Question: Hello! I really need help with these journal entries in my accounting class. Here is the information to go with the journal entries. I will

Hello! I really need help with these journal entries in my accounting class. Here is the information to go with the journal entries. I will make sure to thumbs up anyone that helps me out! Thank you so much!

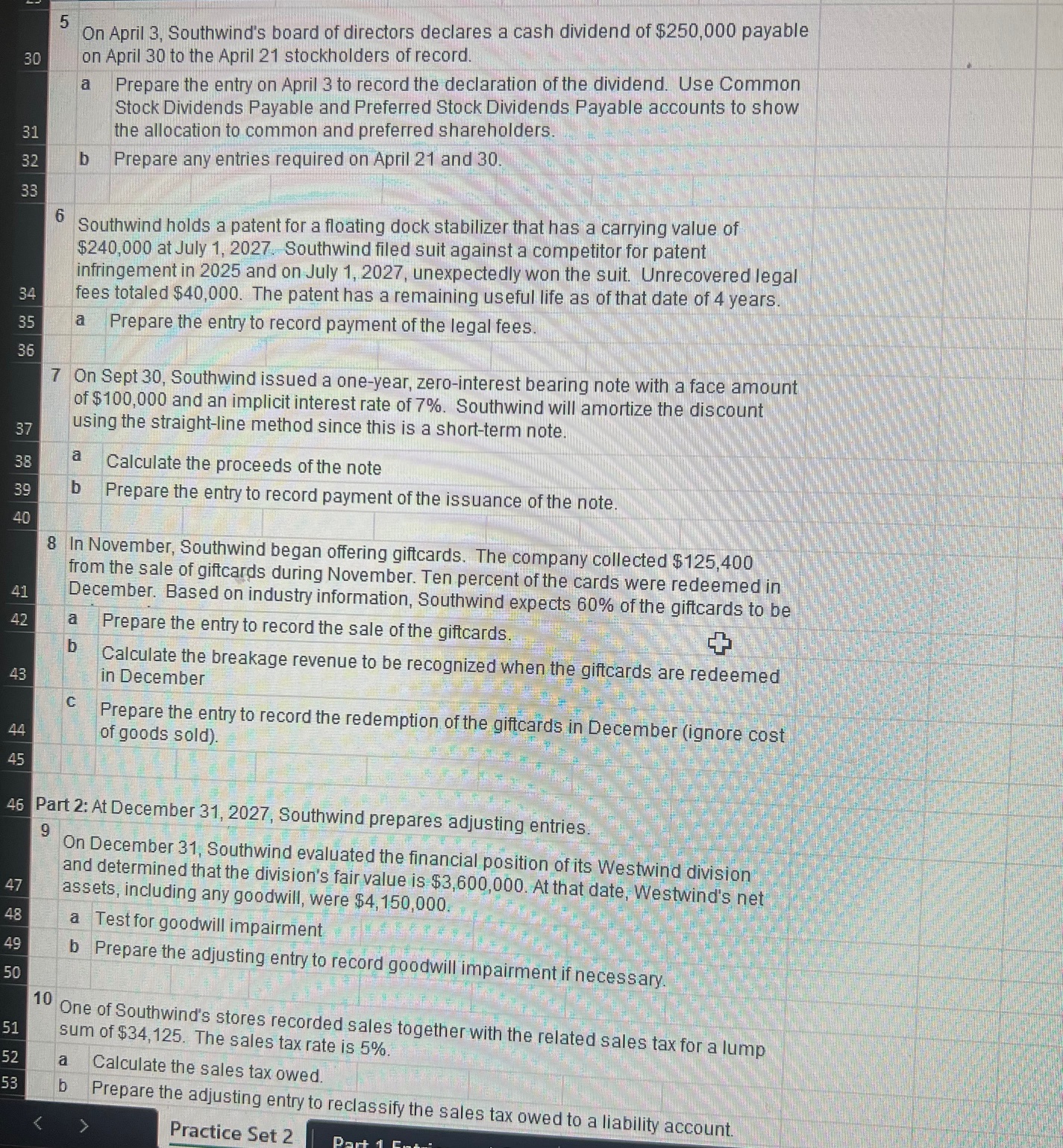

On April Southwind's board of directors declares a cash dividend of $ payable on April to the April stockholders of record.

a Prepare the entry on April to record the declaration of the dividend. Use Common Stock Dividends Payable and Preferred Stock Dividends Payable accounts to show

the allocation to common and preferred shareholders.

Southwind holds a patent for a floating dock stabilizer that has a carrying value of $ at July Southwind filed suit against a competitor for patent infringement in and on July unexpectedly won the suit. Unrecovered legal fees totaled $ The patent has a remaining useful life as of that date of years.

a Prepare the entry to record payment of the legal fees.

On Sept Southwind issued a oneyear, zerointerest bearing note with a face amount of $ and an implicit interest rate of Southwind will amortize the discount using the straightline method since this is a shortterm note.

a Calculate the proceeds of the note

b Prepare the entry to record payment of the issuance of the note.

In November, Southwind began offering giftcards. The company collected $ from the sale of giftcards during November. Ten percent of the cards were redeemed in December. Based on industry information, Southwind expects of the giftcards to be

a Prepare the entry to record the sale of the giftcards.

b Calculate the breakage revenue to be recognized when the giftcards are redeemed in December

c Prepare the entry to record the redemption of the giftcards in December ignore cost of goods sold

Part : At December Southwind prepares adjusting entries.

On December Southwind evaluated the financial position of its Westwind division and determined that the division's fair value is $ At that date, Westwind's net assets, including any goodwill, were $

a Test for goodwill impairment

b Prepare the adjusting entry to record goodwill impairment if necessary.

One of Southwind's stores recorded sales together with the related sales tax for a lump sum of $ The sales tax rate is

a Calculate the sales tax owed.

b Prepare the adjusting entry to reclassify the sales tax owed to a liability account.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock