Question: Hello! I need some help with these finance problems. Within 24 hours if possible! Thank you. Hillside Publishing is a small publishing company that began

Hello! I need some help with these finance problems. Within 24 hours if possible! Thank you.

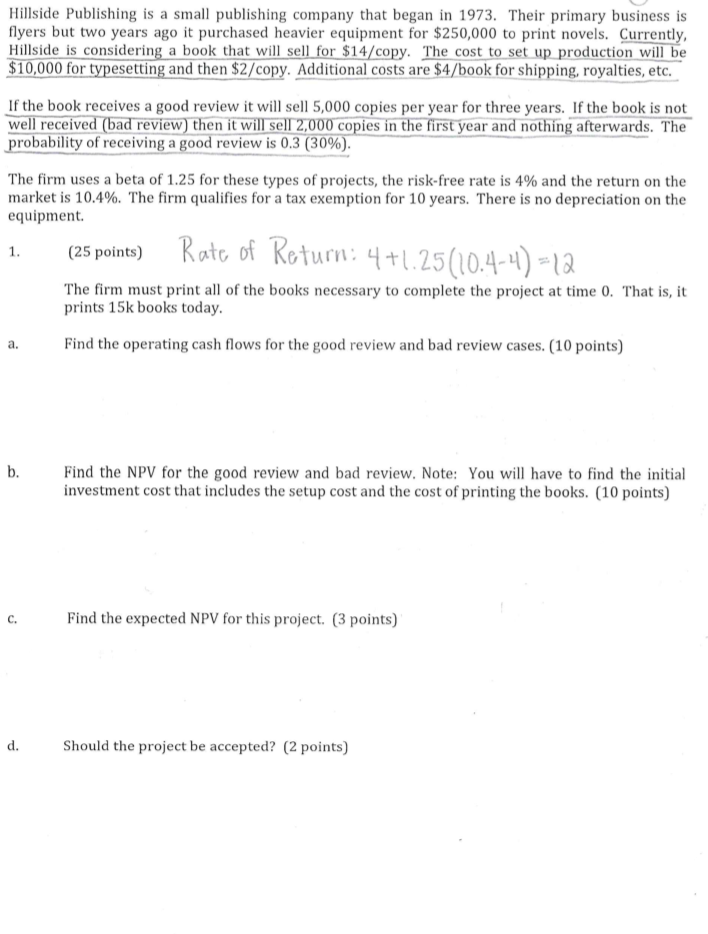

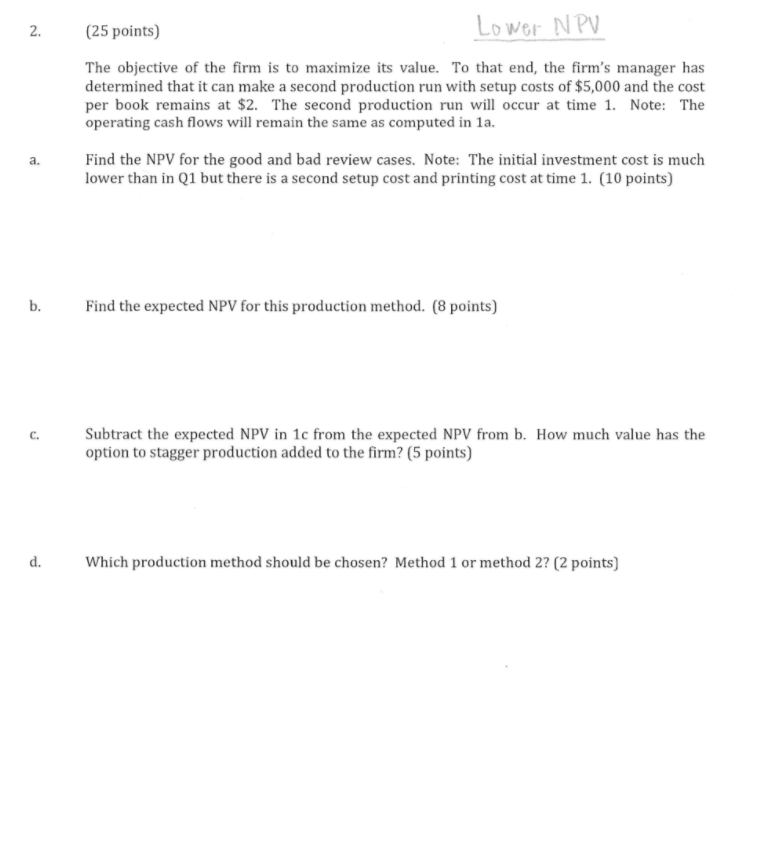

Hillside Publishing is a small publishing company that began in 1973. Their primary business is flyers but two years ago it purchased heavier equipment for $250,000 to print novels. Currently Hillside is considering a book that will sell for $14/copy. The cost to set up production will be $10,000 for typesetting and then $2/copy. Additional costs are S4/book for shipping, royalties, etc. If the book receives a good review it will sell 5,000 copies per year for three years. If the book is not well received (bad review) then it will sel1 2,000 copies in the first year and nothing afterwards. The probability of receiviof mroicects,the rilk-fre rae a good review is 0.3 (30%) The firm uses a beta of 1.25 for these types of projects, the risk-free rate is 4% and the return on the market is 10.4%. The firm qualifies for a tax exemption for 10 years. There is no depreciation on the equipment. de at t ints) Roto of Roturn:25(04-)1 The firm must print all of the books necessary to complete the project at time 0. That is, it prints 15k books today. a. Find the operating cash flows for the good review and bad review cases. (10 points) b. Find the NPV for the good review and bad review. Note: You will have to find the initial investment cost that includes the setup cost and the cost of printing the books. (10 points) c. Find the expected NPV for this project. (3 points) d. Should the project be accepted? (2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts