Question: Hello I need a solution as soon as possible and I do not need an explanation I just want a solution and Thank you in

Hello I need a solution as soon as possible and I do not need an explanation I just want a solution and Thank you in advance

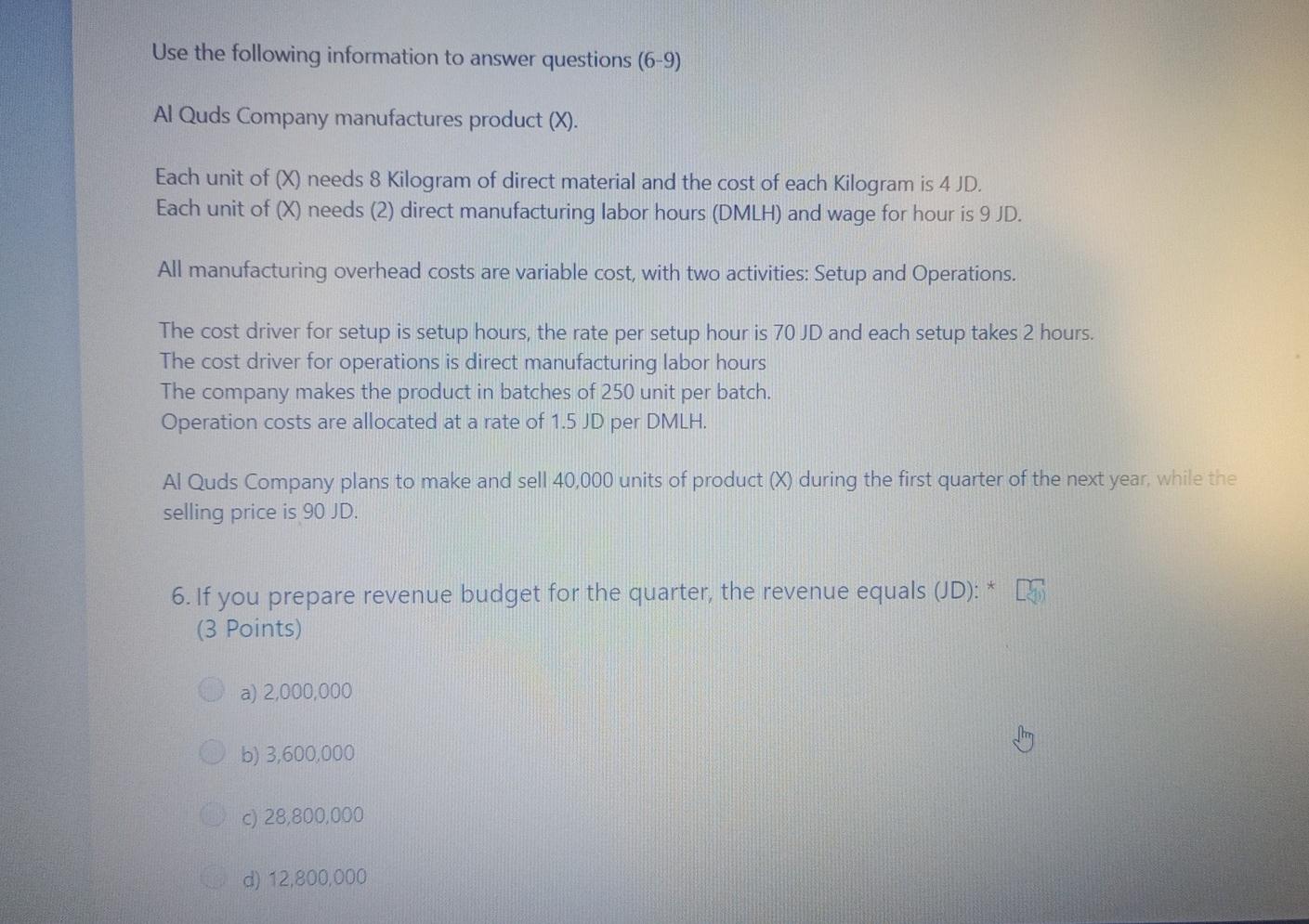

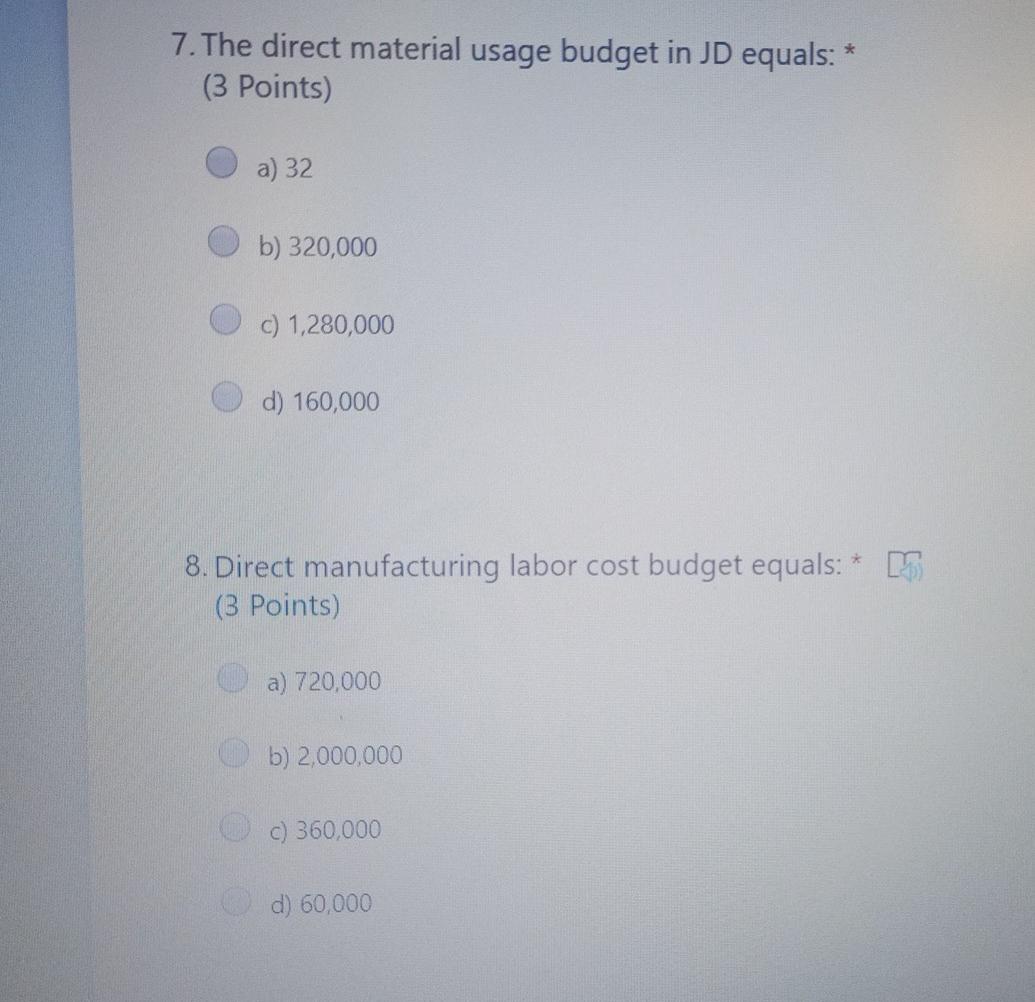

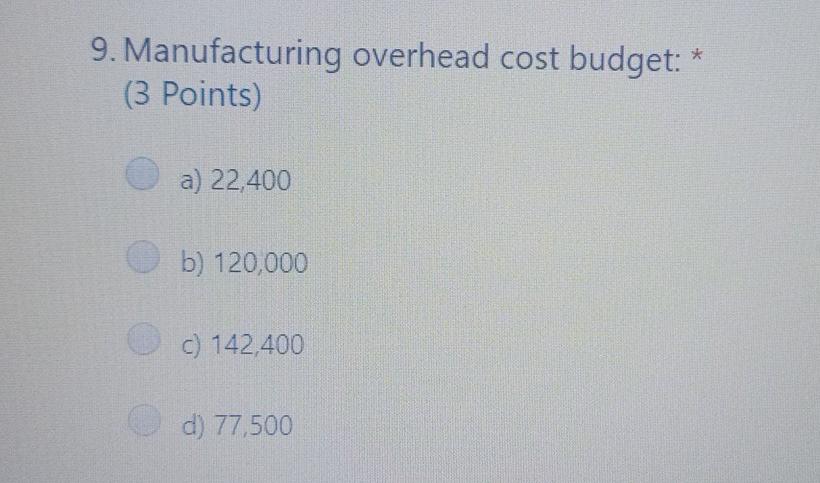

Use the following information to answer questions (6-9) Al Quds Company manufactures product (X). Each unit of (X) needs 8 Kilogram of direct material and the cost of each kilogram is 4 JD. Each unit of (X) needs (2) direct manufacturing labor hours (DMLH) and wage for hour is 9 JD. All manufacturing overhead costs are variable cost, with two activities: Setup and Operations. The cost driver for setup is setup hours, the rate per setup hour is 70 JD and each setup takes 2 hours. The cost driver for operations is direct manufacturing labor hours The company makes the product in batches of 250 unit per batch. Operation costs are allocated at a rate of 1.5 D per DMLH. Al Quds Company plans to make and sell 40,000 units of product (X) during the first quarter of the next year, while the selling price is 90 JD. 6. If you prepare revenue budget for the quarter, the revenue equals (JD): * (3 Points) a) 2,000,000 b) 3,600,000 c) 28,800,000 d) 12,800,000 * 7. The direct material usage budget in JD equals: (3 Points) a) 32 b) 320,000 c) 1,280,000 d) 160,000 8. Direct manufacturing labor cost budget equals: * (3 Points) a) 720,000 b) 2,000,000 c) 360,000 d) 60,000 9. Manufacturing overhead cost budget: * (3 Points) a) 22,400 b) 120,000 c) 142.400 d) 77,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts