Question: Hello, I would like to better understand how to solve these problems. If you could solve all of them that would be amazing, thank you!

Hello, I would like to better understand how to solve these problems. If you could solve all of them that would be amazing, thank you!

Hello, I would like to better understand how to solve these problems. If you could solve all of them that would be amazing, thank you!

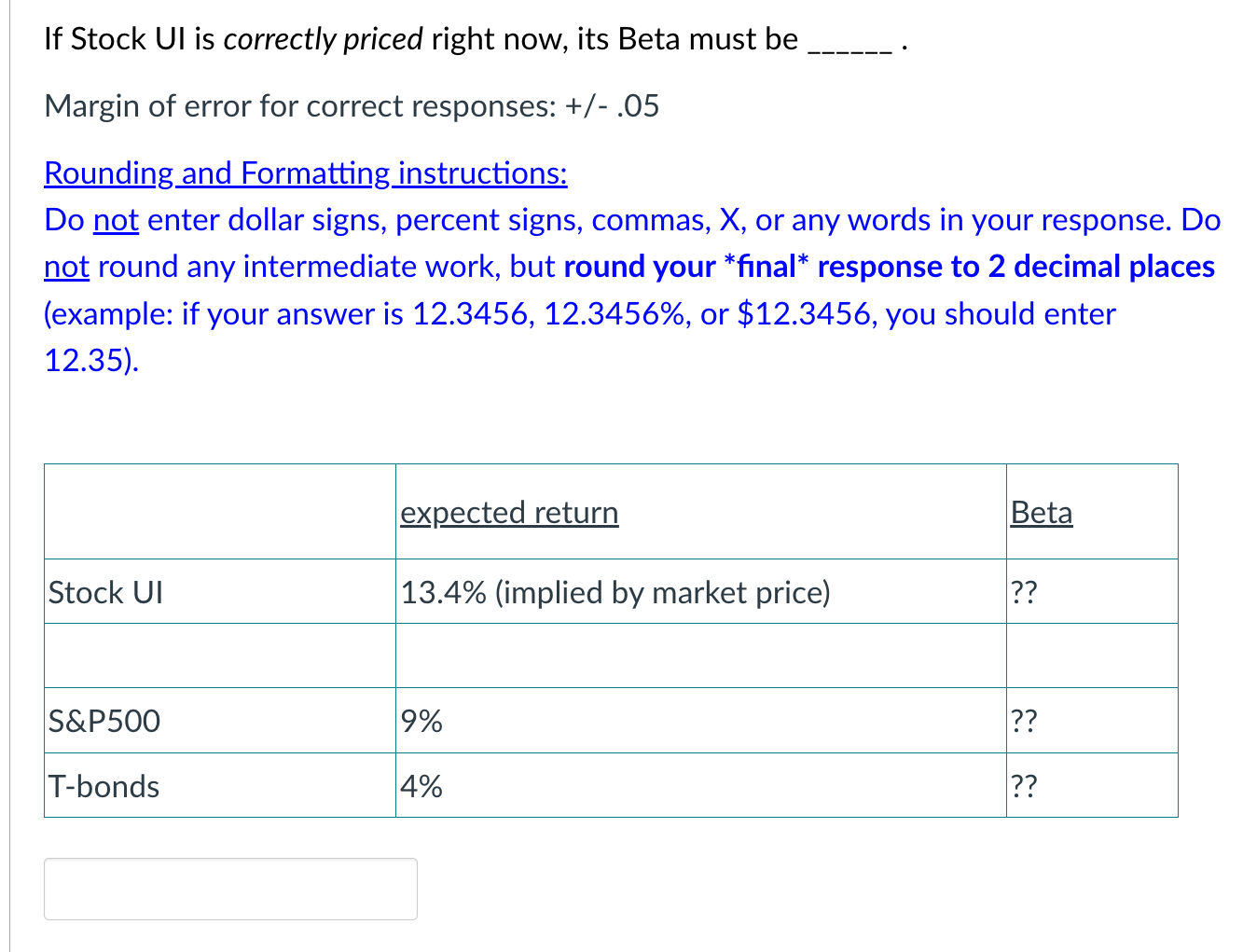

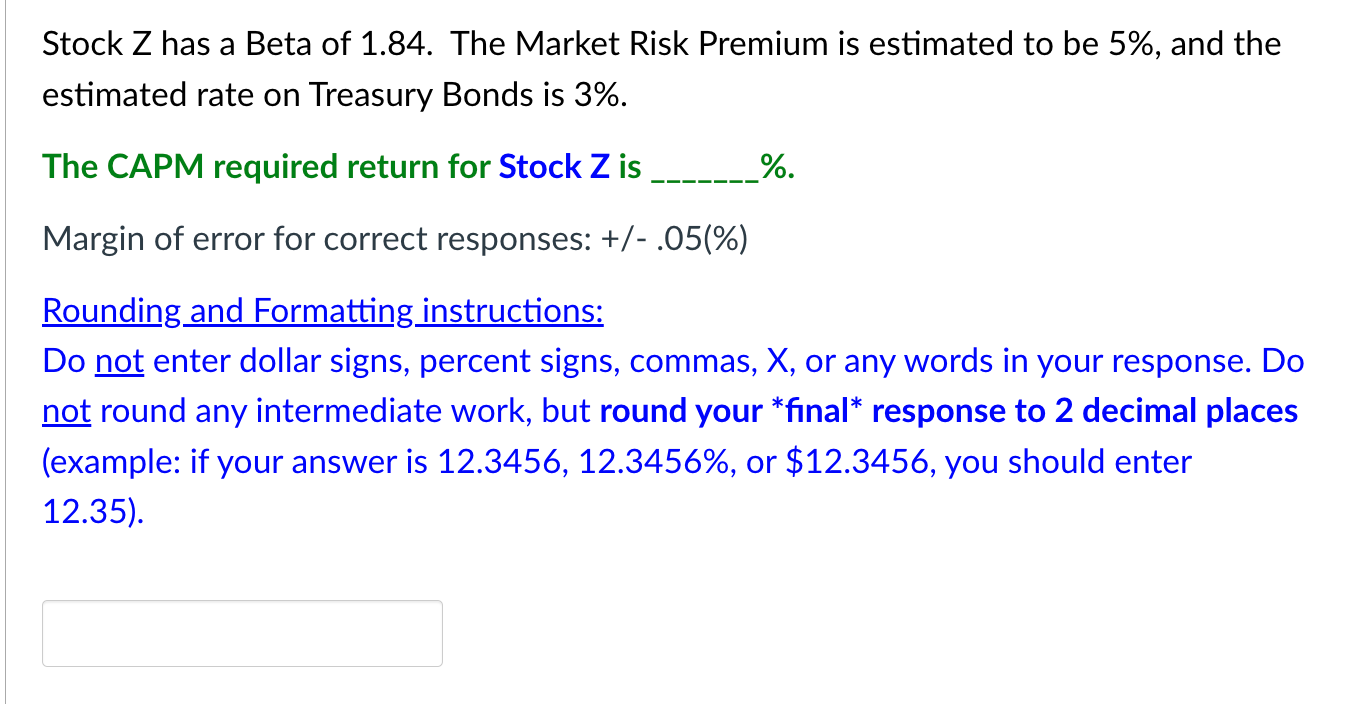

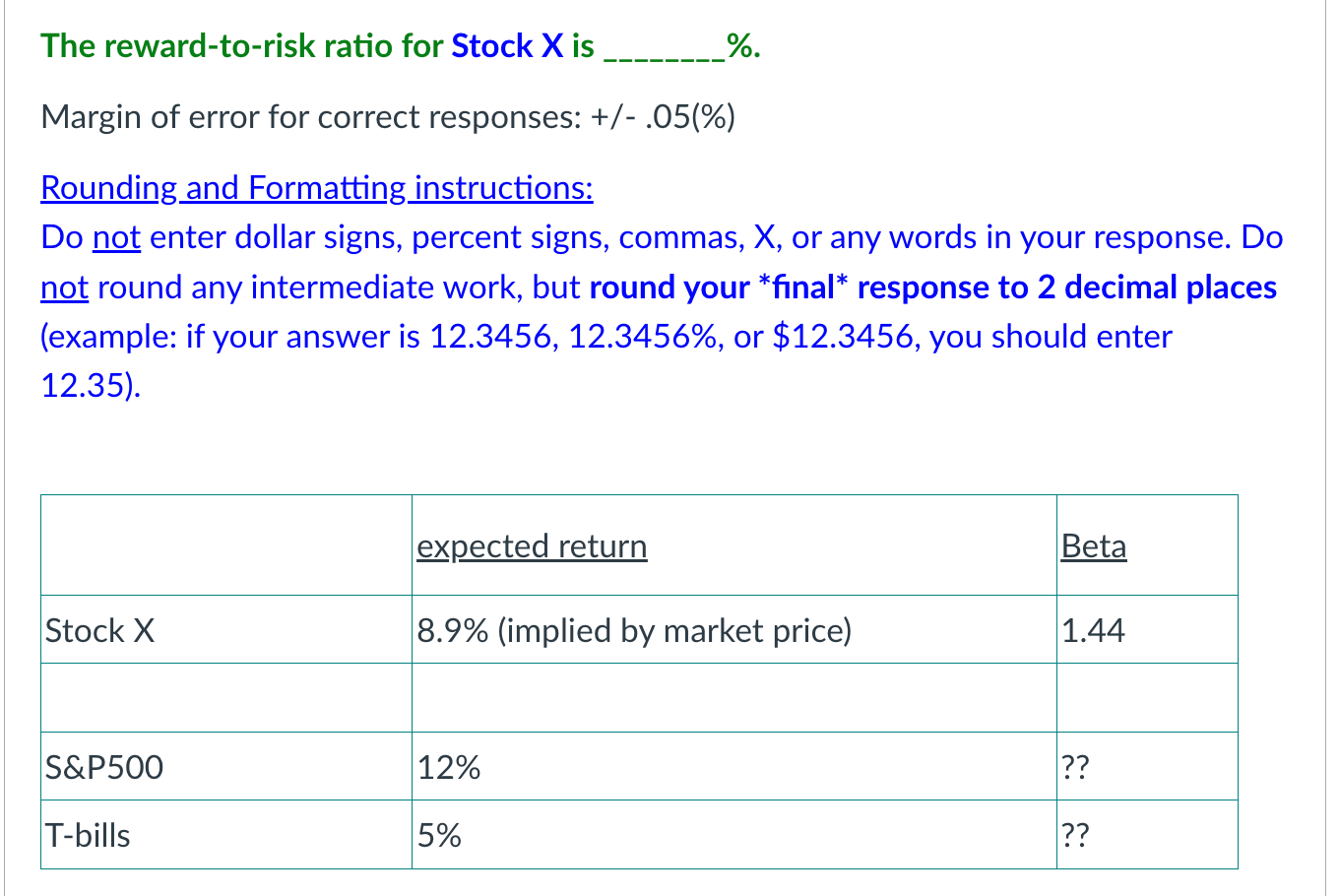

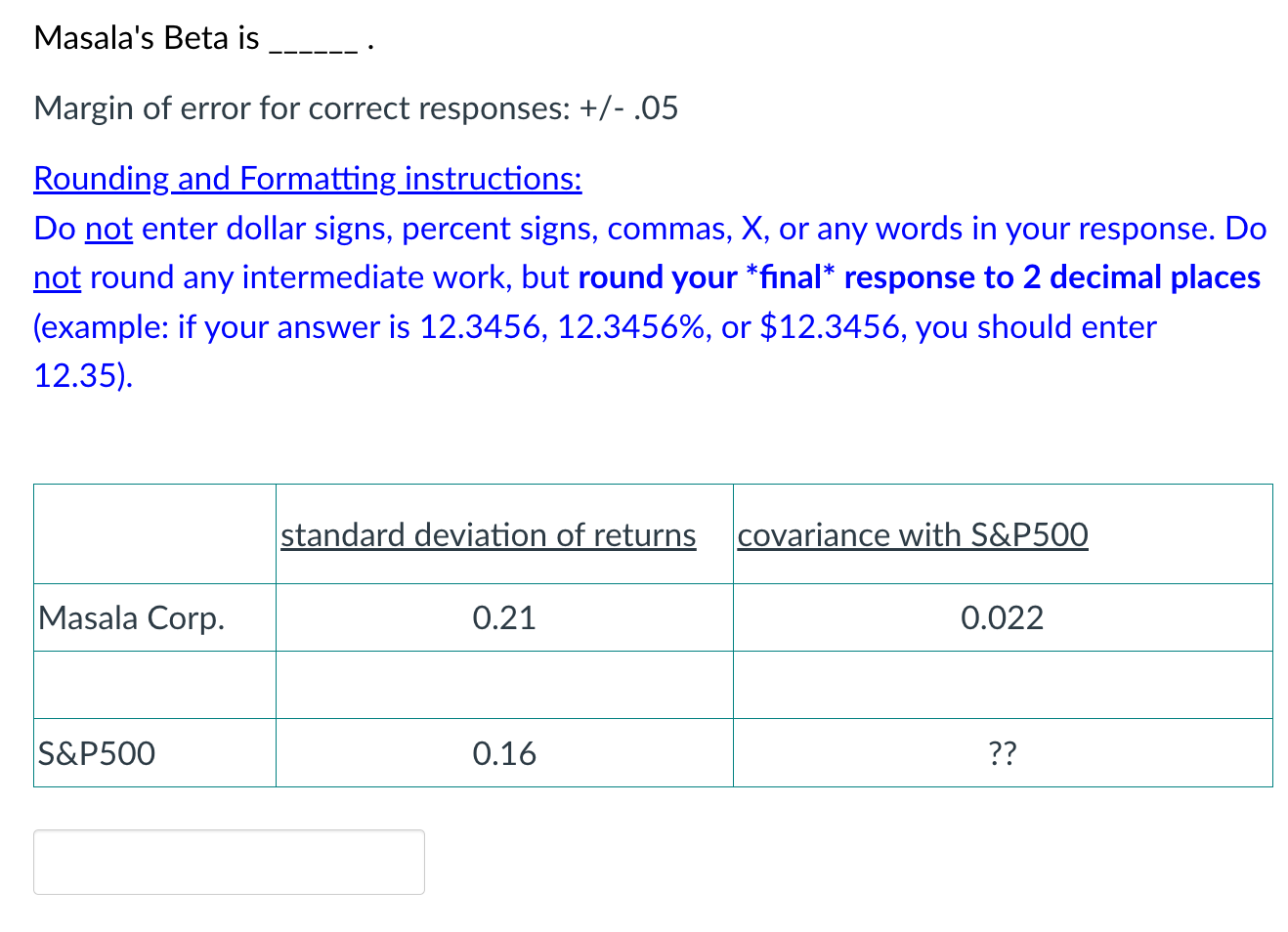

If Stock UI is correctly priced right now, its Beta must be Margin of error for correct responses: +/.05 Rounding and Formatting instructions: Do not enter dollar signs, percent signs, commas, X, or any words in your response. Do not round any intermediate work, but round your *final* response to 2 decimal places (example: if your answer is 12.3456,12.3456%, or $12.3456, you should enter 12.35). Stock Z has a Beta of 1.84 . The Market Risk Premium is estimated to be 5%, and the estimated rate on Treasury Bonds is 3%. The CAPM required return for Stock Z is % Margin of error for correct responses: +/.05(%) Rounding and Formatting instructions: Do not enter dollar signs, percent signs, commas, X, or any words in your response. Do not round any intermediate work, but round your *final* response to 2 decimal places (example: if your answer is 12.3456,12.3456%, or $12.3456, you should enter 12.35) The reward-to-risk ratio for Stock X is %. Margin of error for correct responses: +/.05(%) Rounding and Formatting instructions: Do not enter dollar signs, percent signs, commas, X, or any words in your response. Do not round any intermediate work, but round your *final* response to 2 decimal places (example: if your answer is 12.3456,12.3456%, or $12.3456, you should enter 12.35). Masala's Beta is Margin of error for correct responses: +/.05 Rounding and Formatting instructions: Do not enter dollar signs, percent signs, commas, X, or any words in your response. Do not round any intermediate work, but round your *final* response to 2 decimal places (example: if your answer is 12.3456,12.3456%, or $12.3456, you should enter 12.35)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts