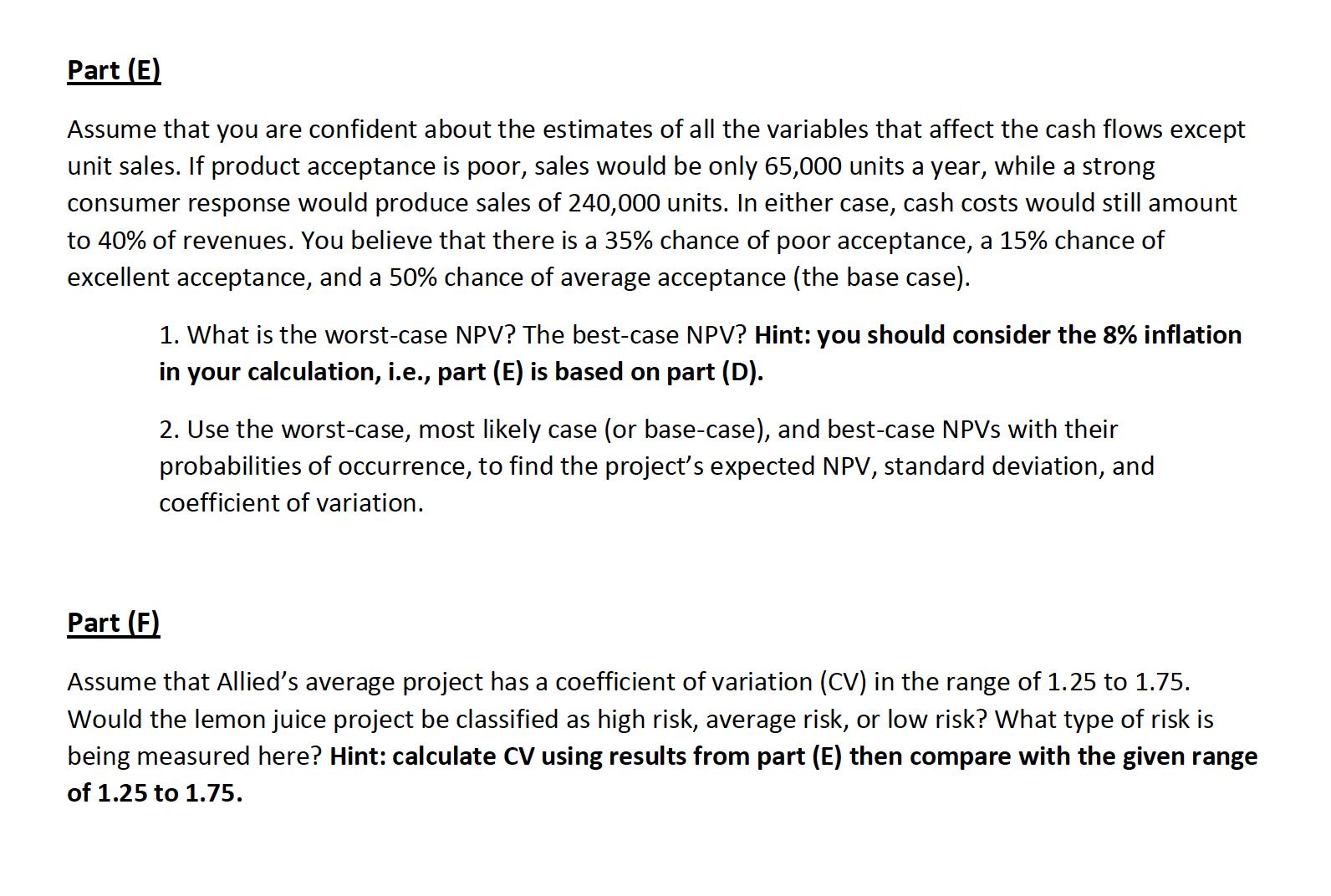

Question: Hello. I need help comprehending letters E and F and understanding how to solve them. I am having a horrible time understanding those. Part (D)

Hello. I need help comprehending letters E and F and understanding how to solve them. I am having a horrible time understanding those.

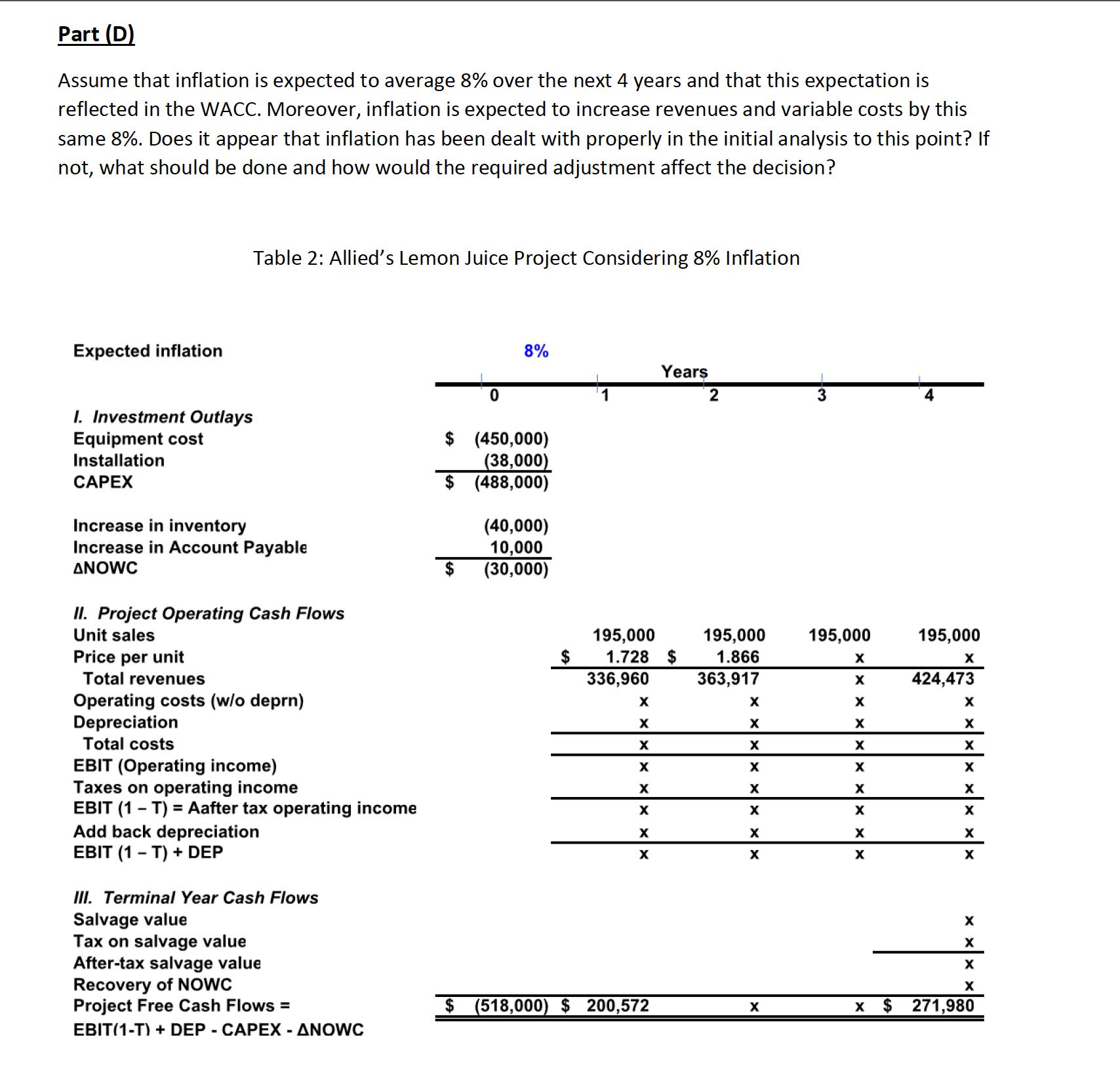

Part (D) Assume that inflation is expected to average 8% over the next 4 years and that this expectation is reflected in the WACC. Moreover, inflation is expected to increase revenues and variable costs by this same 8%. Does it appear that inflation has been dealt with properly in the initial analysis to this point? If not, what should be done and how would the required adjustment affect the decision? Expected inflation Table 2: Allied's Lemon Juice Project Considering 8% Inflation 8% Years 2 3 4 I. Investment Outlays Equipment cost Installation CAPEX Increase in inventory Increase in Account Payable ANOWC II. Project Operating Cash Flows 0 $ (450,000) (38,000) $ (488,000) (40,000) 10,000 $ (30,000) Unit sales 195,000 Price per unit $ 1.728 $ 195,000 1.866 195,000 195,000 X X Total revenues 336,960 363,917 X 424,473 Operating costs (w/o deprn) X X X X Depreciation X X X X Total costs X X X X EBIT (Operating income) X X Taxes on operating income X X X X EBIT (1-T) = Aafter tax operating income Add back depreciation X X X X X X x X EBIT (1-T) + DEP X X X x III. Terminal Year Cash Flows Salvage value X Tax on salvage value After-tax salvage value Recovery of NOWC Project Free Cash Flows = EBIT(1-T) + DEP - CAPEX - ANOWC X X $ (518,000) $ 200,572 X X $ 271,980

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts