Question: hello, I need help solving problem 7.17 using the following chart from the appendix. Final answer should be $3727.20. Please show work, will rate. 7.17

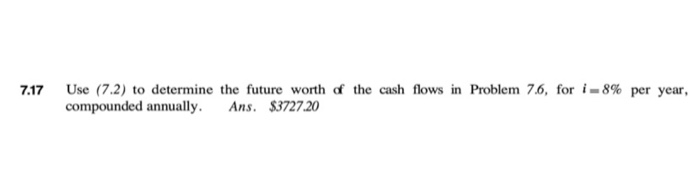

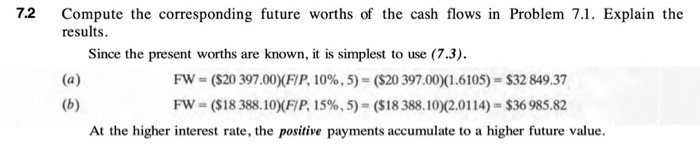

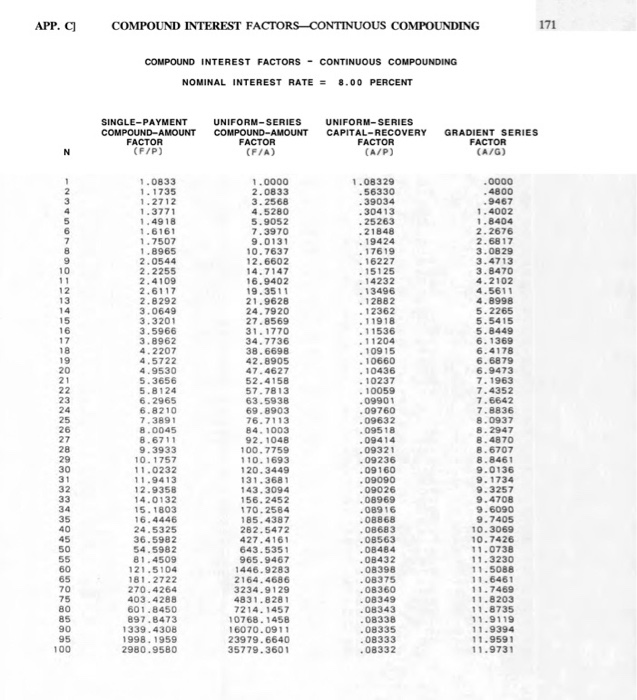

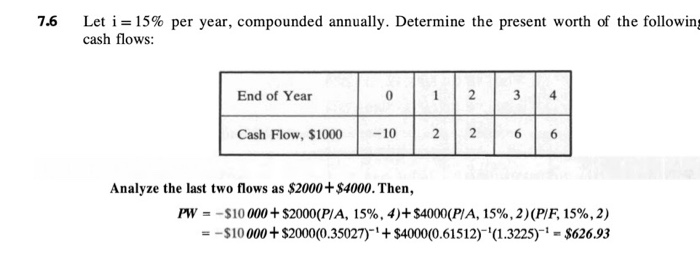

7.17 Use (7.2) to determine the future worth of the cash flows in Problem 7.6, for i-8% per year, compounded annually. Ans. $3727.20 7.2 Compute the corresponding future worths of the cash flows in Problem 7.1. Explain the results. Since the present worths are known, it is simplest to use (7.3). (a) FW = ($20 397.00)(F/P, 10%, 5) = ($20 397.00)(1.6105) = $32 849.37 FW = ($18 388.10)(F1P, 15%, 5) = ($18 388.10)(2.0114) = $36 985.82 At the higher interest rate, the positive payments accumulate to a higher future value. APP.C COMPOUND INTEREST FACTORS-CONTINUOUS COMPOUNDING COMPOUND INTEREST FACTORS - CONTINUOUS COMPOUNDING NOMINAL INTEREST RATE = 8.00 PERCENT SINGLE-PAYMENT COMPOUND-AMOUNT FACTOR (F/P) UNIFORM-SERIES COMPOUND-AMOUNT FACTOR (F/A) UNIFORM-SERIES CAPITAL-RECOVERY FACTOR (A/P) GRADIENT SERIES FACTOR (A/G) 13 1.0833 1. 1735 1.2712 1.3771 1.4918 1.6161 1.7507 1.8965 2.0544 2.2255 2.4109 2.6117 2.8292 3.0649 3.3201 3.5966 3.8962 4.2207 4.5722 4.9530 5.3656 5.8124 6.2965 6.8210 7.3891 8.0045 8.6711 9.3933 10.1757 11.0232 11.9413 12.9358 14.0132 15. 1803 16.4446 24.5325 36.5982 54.5982 81.4509 121.5 104 181.2722 270.4264 403.4288 601.8450 897.8473 1339.4308 1998, 1959 2980.9580 1.0000 2.0833 3.2568 4.5280 5.9052 7.3970 9.0131 10.7637 12.6602 14,7147 16.9402 19.3511 21.9628 24. 7920 27.8569 31. 1770 34.7736 38.6698 42.8905 47.4627 52.4158 57.7813 63.5938 69.8903 76.7113 84 1003 92. 1048 100.7759 110. 1693 120.3449 131.3681 17 1.08329 .56330 . 39034 30413 25263 . 21848 . 19424 . 17619 16227 15125 . 14232 - 13496 12882 12362 11918 11536 11204 . 109 15 10660 10436 10237 10059 .09901 .09760 .09632 .095 18 .09414 .09321 . 09236 . 09160 .09090 .09026 .08969 .08916 .08868 08683 .08563 .08484 08432 .08398 .08375 .08360 .08349 .08343 .08338 .08335 .08333 .08332 .0000 .4800 .9467 1.4002 1.8404 2.2676 2.68 17 3.0829 3.4713 3.8470 4.2102 4.5611 4.8998 5.2265 5.54 15 5.8449 6. 1369 6.4178 6.6879 6.9473 7.1963 7.4352 7.6642 7.8836 8.0937 8.2947 3.4870 8.6707 8.8461 9.0136 9. 1734 9.3257 9.4708 9.6090 9.7405 10.3069 10.7426 11.0738 40 45 50 60 65 156.2452 170.2564 185.4387 282.5472 427.4161 643.5351 965.9467 1446.9283 2164.4686 3234.9129 4831.8281 7214. 1457 10768. 1458 16070.0911 23979.6640 35779.3601 75 80 11.5088 11.6461 11.7469 11.8203 11.8735 11.9119 11.9394 11.9591 11.9731 85 90 95 100 7.6 Let i = 15% per year, compounded annually. Determine the present worth of the following cash flows: End of Year 0 1 1 2 3 4 Cash Flow, $1000 -10 66 Analyze the last two flows as $2000+ $4000. Then, PW = -$10 000 + $2000(P/A, 15%, 4)+ $4000(P/A, 15%, 2) (P/F, 15%, 2) --$10 000 + $2000(0.35027)-' + $4000(0.61512)-|(1.3225)"! - $626.93

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts