Question: Hello, I need to have the process shown how arrived at answers for all please. Thank you! SELF-TEST PROBLEM Solution Appears in Appendix A (ST-1)

Hello, I need to have the process shown how arrived at answers for all please. Thank you!

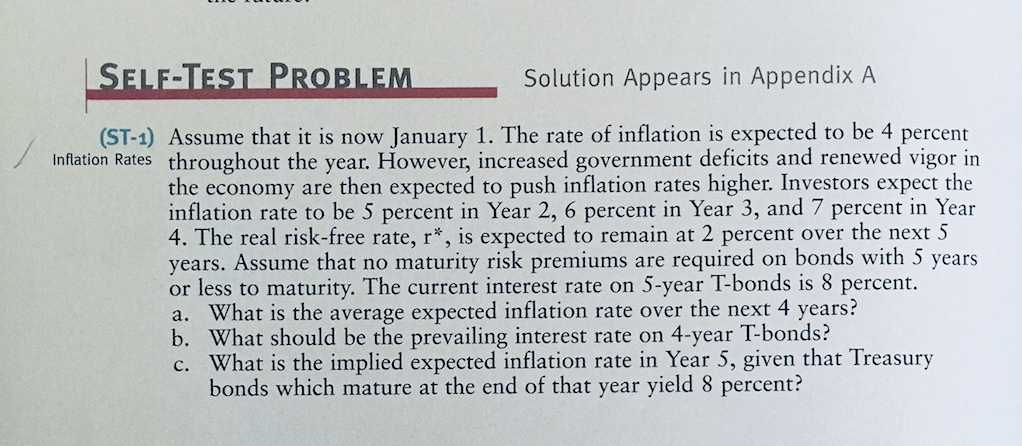

SELF-TEST PROBLEM Solution Appears in Appendix A (ST-1) Assume that it is now January 1. The rate of inflation is expected to be 4 percent Inflation Rates throughout the year. However, increased government deficits and renewed vigor in the economy are then expected to push inflation rates higher. Investors expect the inflation rate to be 5 percent in Year 2, 6 percent in Year 3, and 7 percent in Year 4. The real risk-free rate, r*, is expected to remain at 2 percent over the next 5 years. Assume that no maturity risk premiums are required on bonds with 5 years or less to maturity. The current interest rate on 5-year T-bonds is 8 percent. a. What is the average expected inflation rate over the next 4 years? b. What should be the prevailing interest rate on 4-year T-bonds? c. What is the implied expected inflation rate in Year 5, given that Treasury bonds which mature at the end of that year yield 8 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts