Question: Hello i need your help, i need to do a capital structure essay about this balance sheet. This is what i am supposed to calculate

Hello i need your help, i need to do a capital structure essay about this balance sheet. This is what i am supposed to calculate in an exel sheet.

Hello i need your help, i need to do a capital structure essay about this balance sheet. This is what i am supposed to calculate in an exel sheet.

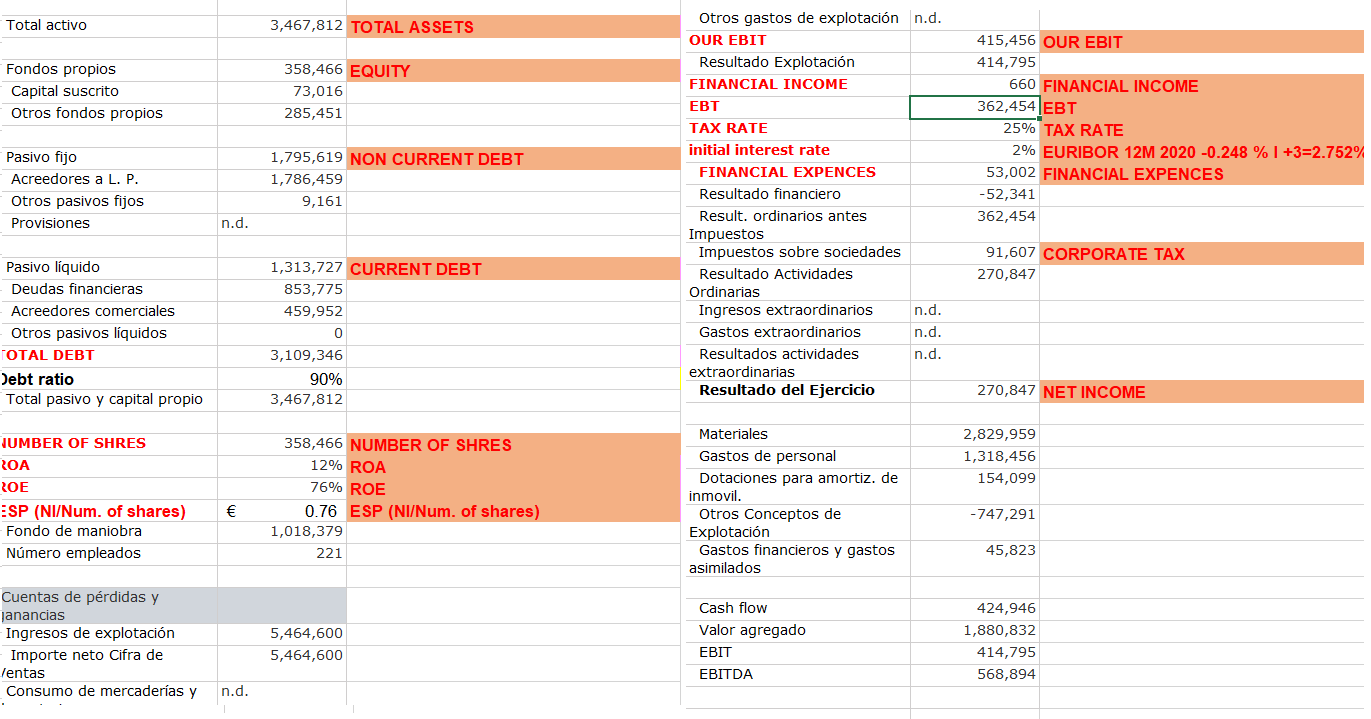

In the Profit and Loss account, you only need the EBIT (A1 Resultado de explotacin) to which you will add the accounting items that follow, and which will lead to the EBT, apart from financial expenses, in such a way that it should look like this:

1 EBIT

2 Financial expenses

3 EBT

4 Corporate taxes

5 Net Income

In such a way that these last 2 items and financial expenses have to coincide with the SABI data.

Alfterwards you should calculate the current indebtedness of the company and analyze what happens if the company has a debt of 20%, 40%, 60% and 80% with respect to the current debt level, keeping the Total Funds figure unchanged. There will be times when you have to reduce debt by issuing shares and others when you will have to borrow more and buy back shares. We will assume that the shares are issued and bought back at their net book value (equity / number of shares). We will assume that all shares have a par value of 1 euro. The debt ratio is measured as L = (non-current liabilities + current liabilities) / Total Funds. You should analyze what happens with EPS (earnings per share) and with ROE (return on equity) for each level of debt. You better calculate the ROA (return on assets) too.

We will assume that financial expenses will increase / decrease when debt increases / decreases by the amount of the change in debt by the 12-month Euribor + 3 points. The real tax rate: (Corporate tax) / (EBT), will be used to calculate the tax to be paid from the EBT you obtained in each case for each specific level of debt. If you experience problems, like for example that you reduce debt and you end up with a negative interest payment, just ask here in the forum.

I would be grateful if anyone could explain how should i do this

Total activo Fondos propios Capital suscrito Otros fondos propios Pasivo fijo Acreedores a L. P. Otros pasivos fijos Provisiones Pasivo lquido Deudas financieras Acreedores comerciales Otros pasivos lquidos TOTAL DEBT Debt ratio Total pasivo y capital propio NUMBER OF SHRES ROA ROE ESP (NI/Num. of shares) Fondo de maniobra Nmero empleados Cuentas de prdidas y Janancias Ingresos de explotacin Importe neto Cifra de /entas Consumo de mercaderas y n.d. n.d. 3,467,812 TOTAL ASSETS 358,466 EQUITY 73,016 285,451 1,795,619 NON CURRENT DEBT 1,786,459 9,161 1,313,727 CURRENT DEBT 853,775 459,952 0 3,109,346 90% 3,467,812 358,466 NUMBER OF SHRES 12% ROA 76% ROE 0.76 ESP (NI/Num. of shares) 1,018,379 221 5,464,600 5,464,600 Otros gastos de explotacin n.d. OUR EBIT Resultado Explotacin FINANCIAL INCOME EBT TAX RATE initial interest rate FINANCIAL EXPENCES Resultado financiero Result. ordinarios antes Impuestos Impuestos sobre sociedades Resultado Actividades Ordinarias Ingresos extraordinarios Gastos extraordinarios Resultados actividades extraordinarias Resultado del Ejercicio Materiales Gastos de personal Dotaciones para amortiz. de inmovil. Otros Conceptos de Explotacin Gastos financieros y gastos asimilados Cash flow Valor agregado EBIT EBITDA n.d. n.d. n.d. 415,456 OUR EBIT 414,795 362,454 EBT 660 FINANCIAL INCOME 25% TAX RATE 2% EURIBOR 12M 2020 -0.248 % | +3=2.752% 53,002 FINANCIAL EXPENCES -52,341 362,454 91,607 CORPORATE TAX 270,847 270,847 NET INCOME 2,829,959 1,318,456 154,099 -747,291 45,823 424,946 1,880,832 414,795 568,894 Total activo Fondos propios Capital suscrito Otros fondos propios Pasivo fijo Acreedores a L. P. Otros pasivos fijos Provisiones Pasivo lquido Deudas financieras Acreedores comerciales Otros pasivos lquidos TOTAL DEBT Debt ratio Total pasivo y capital propio NUMBER OF SHRES ROA ROE ESP (NI/Num. of shares) Fondo de maniobra Nmero empleados Cuentas de prdidas y Janancias Ingresos de explotacin Importe neto Cifra de /entas Consumo de mercaderas y n.d. n.d. 3,467,812 TOTAL ASSETS 358,466 EQUITY 73,016 285,451 1,795,619 NON CURRENT DEBT 1,786,459 9,161 1,313,727 CURRENT DEBT 853,775 459,952 0 3,109,346 90% 3,467,812 358,466 NUMBER OF SHRES 12% ROA 76% ROE 0.76 ESP (NI/Num. of shares) 1,018,379 221 5,464,600 5,464,600 Otros gastos de explotacin n.d. OUR EBIT Resultado Explotacin FINANCIAL INCOME EBT TAX RATE initial interest rate FINANCIAL EXPENCES Resultado financiero Result. ordinarios antes Impuestos Impuestos sobre sociedades Resultado Actividades Ordinarias Ingresos extraordinarios Gastos extraordinarios Resultados actividades extraordinarias Resultado del Ejercicio Materiales Gastos de personal Dotaciones para amortiz. de inmovil. Otros Conceptos de Explotacin Gastos financieros y gastos asimilados Cash flow Valor agregado EBIT EBITDA n.d. n.d. n.d. 415,456 OUR EBIT 414,795 362,454 EBT 660 FINANCIAL INCOME 25% TAX RATE 2% EURIBOR 12M 2020 -0.248 % | +3=2.752% 53,002 FINANCIAL EXPENCES -52,341 362,454 91,607 CORPORATE TAX 270,847 270,847 NET INCOME 2,829,959 1,318,456 154,099 -747,291 45,823 424,946 1,880,832 414,795 568,894

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts