Question: hello i need help with this question A fast growing firm paid a dividend of $5.87 per share during the most ecent year, The dividend

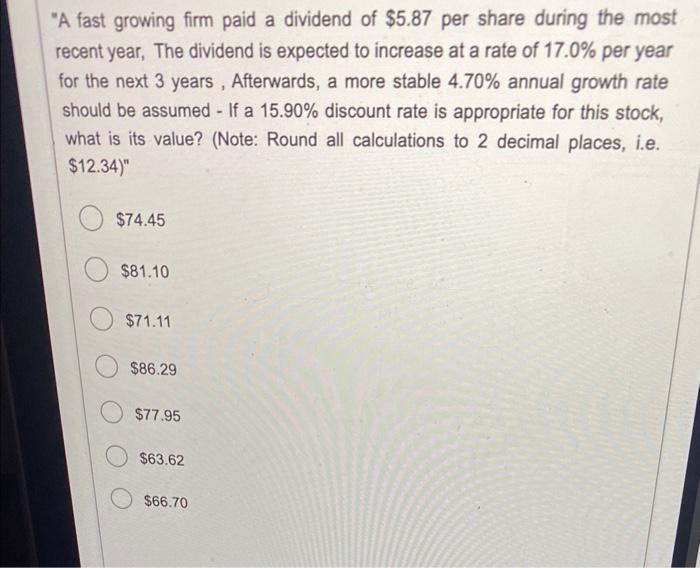

A fast growing firm paid a dividend of $5.87 per share during the most ecent year, The dividend is expected to increase at a rate of 17.0% per year for the next 3 years, Afterwards, a more stable 4.70% annual growth rate should be assumed - If a 15.90% discount rate is appropriate for this stock, what is its value? (Note: Round all calculations to 2 decimal places, i.e. $12.34)n $74.45 $81.10 $71.11 $86.29 $77.95 $63.62 $66.70

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts