Question: Hello, I need some help figuring out how to record these journal entries for this accounting problem. Thank you! The payroll of Oriole Company for

Hello, I need some help figuring out how to record these journal entries for this accounting problem. Thank you!

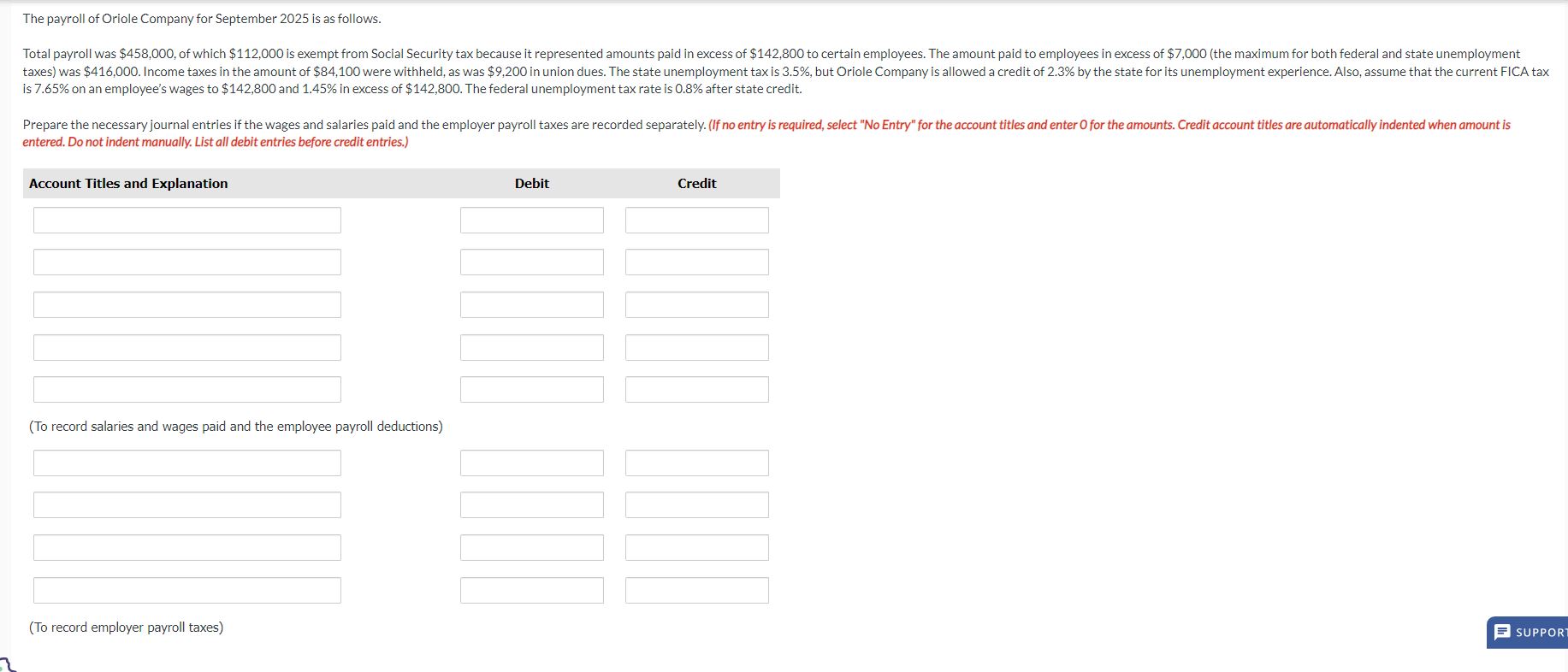

The payroll of Oriole Company for September 2025 is as follows. Total payroll was $458,000, of which $112,000 is exempt from Social Security tax because it represented amounts paid in excess of $142,800 to certain employees. The amount paid to employees in excess of $7,000 (the maximum for both federal and state unemployment taxes) was $416,000. Income taxes in the amount of $84,100 were withheld, as was $9,200 in union dues. The state unemployment tax is 3.5%, but Oriole Company is allowed a credit of 2.3% by the state for its unemployment experience. Also, assume that the current FICA tax is 7.65% on an employee's wages to $142,800 and 1.45% in excess of $142,800. The federal unemployment tax rate is 0.8% after state credit. Prepare the necessary journal entries if the wages and salaries paid and the employer payroll taxes are recorded separately. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. List all debit entries before credit entries.) Account Titles and Explanation Debit Credit (To record salaries and wages paid and the employee payroll deductions) (To record employer payroll taxes) SUPPORT

Step by Step Solution

There are 3 Steps involved in it

Recording Salaries and Wages Paid and Employee Payroll Deductions Calculate total payroll payable To... View full answer

Get step-by-step solutions from verified subject matter experts