Question: A n 9.5% 25-year bond has a par value o $1,000 and a call price o S1 025. The bond's first call date is n

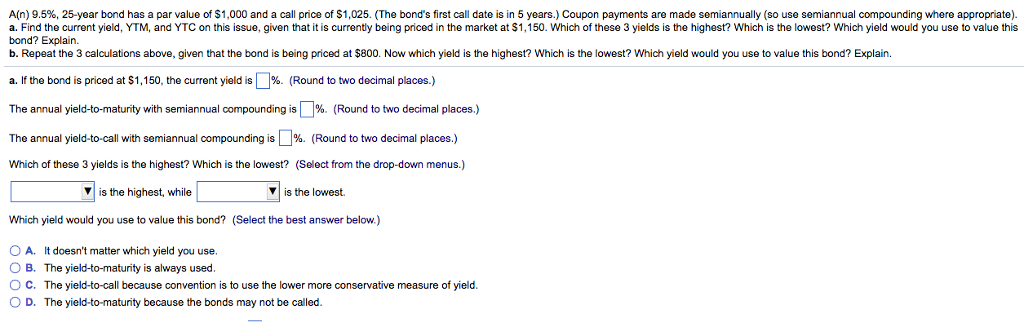

A n 9.5% 25-year bond has a par value o $1,000 and a call price o S1 025. The bond's first call date is n 5 years. Coupon payments are made sem annually so use semiannual compounding where appropriate). a. Find the current yield, YTM, and YTC on this issue, given that it is currently being priced in the market at $1,150. Which of these 3 yields is the highest? Which is the lowest? Which yield would you use to value this bond? Explain b. Repeat the 3 calculations above, given that the bond is being priced at $800. Now which yield is the highest? Which is the lowest? Which yield would you use to value this bond? Explain a.If the bond is priced at $1,150, the current yield is%(Round to two decimal placos.) The annual yield-to-maturity with semiannual compounding is %. (Round to two decimal places) The annual yield-to-call with semiannual compounding is L%. (Round to two decimal places.) Which of these 3 yields is the highest? Which is the lowest? (Select from the drop-down menus.) is the highest, while is the lowest. OA. It doesn't matter which yield you use. O B. The yield-to-maturity is always used O C. The yield-to-call because convention is to use the lower more conservative measure of yield D. The yield-to-maturity because the bonds may not be called

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts