Question: Hello, I need some help figuring out how Each value for all parts of the problem (A, B, and C) and all I ask is

Hello, I need some help figuring out how Each value for all parts of the problem (A, B, and C) and all I ask is for work to be shown if possible because I would like to use this for future reference since I was stumped on this problem the whole day. Thank you!

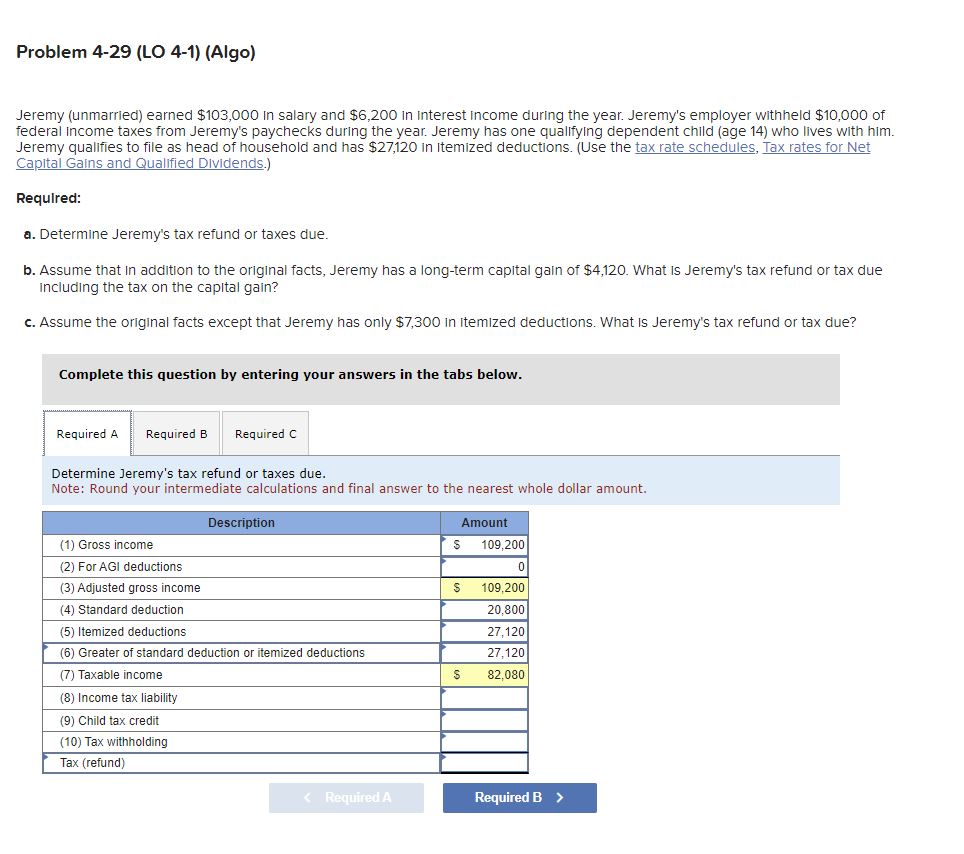

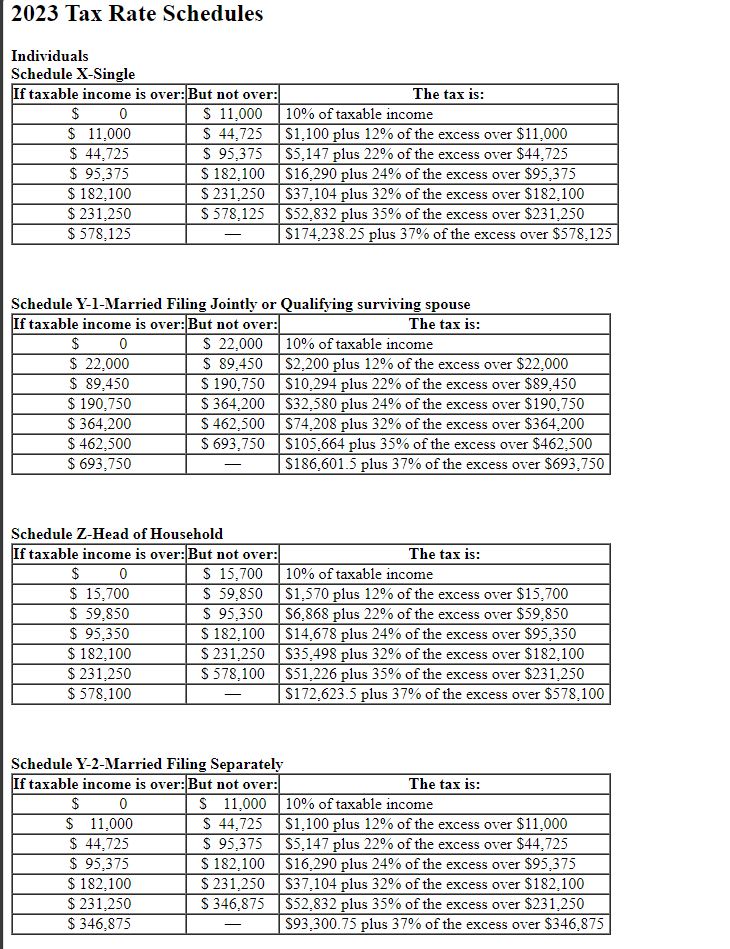

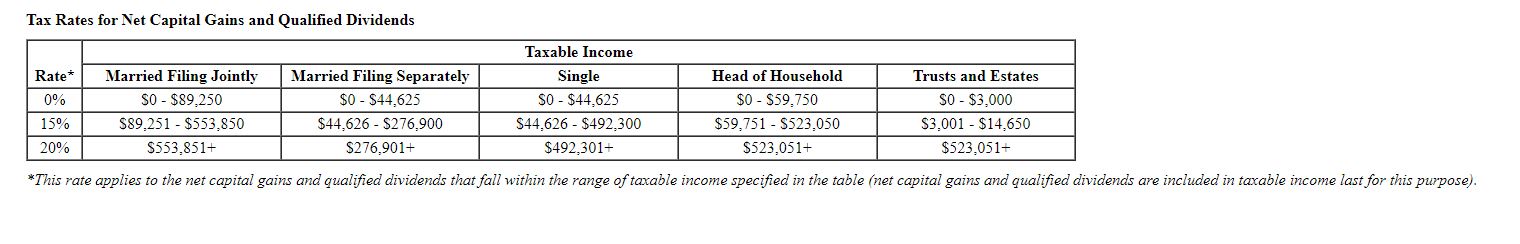

Jeremy (unmarried) earned $103,000 in salary and $6,200 in interest income during the year. Jeremy's employer withheld $10,000 of federal income taxes from Jeremy's paychecks during the year. Jeremy has one qualifying dependent child (age 14) who lives with him. Jeremy qualifies to file as head of household and has $27,120 in Itemized deductions. (Use the tax rate schedules, Tax rates for Net Capital Gains and Qualified DIvidends.) Required: a. Determine Jeremy's tax refund or taxes due. b. Assume that In addition to the original facts, Jeremy has a long-term capital gain of $4,120. What is Jeremy's tax refund or tax due including the tax on the capital gain? c. Assume the original facts except that Jeremy has only $7,300 in itemized deductions. What is Jeremy's tax refund or tax due? Complete this question by entering your answers in the tabs below. Determine Jeremy's tax refund or taxes due. Note: Round your intermediate calculations and final answer to the nearest whole dollar amount. Tax Rates for Net Capital Gains and Qualified Dividends 2023 Tax Rate Schedules Individuals Srhadula X_Sinala

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts