Question: Hello, I am struggling on this assignment and would be great to be shown the work/answers to these problems. Feel free to present an excel

Hello,

I am struggling on this assignment and would be great to be shown the work/answers to these problems. Feel free to present an excel screenshot if easiest. Thank you very much in advance.

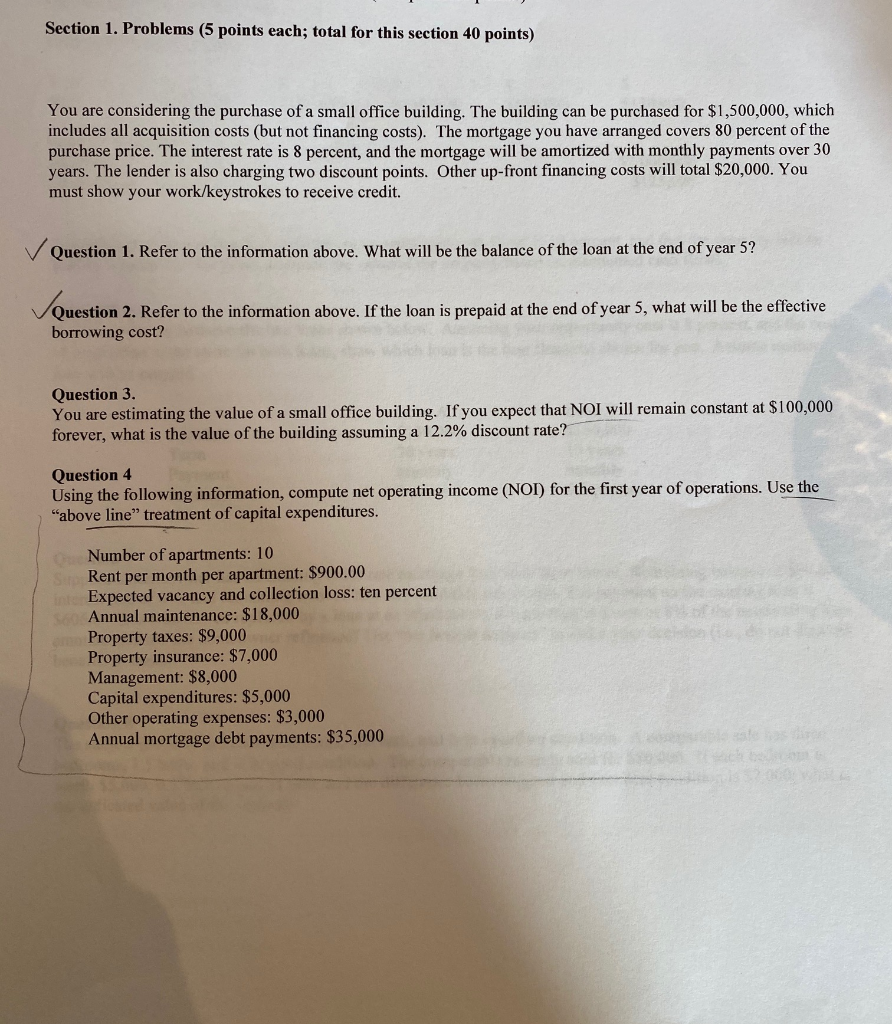

Section 1. Problems (5 points each; total for this section 40 points) You are considering the purchase of a small office building. The building can be purchased for $1,500,000, which includes all acquisition costs (but not financing costs). The mortgage you have arranged covers 80 percent of the purchase price. The interest rate is 8 percent, and the mortgage will be amortized with monthly payments over 30 years. The lender is also charging two discount points. Other up-front financing costs will total $20,000. You must show your work/keystrokes to receive credit. V Question 1. Refer to the information above. What will be the balance of the loan at the end of year 5? Question 2. Refer to the information above. If the loan is prepaid at the end of year 5, what will be the effective borrowing cost? Question 3. You are estimating the value of a small office building. If you expect that NOI will remain constant at $100,000 forever, what is the value of the building assuming a 12.2% discount rate? Question 4 Using the following information, compute net operating income (NOI) for the first year of operations. Use the "above line" treatment of capital expenditures. Number of apartments: 10 Rent per month per apartment: $900.00 Expected vacancy and collection loss: ten percent Annual maintenance: $18,000 Property taxes: $9,000 Property insurance: $7,000 Management: $8,000 Capital expenditures: $5,000 Other operating expenses: $3,000 Annual mortgage debt payments: $35,000 Section 1. Problems (5 points each; total for this section 40 points) You are considering the purchase of a small office building. The building can be purchased for $1,500,000, which includes all acquisition costs (but not financing costs). The mortgage you have arranged covers 80 percent of the purchase price. The interest rate is 8 percent, and the mortgage will be amortized with monthly payments over 30 years. The lender is also charging two discount points. Other up-front financing costs will total $20,000. You must show your work/keystrokes to receive credit. V Question 1. Refer to the information above. What will be the balance of the loan at the end of year 5? Question 2. Refer to the information above. If the loan is prepaid at the end of year 5, what will be the effective borrowing cost? Question 3. You are estimating the value of a small office building. If you expect that NOI will remain constant at $100,000 forever, what is the value of the building assuming a 12.2% discount rate? Question 4 Using the following information, compute net operating income (NOI) for the first year of operations. Use the "above line" treatment of capital expenditures. Number of apartments: 10 Rent per month per apartment: $900.00 Expected vacancy and collection loss: ten percent Annual maintenance: $18,000 Property taxes: $9,000 Property insurance: $7,000 Management: $8,000 Capital expenditures: $5,000 Other operating expenses: $3,000 Annual mortgage debt payments: $35,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts