the cost of origination is the same for both loans, show which loan is the best financial choice for you. Assume neither loan will be prepaid. Amount Term Payment Interest rate Loan A $150,000 30 years monthly 7 percent Loan B $150,000 15 years monthly 6.5 percent Question 7 Suppose a homeowner has an existing fixed-rate mortgage loan with these terms: Remaining balance of $50,000, interest rate of 8%, and remaining term of 10 years (monthly payments). The payment on the existing loan is $606.64 This loan can be replaced by a loan at an interest rate of 6 percent, at a cost of 8% of the outstanding loan amount. Should the homeowner refinance? Use "net benefit analysis to make your decision (i.e., do not discount benefits or costs). Question 8 The subject property has three bedrooms, one bath, and is in excellent condition. A comparable sale has three bedrooms, 1.5 baths, and is in good condition. The comparable recently sold for $80,000. If each bedroom is worth $5,000; 0.5 baths equal $1,000; and the difference between good and excellent condition is $2,000; what is the indicated value of the subject? ted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts