Question: Hello , I got this question wrong because i used the expected value and standard deviation of the minimum variance portfolio. I don't understand how

Hello , I got this question wrong because i used the expected value and standard deviation of the minimum variance portfolio. I don't understand how they are getting the tangency portfolio from this. Would someone be able to explain to me why they are using the Tangency portfolio? and how am i supposed to find the tangency portfolio , i dont understand what they quite mean by tangency portfolio. Appreciated!

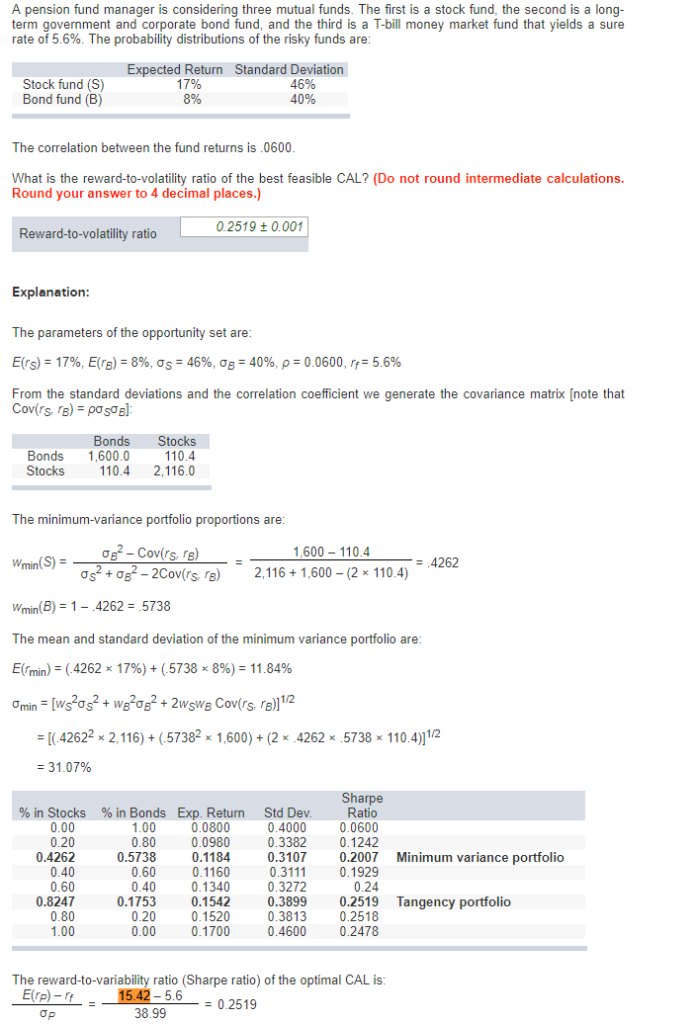

A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long- term government and corporate bond fund, and the third is a T-bill money market fund that yields a sure rate of 5.6%. The probability distributions of the risky funds are Expected Return Standard Deviation Stock fund (S) Bond fund (B) 17% 8% 46% 40% The correlation between the fund returns is.0600 What is the reward-to-volatility ratio of the best feasible CAL? (Do not round intermediate calculations. Round your answer to 4 decimal places.) 02519 t 0.001 Reward-to-volatility ratio Explanation The parameters of the opportunity set are E(rs) : 17%. E('s) : 8%, s* 46%, s* 40%, p:0.0600, rf: 5.6% From the standard deviations and the correlation coefficient we generate the covariance matrix [note that Bonds 1,600.0 Stocks Bonds Stocks 110.4 110.4 2,116.0 The minimum-variance portfolio proportions are 1600 1104 2.116 + 1.600-(2x 110.4) 4262 0s2 + B2-2Cov('s g) Wmin(B)1-4262 5738 The mean and standard deviation of the minimum variance portfolio are E(rmin)-(.4262x 1796) + (. 5738x 896)-11.84% 42622 2,116)(5738 1,600)+(2x 4262 5738110.4)12 31.07% Sharpe % in Stocks % in Bonds Exp Return Std 0.00 0.20 0.4262 0.40 0.60 1.00 0.80 0.5738 0.60 0.40 0.0800 0.0980 0.1184 0.1160 0.1340 Ratio 0.0600 0.3382 0.1242 0.2007 0.1929 0.24 0.4000 0.3107 0.3111 0.3272 Minimum variance portfolio 0.8247 0.753 0.1542 0.3899 0.2519 Tangency portfolio 0.80 1.00 0.20 0.00 0.1520 0.1700 0.3813 0.2518 0.4600 0.2478 The reward-to-variability ratio (Sharpe ratio) of the optimal CAL is E(rp)-r -_1542-5.6 -=0.2519 38.99

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts