Question: Hello, I need help to answer this for my final case study. Your help are much appreciated. Thank you. The following exchange rates are available

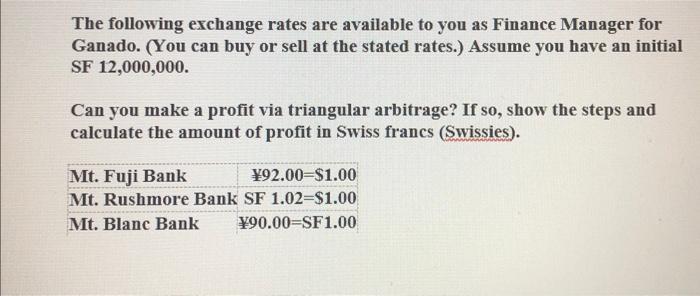

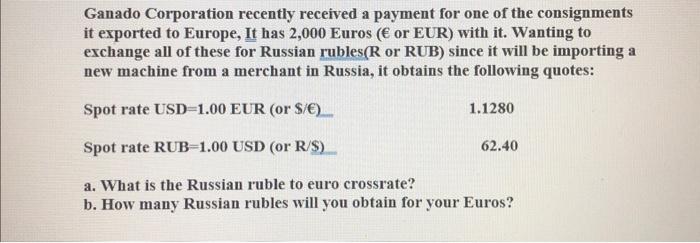

The following exchange rates are available to you as Finance Manager for Ganado. (You can buy or sell at the stated rates.) Assume you have an initial SF 12,000,000. Can you make a profit via triangular arbitrage? If so, show the steps and calculate the amount of profit in Swiss francs (Swissies). Ganado Corporation recently received a payment for one of the consignments it exported to Europe, It has 2,000 Euros ( or EUR) with it. Wanting to exchange all of these for Russian rubles(R or RUB) since it will be importing a new machine from a merchant in Russia, it obtains the following quotes: Spot rate USD =1.00 EUR ( or $/) 1.1280 Spot rate RUB=1.00USD( or R/$) 62.40 a. What is the Russian ruble to euro crossrate? b. How many Russian rubles will you obtain for your Euros

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts