Question: Hello, I would like to have the answer to question a to h. I am a beginner and would like to understand the steps one

Hello,

I would like to have the answer to question a to h. I am a beginner and would like to understand the steps one by one I have started to fill in an Excel.

I thank you in advance, Sincerely

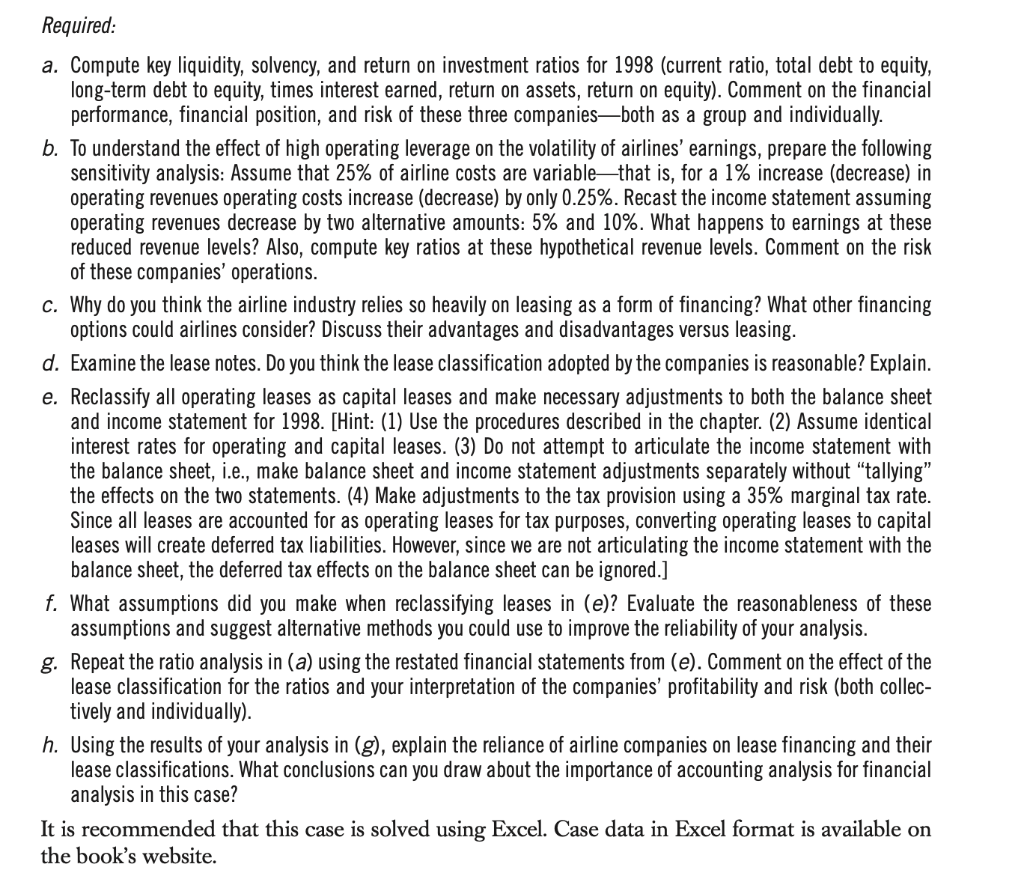

Required: a. Compute key liquidity, solvency, and return on investment ratios for 1998 (current ratio, total debt to equity, long-term debt to equity, times interest earned, return on assets, return on equity). Comment on the financial performance, financial position, and risk of these three companiesboth as a group and individually. b. To understand the effect of high operating leverage on the volatility of airlines' earnings, prepare the following sensitivity analysis: Assume that 25% of airline costs are variablethat is, for a 1% increase (decrease) in operating revenues operating costs increase (decrease) by only 0.25%. Recast the income statement assuming operating revenues decrease by two alternative amounts: 5% and 10%. What happens to earnings at these reduced revenue levels? Also, compute key ratios at these hypothetical revenue levels. Comment on the risk of these companies' operations. c. Why do you think the airline industry relies so heavily on leasing as a form of financing? What other financing options could airlines consider? Discuss their advantages and disadvantages versus leasing. d. Examine the lease notes. Do you think the lease classification adopted by the companies is reasonable? Explain. e. Reclassify all operating leases as capital leases and make necessary adjustments to both the balance sheet and income statement for 1998. [Hint: (1) Use the procedures described in the chapter. (2) Assume identical interest rates for operating and capital leases. (3) Do not attempt to articulate the income statement with the balance sheet, i.e., make balance sheet and income statement adjustments separately without tallying the effects on the two statements. (4) Make adjustments to the tax provision using a 35% marginal tax rate. Since all leases are accounted for as operating leases for tax purposes, converting operating leases to capital leases will create deferred tax liabilities. However, since we are not articulating the income statement with the balance sheet, the deferred tax effects on the balance sheet can be ignored.] f. What assumptions did you make when reclassifying leases in (e)? Evaluate the reasonableness these assumptions and suggest alternative methods you could use to improve the reliability of your analysis. g. Repeat the ratio analysis in (a) using the restated financial statements from (e). Comment on the effect of the lease classification for the ratios and your interpretation of the companies' profitability and risk (both collec- tively and individually). h. Using the results of your analysis in (g), explain the reliance of airline companies on lease financing and their lease classifications. What conclusions can you draw about the importance of accounting analysis for financial analysis in this case? It is recommended that this case is solved using Excel. Case data in Excel format is available on the book's website

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts