Question: Hello, I need help with all these steps please with explanation! I tried to upload the rest of the pixtures but it would not allow

Hello, I need help with all these steps please with explanation! I tried to upload the rest of the pixtures but it would not allow me to Thank you so much!

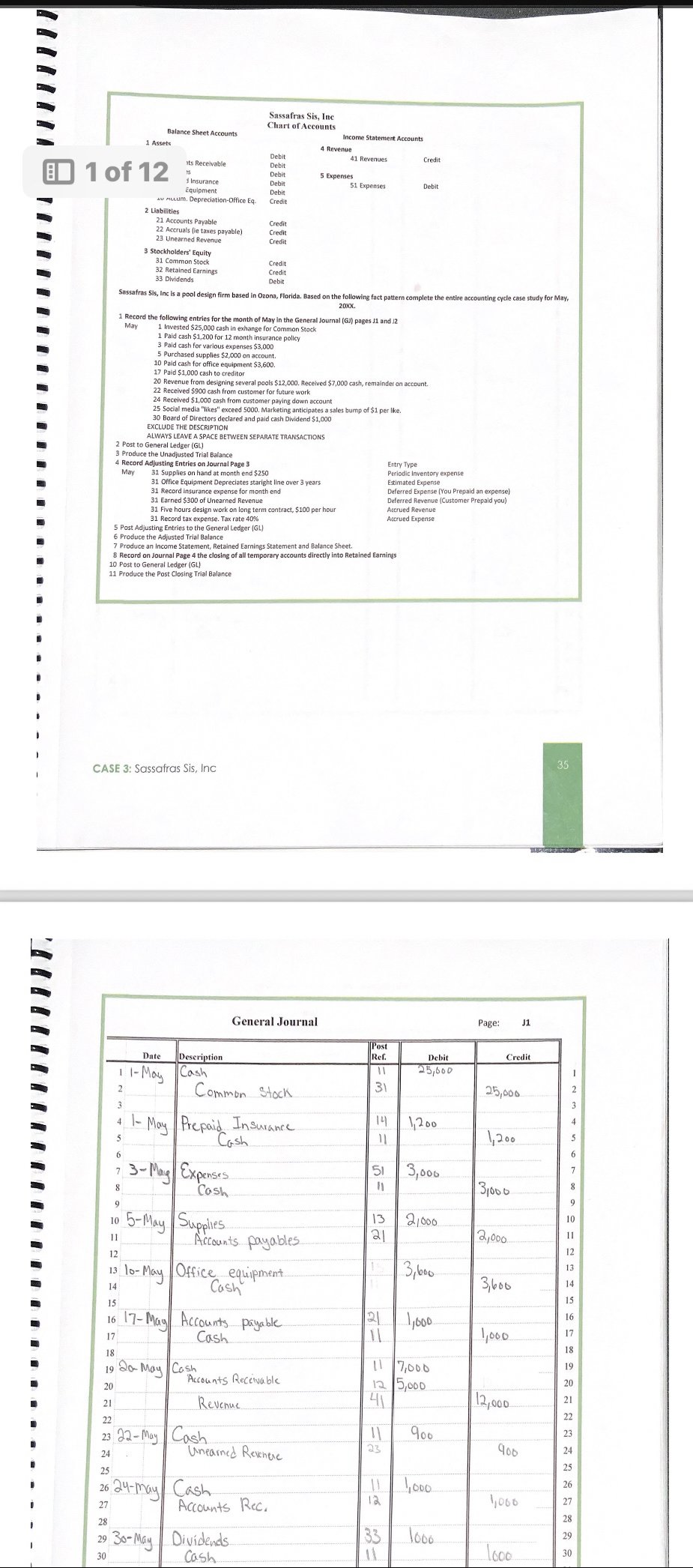

Step : Journalize the transactions on page May May in the General Journal pages and Remember to SKIP a row between each journal entry.DO NOT create an entry for the May th transaction This is a trick transaction because it does not provide enough information to require an entryStep : Post each journal entry to the General Ledger Accounts pages and Step : Prepare the Unadjusted Trial Balance page Make sure you use the balances in the General Ledger Accounts to get the account totals for the Unadjusted Trial BalanceDon't forget to calculate the column totals add up the debit and credit columns they should equalhave the same total

PLEASE NOTE: The UNADJUSTED TRIAL BALANCE Step must be completed BEFORE you complete step The adjusting entries

Step : Journalize each Adjusting Entry May st transactions in the General Journal titled "Adjusting Entries"page The adjustments are for May only for example, the prepaid insurance adjustment is for one monthMayFor the depreciation adjusting entry, the monthly depreciation amount is $ You will learn how to calculate this in Chapter To complete the tax adjusting entry you need to know your "Income from Operations" which is $ The tax amount is calculated as follows: Income from Operations X the Tax Rate $ X $ Therefore, the tax amount you need to accrue is $

Step : Post the Adjusting Entries to the General Ledger Accounts pages and

Step : Prepare the Adjusted Trial Balance page Make sure you use the balances in the General Ledger Accounts AFTER the adjusting entries have been posted to get the balances for the ATBDon't forget to calculate the column totals add up the debit and credit columns they should equalhave the same total

Step : Prepare the Income StatementUse the totals from the ledger accounts or the adjusted trial balance to prepare the statement

Step : Prepare the Statement of Stockholder's EquityDO NOT complete the Retained Earnings Statement. You need to PRINT a copy of the Statement of Stockholder's Equity and complete it instead!Use the totals from the ledger accounts or the adjusted trial balance to prepare the statement

Step : Prepare the Balance SheetUse the totals from the ledger accounts or the adjusted trial balance to prepare the statement, except for the equity section. To complete the equity section you must use the Statement of Stockholder's Equity.

CASE : Sassafras Sis, Inc

PLEASE NOTE: Due to the fact that this is a summer course, you DO NOT need to complete the closing entries or the Post Close Trial Balance.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock