Question: Hello I need a detailed answer for this problem and please explain how to calculate OCF Problem 2 (20 points) Mills is considering a new

Hello I need a detailed answer for this problem and please explain how to calculate OCF

Hello I need a detailed answer for this problem and please explain how to calculate OCF

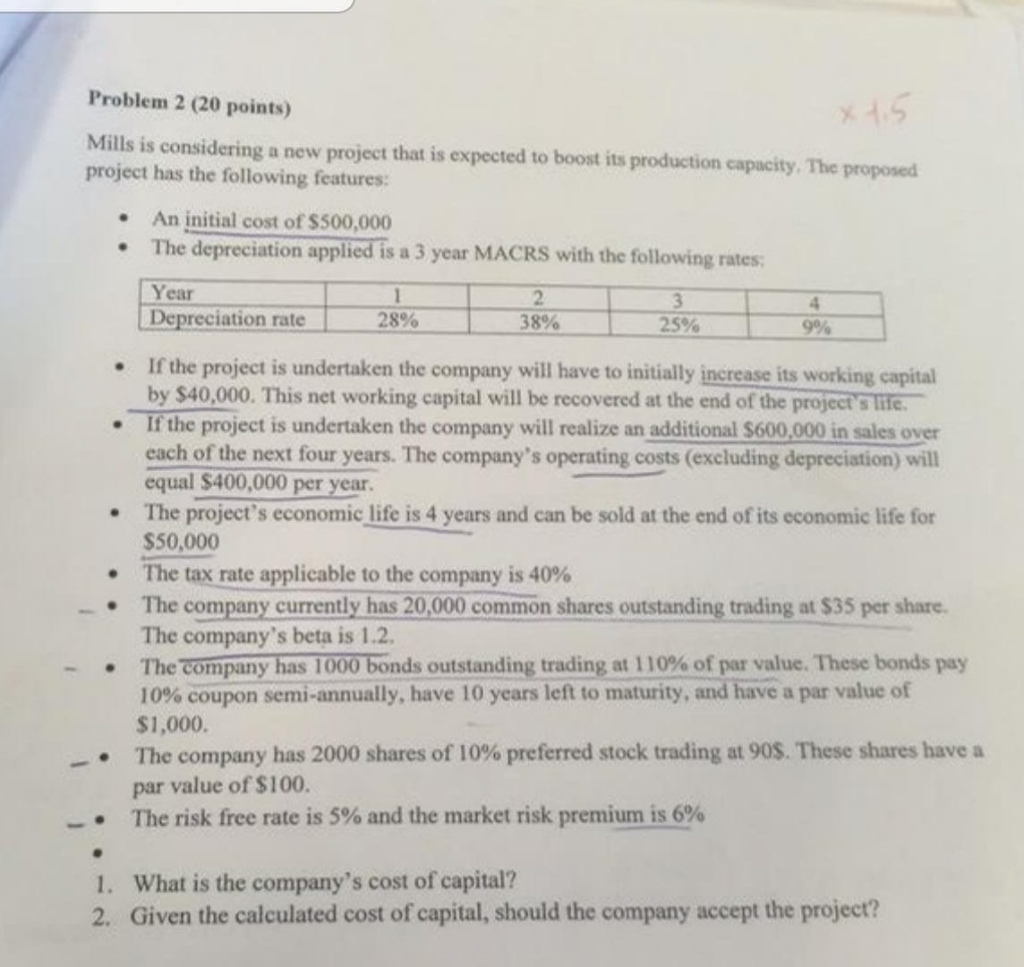

Problem 2 (20 points) Mills is considering a new project that is expected to boost its production capacity. The proposed project has the following features: .An initial cost of $500,000 . The depreciation applied is a 3 year MACRS with the following rates Year 2 Depreciation rate 2896 38% 25% 9% If the project is undertaken the company will have to initially increase its working capital by $40,000. This net working capital will be recovered at the end of the projects lle. If the project is undertaken the company will realize an additional $600,000 in sales over . each of the next four years. The company's operating costs (excluding depreciation) will equal $400,000 per year The project's economic life is4years and can be sold at the end of its cconomic life for $50,000 . . The tax rate applicable to the company is 40% . The company currently has 20,000 common shares outstanding trading at $35 per share. . TheTompany as 1000 bonds outstanding trading at 110% of par value. These bonds pay The company's beta is 1.2. 10% coupon semi-annually, have 10 years left to maturity, andhave a par value of $1,000. The company has 2000 shares of 10% preferred stock trading at 90s. These shares have a par value of $100. The risk free rate is 5% and the market risk premium is 6% -. What is the company's cost of capital? Given the calculated cost of capital, should the company accept the project? 1. 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts