Question: please answer d & e only Problem 1 Given the following data as of the close of trading on 10/26/18: Quest Diagnostics (DGX): 91.47 T-bill:

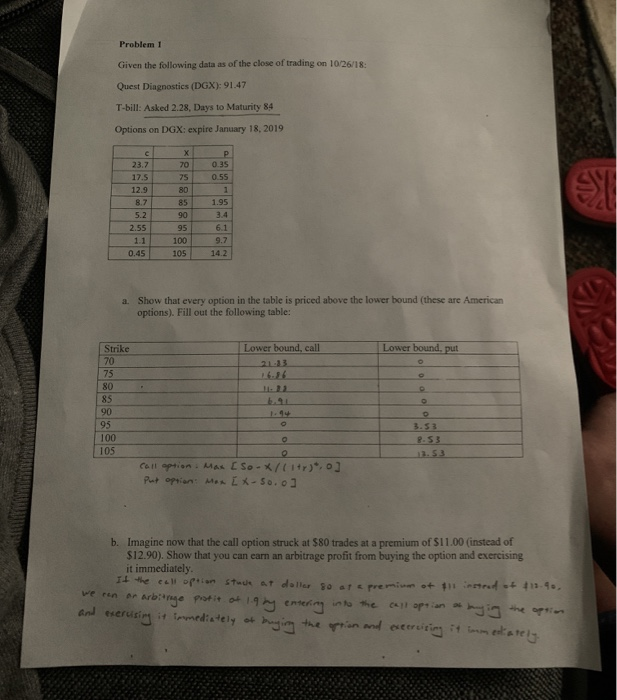

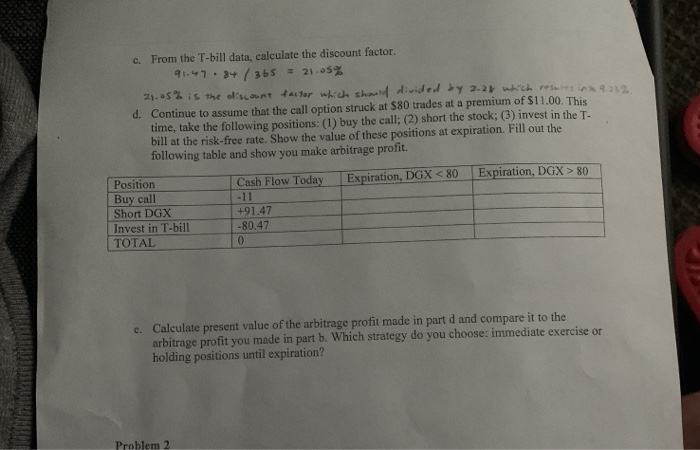

Problem 1 Given the following data as of the close of trading on 10/26/18: Quest Diagnostics (DGX): 91.47 T-bill: Asked 2.28, Days to Maturity 84 Options on DGX: expire January 18, 2019 23.7 90 100 0.45 105 14.2 a. Show that every option in the table is priced above the lower bound (these are American options). Fill out the following table: Strike Lower bound, call Lower bound, put 80 1. 10 95 100 105 P.53 13.53 Call option. Max CSO -x/t1+r), 0] Put option: Max [x-so.o] b. Imagine now that the call option struck at $80 trades at a premium of $11.00 (instead of $12.90). Show that you can earn an arbitrage profit from buying the option and exercising it immediately It the call option stuck at doller so at a premiun of instead of $12.90 we on or arborge profit of 1-9 my entering into the cell option is the optio and serusing it immediately of hanging the option and serviting it immediately c. From the T-bill data, calculate the discount factor. 91.47.34 / 365 = 21.65% 21.052 is the otiscount factor which should divided by 2.28 which results in an d. Continue to assume that the call option struck at $80 trades at a premium of $11.00. This time, take the following positions: (1) buy the call; (2) short the stock; (3) invest in the T- bill at the risk-free rate. Show the value of these positions at expiration. Fill out the following table and show you make arbitrage profit. Expiration, DGX 80 Position Buy call Short DGX Invest in T-bill TOTAL Cash Flow Today -11 +91.47 -80.47 PALLARI e. Calculate present value of the arbitrage profit made in part d and compare it to the arbitrage profit you made in part b. Which strategy do you choose: immediate exercise or holding positions until expiration? Problem 2 Problem 1 Given the following data as of the close of trading on 10/26/18: Quest Diagnostics (DGX): 91.47 T-bill: Asked 2.28, Days to Maturity 84 Options on DGX: expire January 18, 2019 23.7 90 100 0.45 105 14.2 a. Show that every option in the table is priced above the lower bound (these are American options). Fill out the following table: Strike Lower bound, call Lower bound, put 80 1. 10 95 100 105 P.53 13.53 Call option. Max CSO -x/t1+r), 0] Put option: Max [x-so.o] b. Imagine now that the call option struck at $80 trades at a premium of $11.00 (instead of $12.90). Show that you can earn an arbitrage profit from buying the option and exercising it immediately It the call option stuck at doller so at a premiun of instead of $12.90 we on or arborge profit of 1-9 my entering into the cell option is the optio and serusing it immediately of hanging the option and serviting it immediately c. From the T-bill data, calculate the discount factor. 91.47.34 / 365 = 21.65% 21.052 is the otiscount factor which should divided by 2.28 which results in an d. Continue to assume that the call option struck at $80 trades at a premium of $11.00. This time, take the following positions: (1) buy the call; (2) short the stock; (3) invest in the T- bill at the risk-free rate. Show the value of these positions at expiration. Fill out the following table and show you make arbitrage profit. Expiration, DGX 80 Position Buy call Short DGX Invest in T-bill TOTAL Cash Flow Today -11 +91.47 -80.47 PALLARI e. Calculate present value of the arbitrage profit made in part d and compare it to the arbitrage profit you made in part b. Which strategy do you choose: immediate exercise or holding positions until expiration? Problem 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts