Question: Hello! I need some clarification on the steps for the problem below: Bond 1 has a 5% annual coupon rate (i.e., a $50 coupon

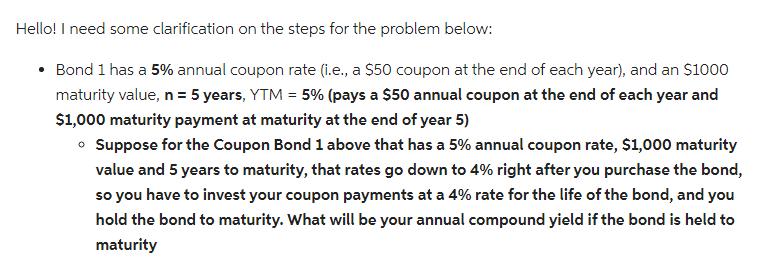

Hello! I need some clarification on the steps for the problem below: Bond 1 has a 5% annual coupon rate (i.e., a $50 coupon at the end of each year), and an $1000 maturity value, n = 5 years, YTM = 5% (pays a $50 annual coupon at the end of each year and $1,000 maturity payment at maturity at the end of year 5) Suppose for the Coupon Bond 1 above that has a 5% annual coupon rate, $1,000 maturity value and 5 years to maturity, that rates go down to 4% right after you purchase the bond, so you have to invest your coupon payments at a 4% rate for the life of the bond, and you hold the bond to maturity. What will be your annual compound yield if the bond is held to maturity

Step by Step Solution

3.36 Rating (152 Votes )

There are 3 Steps involved in it

The detailed ... View full answer

Get step-by-step solutions from verified subject matter experts