Question: Hello! I need some help solving these multiple choice finance questions. 1. a. total risk b. systematic risk c. diversifiable or firm specific risk d.

Hello! I need some help solving these multiple choice finance questions.

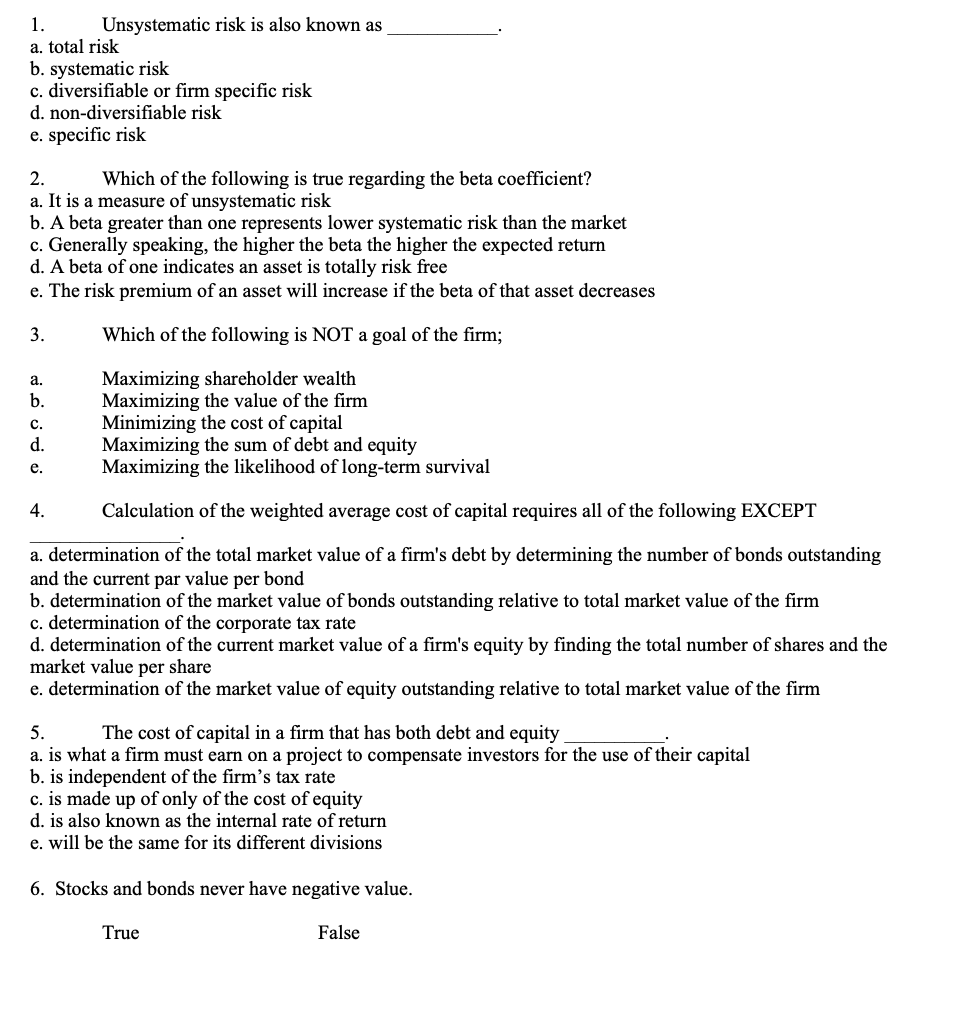

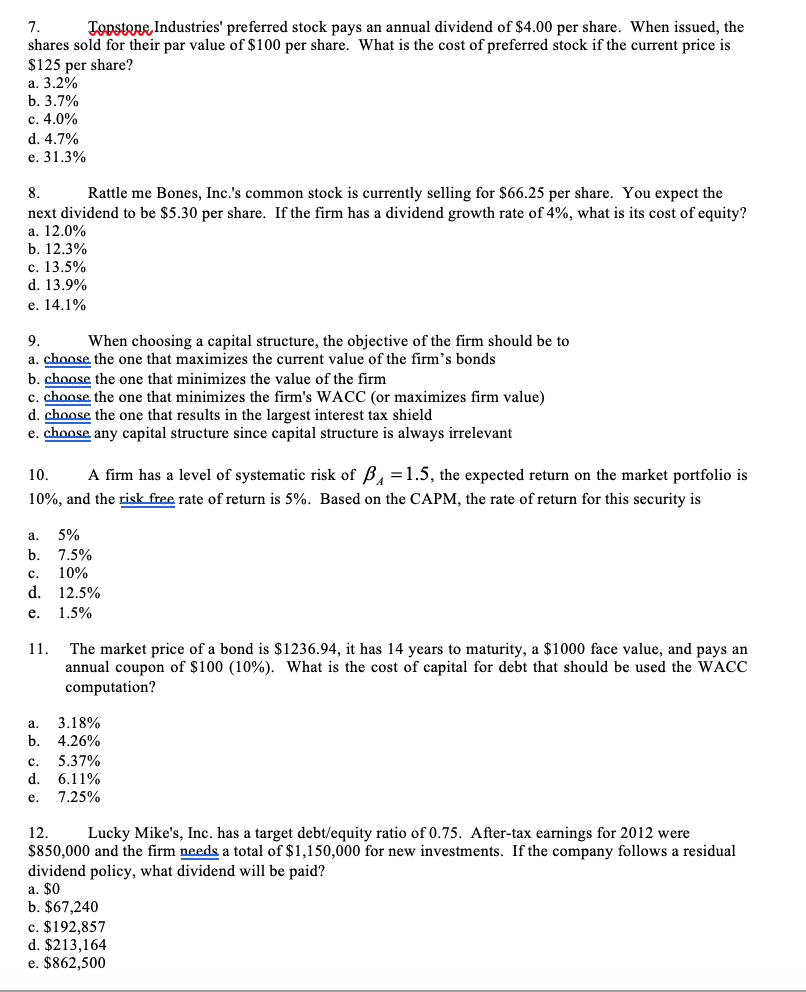

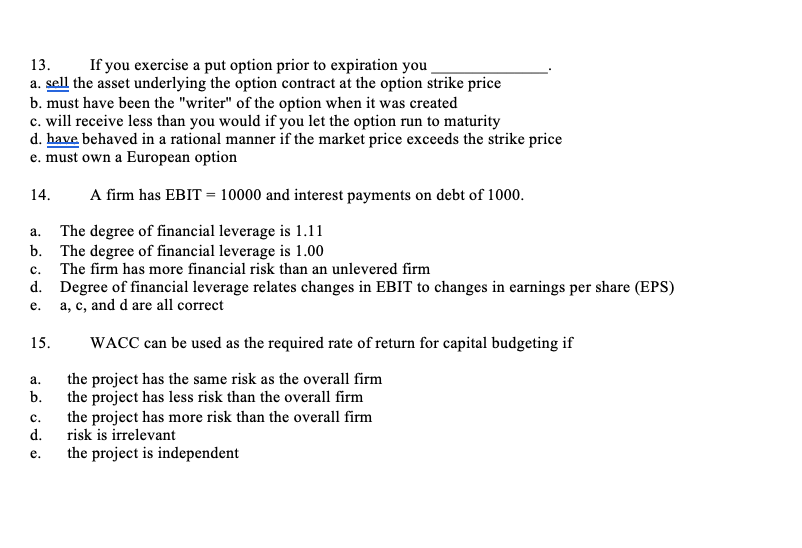

1. a. total risk b. systematic risk c. diversifiable or firm specific risk d. non-diversifiable risk e. specific risk Unsystematic risk is also known as 2. a. It is a measure of unsystematic risk b. A beta greater than one represents lower systematic risk than the market c. Generally speaking, the higher the beta the higher the expected return d. A beta of one indicates an asset is totally risk free e. The risk premium of an asset will increase if the beta of that asset decreases Which of the following is true regarding the beta coefficient? Which of the following is NOT a goal of the firm; Maximizing shareholder wealth Maximizing the value of the firm Minimizing the cost of capital Maximizing the sum of debt and equity Maximizing the likelihood of long-term survival a. b. 4 Calculation of the weighted average cost of capital requires all of the following EXCEPT a. determination of the total market value of a firm's debt by determining the number of bonds outstanding and the current par value per bond b. determination of the market value of bonds outstanding relative to total market value of the firm c. determination of the corporate tax rat

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts