Question: Hello, I need some help figuring out how each item would be reported on the balance sheet for this accounting problem. The options include current

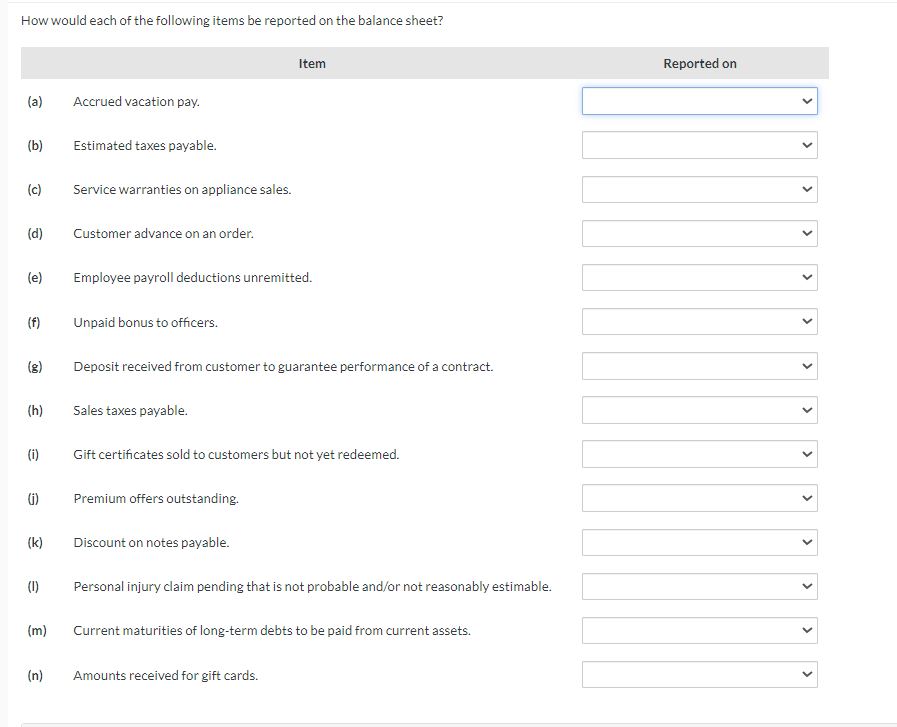

Hello, I need some help figuring out how each item would be reported on the balance sheet for this accounting problem. The options include current assets, current liability, current liability or long-term liability, footnote disclosure, long-term investments, property plant and equipment, and stockholders' equity. Thank you!

How would each of the following items be reported on the balance sheet? Item (a) Accrued vacation pay. (b) Estimated taxes payable. (c) Service warranties on appliance sales. (d) Customer advance on an order. (e) Employee payroll deductions unremitted. Reported on (f) Unpaid bonus to officers. (g) Deposit received from customer to guarantee performance of a contract. (h) Sales taxes payable. (i) Gift certificates sold to customers but not yet redeemed. (j) Premium offers outstanding. (k) Discount on notes payable. (1) Personal injury claim pending that is not probable and/or not reasonably estimable. (m) (n) Current maturities of long-term debts to be paid from current assets. Amounts received for gift cards. > > < > > > >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts