Question: Hello, I'm having a hard time with this assignment, I realize Chegg has a small time allotment but any help you can give is SO

Hello, I'm having a hard time with this assignment, I realize Chegg has a small time allotment but any help you can give is SO appreciated to get started on the VSM map.

Create a current state map for the mailroom operation for categories 1-3 (page 6)

. Start your value stream map with delivery of the mail to ING.

Additional information:

Assume 1000 pieces of mail for your inventory calculations

Receiving and transporting the mail to the mailrooms take 5 min each

Creating the calculator tapes takes 5 minutes, in 20% of the cases the totals of the two tapes are different

Manual verification takes 1 minute, totals are rarely wrong.

Use a weighted average for the processing time of CIFing

You do not have to calculate total lead time and processing time since some of the processes are performed at the same time, but you need to show the timeline.

Show how you calculated your times

Identify at least 2 improvement opportunities

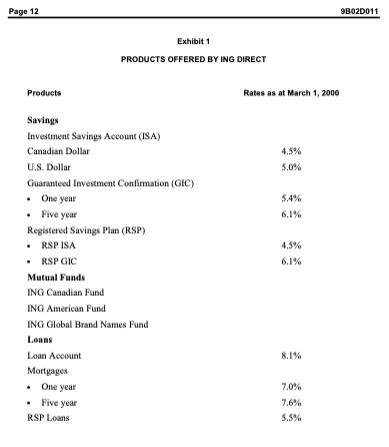

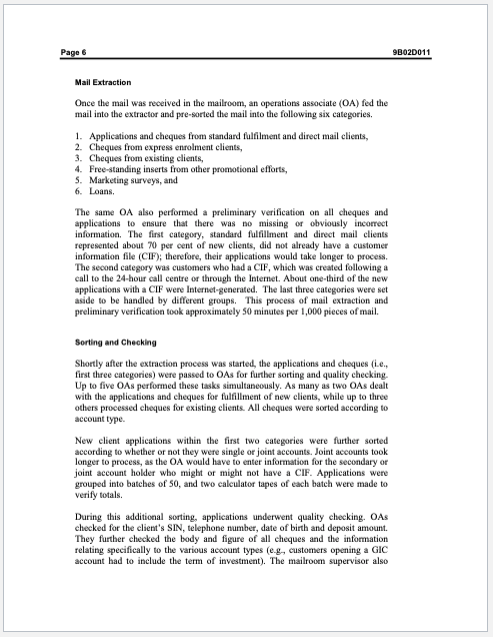

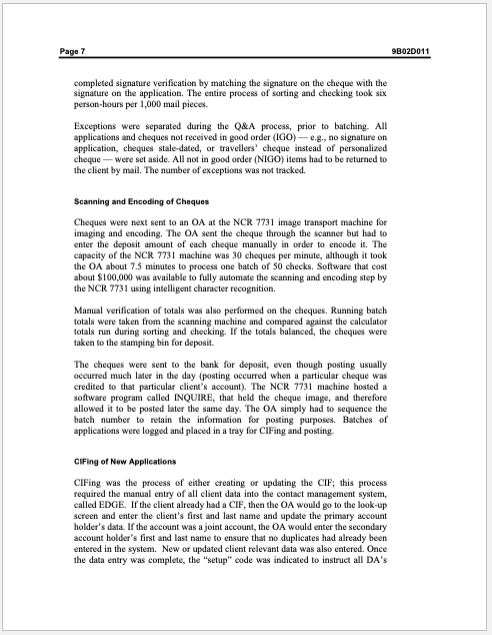

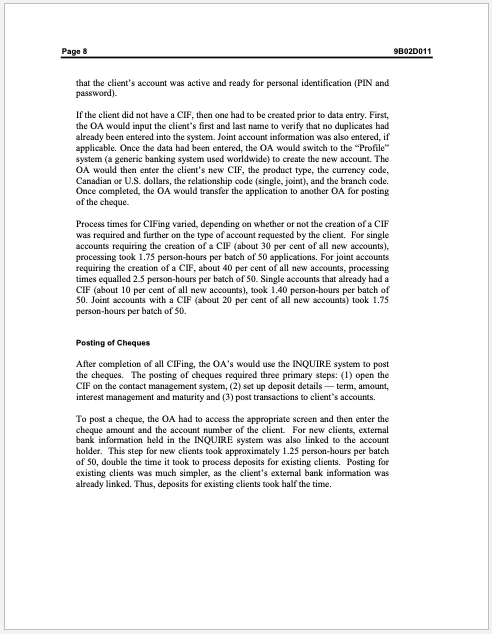

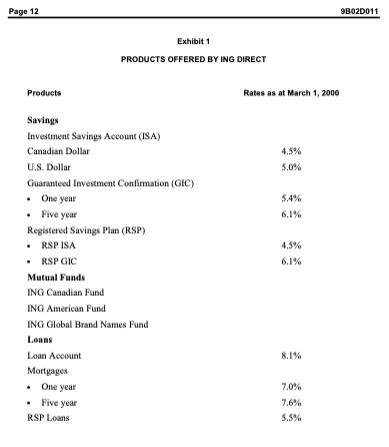

Page 6 98020011 Mail Extraction Once the mail was received in the mailroom, an operations associate (OA) fed the mail into the extractor and pre-sorted the mail into the following six categories 1. Applications and cheques from standard fulfilment and direct mail clients, 2. Cheques from express enrolment clients, 3. Chegues from existing clients, 4. Free-standing inserts from other promotional efforts 5. Marketing surveys, and 6 Loans The same OA also performed a preliminary verification on all cheques and applications to ensure that there was no missing or obviously incorrect information. The first category, standard fulfillment and direct mail clients represented about 70 per cent of new clients, did not already have a customer information file (CIF); therefore, their applications would take longer to process The second category was customers who had a CIF, which was created following a call to the 24-hour call centre or through the Internet. About one-third of the new applications with a CIF were Internet-generated. The last three categories were set aside to be handled by different groups. This process of mail extraction and preliminary verification took approximately 50 minutes per 1,000 pieces of mail Sorting and Checking Shortly after the extraction process was started, the applications and cheques (.. first three categories) were passed to OAs for further sorting and quality checking Up to five OAs performed these tasks simultaneously. As many as two OAs dealt with the applications and cheques for fulfillment of new clients, while up to three others processed cheques for existing clients. All cheques were sorted according to accounttype. New client applications within the first two categories were further sorted according to whether or not they were single or joint accounts. Joint accounts took longer to process, as the OA would have to enter information for the secondary or joint account holder who might or might not have a CIF. Applications were grouped into batches of 50, and two calculator tapes of each batch were made to verify totals. During this additional sorting, applications underwent quality checking. OAS checked for the client's SIN, telephone number, date of birth and deposit amount They further checked the body and figure of all cheques and the information relating specifically to the various account types (eg, customers opening a GIC account had to include the term of investment). The mailroom supervisor also Page 7 98020011 completed signature verification by matching the signature on the cheque with the signature on the application. The entire process of sorting and checking took six person-hours per 1,000 mail pieces. Exceptions were separated during the Q&A process, prior to balching. All applications and cheques not received in good order (100)- .g. no signature on application, cheques stale-dated, or travellers' cheque instead of personalized cheque-were set aside. All not in good order (NIGO) items had to be returned to the client by mail. The number of exceptions was not tracked Scanning and Encoding of Cheques Cheques were next sent to an OA at the NCR 7731 image transport machine for Imaging and encoding. The OA sent the cheque through the scanner but had to enter the deposit amount of each cheque manually in order to encode it. The capacity of the NCR 7731 machine was 30 cheques per minute, although it took the OA about 7.5 minutes to process one batch of 50 checks. Software that cost about $100,000 was available to fully automate the scanning and encoding step by the NCR 7731 using intelligent character recognition Manual verification of totals was also performed on the cheques. Running batch totals were taken from the scanning machine and compared against the calculator totals run during sorting and checking. If the totals balanced, the cheques were taken to the stamping bin for deposit The cheques were sent to the bank for deposit, even though posting usually occurred much later in the day posting occurred when a particular cheque was credited to that particular client's account). The NCR 7731 machine hosted a software program called INQUIRE, that held the cheque image, and therefore allowed it to be posted later the same day. The OA simply had to sequence the batch number to retain the information for posting purposes. Batches of applications were logged and placed in a tray for CIFing and posting CIFing of New Applications CIFing was the process of either creating or updating the CIF, this process required the manual entry of all client data into the contact management system, called EDGE. If the client already had a CIF, then the OA would go to the look-up screen and enter the client's first and last name and update the primary account holder's data. If the account was a joint account, the OA would enter the secondary account holder's first and last name to ensure that no duplicates had already been entered in the system. New or updated client relevant data was also entered. Once the data entry was complete the setup" code was indicated to instruct all DA's 98020011 that the client's account was active and ready for personal identification (PIN and password) Ir the client did not have a CIF, then one had to be created prior to data entry. First, the OA would input the client's first and last name to verify that no duplicates had already been entered into the system. Joint account information was also entered, if applicable. Once the data had been entered, the OA would switch to the Profile system (a generic banking system used worldwide) to create the new account. The OA would then enter the client's new CIF, the product type, the currency code, Canadian or US dollars, the relationship code (single joint), and the branch code. Once completed, the OA would transfer the application to another OA for posting of the cheque. Process times for CIFing varied, depending on whether or not the creation of a CIF was required and further on the type of account requested by the client. For single accounts requiring the creation of a CIF (about 30 per cent of all new accounts), processing took 1.75 person-hours per batch of 50 applications. For joint accounts requiring the creation of a CIF, about 40 per cent of all new accounts, processing times equalled 25 person-hours per batch of 50. Single accounts that already had a CIF (about 10 per cent of all new accounts), took 1.40 person-hours per batch of SO. Joint accounts with a CIF (about 20 per cent of all new accounts) took 1.75 person-hours per batch of 50. Posting of Cheques After completion of all CIFing, the OA's would use the INQUIRE system to post the cheques. The posting of cheques required three primary steps: (1) open the CIF on the contact management system, (2) set up deposit details-term, amount, interest management and maturity and (3) post transactions to client's accounts To post a cheque, the OA had to access the appropriate screen and then enter the chegue amount and the account number of the client For new clients external bank information held in the INQUIRE system was also linked to the account holder. This step for new clients took approximately 1.25 person-hours per batch of 50, double the time it took to process deposits for existing clients. Posting for existing clients was much simpler, as the client's extemal bank information was already linked. Thus, deposits for existing clients took half the time. Page 9 9B02D011 STAFFING LEVELS AND BATCH SIZES In total, nine OA's were involved in the mailroom operations process at various times during the day. One OA was responsible for opening the mail, up to five OA's were responsible for sorting and checking, and an additional OA was responsible for the scanning. Once these tasks were complete, these seven OA's would join the other two in the CIFing and posting part of the process. Hadley MacDonald had tried to estimate the mailroom capacity for preparation and processing of new and existing accounts. He knew that delays were not currently tracked, although there was a factor built into average process times to account for delays at each step. As a result, total available staff hours were an approximation based on the following calculations, Nine OAs worked 6.5 hours, for a total of 58.5 hours per day. However, only five of these associates worked in the preparation, including extracting, sorting and checking, and scanning and encoding. The remaining four OAs worked in another area of the operations group until some applications were ready for CIFing and posting, Mail was received at 8:30 a.m., and CIFing and posting were scheduled to begin at 10:30a.m. As a result, eight hours were subtracted from $8.5 hours, giving an approximate total of 50.5 hours available for preparation and processing of new and existing accounts Hadley MacDonald learned that the batch size for the various mailroom processes had been set by a previous mailroom supervisor and had not been changed since 1997 Page 12 0020011 Exhibit 1 PRODUCTS OFFERED BY ING DIRECT Products Rates as at March 1, 2000 4.5% 5.0% 5.4% 6,1% Savings Investment Savings Account (ISA) Canadian Dollar U.S. Dollar Guaranteed Investment Confirmation (GIC) One year . Five year Registered Savings Plan (RSP) RSPISA RSP GIC Mutual Funds ING Canadian Fund ING American Fund ING Global Brand Names Fund Loans Loan Account Mortgages One year Five year RSP Loans 8.1% 7.0% 5.3% Page 6 98020011 Mail Extraction Once the mail was received in the mailroom, an operations associate (OA) fed the mail into the extractor and pre-sorted the mail into the following six categories 1. Applications and cheques from standard fulfilment and direct mail clients, 2. Cheques from express enrolment clients, 3. Chegues from existing clients, 4. Free-standing inserts from other promotional efforts 5. Marketing surveys, and 6 Loans The same OA also performed a preliminary verification on all cheques and applications to ensure that there was no missing or obviously incorrect information. The first category, standard fulfillment and direct mail clients represented about 70 per cent of new clients, did not already have a customer information file (CIF); therefore, their applications would take longer to process The second category was customers who had a CIF, which was created following a call to the 24-hour call centre or through the Internet. About one-third of the new applications with a CIF were Internet-generated. The last three categories were set aside to be handled by different groups. This process of mail extraction and preliminary verification took approximately 50 minutes per 1,000 pieces of mail Sorting and Checking Shortly after the extraction process was started, the applications and cheques (.. first three categories) were passed to OAs for further sorting and quality checking Up to five OAs performed these tasks simultaneously. As many as two OAs dealt with the applications and cheques for fulfillment of new clients, while up to three others processed cheques for existing clients. All cheques were sorted according to accounttype. New client applications within the first two categories were further sorted according to whether or not they were single or joint accounts. Joint accounts took longer to process, as the OA would have to enter information for the secondary or joint account holder who might or might not have a CIF. Applications were grouped into batches of 50, and two calculator tapes of each batch were made to verify totals. During this additional sorting, applications underwent quality checking. OAS checked for the client's SIN, telephone number, date of birth and deposit amount They further checked the body and figure of all cheques and the information relating specifically to the various account types (eg, customers opening a GIC account had to include the term of investment). The mailroom supervisor also Page 7 98020011 completed signature verification by matching the signature on the cheque with the signature on the application. The entire process of sorting and checking took six person-hours per 1,000 mail pieces. Exceptions were separated during the Q&A process, prior to balching. All applications and cheques not received in good order (100)- .g. no signature on application, cheques stale-dated, or travellers' cheque instead of personalized cheque-were set aside. All not in good order (NIGO) items had to be returned to the client by mail. The number of exceptions was not tracked Scanning and Encoding of Cheques Cheques were next sent to an OA at the NCR 7731 image transport machine for Imaging and encoding. The OA sent the cheque through the scanner but had to enter the deposit amount of each cheque manually in order to encode it. The capacity of the NCR 7731 machine was 30 cheques per minute, although it took the OA about 7.5 minutes to process one batch of 50 checks. Software that cost about $100,000 was available to fully automate the scanning and encoding step by the NCR 7731 using intelligent character recognition Manual verification of totals was also performed on the cheques. Running batch totals were taken from the scanning machine and compared against the calculator totals run during sorting and checking. If the totals balanced, the cheques were taken to the stamping bin for deposit The cheques were sent to the bank for deposit, even though posting usually occurred much later in the day posting occurred when a particular cheque was credited to that particular client's account). The NCR 7731 machine hosted a software program called INQUIRE, that held the cheque image, and therefore allowed it to be posted later the same day. The OA simply had to sequence the batch number to retain the information for posting purposes. Batches of applications were logged and placed in a tray for CIFing and posting CIFing of New Applications CIFing was the process of either creating or updating the CIF, this process required the manual entry of all client data into the contact management system, called EDGE. If the client already had a CIF, then the OA would go to the look-up screen and enter the client's first and last name and update the primary account holder's data. If the account was a joint account, the OA would enter the secondary account holder's first and last name to ensure that no duplicates had already been entered in the system. New or updated client relevant data was also entered. Once the data entry was complete the setup" code was indicated to instruct all DA's 98020011 that the client's account was active and ready for personal identification (PIN and password) Ir the client did not have a CIF, then one had to be created prior to data entry. First, the OA would input the client's first and last name to verify that no duplicates had already been entered into the system. Joint account information was also entered, if applicable. Once the data had been entered, the OA would switch to the Profile system (a generic banking system used worldwide) to create the new account. The OA would then enter the client's new CIF, the product type, the currency code, Canadian or US dollars, the relationship code (single joint), and the branch code. Once completed, the OA would transfer the application to another OA for posting of the cheque. Process times for CIFing varied, depending on whether or not the creation of a CIF was required and further on the type of account requested by the client. For single accounts requiring the creation of a CIF (about 30 per cent of all new accounts), processing took 1.75 person-hours per batch of 50 applications. For joint accounts requiring the creation of a CIF, about 40 per cent of all new accounts, processing times equalled 25 person-hours per batch of 50. Single accounts that already had a CIF (about 10 per cent of all new accounts), took 1.40 person-hours per batch of SO. Joint accounts with a CIF (about 20 per cent of all new accounts) took 1.75 person-hours per batch of 50. Posting of Cheques After completion of all CIFing, the OA's would use the INQUIRE system to post the cheques. The posting of cheques required three primary steps: (1) open the CIF on the contact management system, (2) set up deposit details-term, amount, interest management and maturity and (3) post transactions to client's accounts To post a cheque, the OA had to access the appropriate screen and then enter the chegue amount and the account number of the client For new clients external bank information held in the INQUIRE system was also linked to the account holder. This step for new clients took approximately 1.25 person-hours per batch of 50, double the time it took to process deposits for existing clients. Posting for existing clients was much simpler, as the client's extemal bank information was already linked. Thus, deposits for existing clients took half the time. Page 9 9B02D011 STAFFING LEVELS AND BATCH SIZES In total, nine OA's were involved in the mailroom operations process at various times during the day. One OA was responsible for opening the mail, up to five OA's were responsible for sorting and checking, and an additional OA was responsible for the scanning. Once these tasks were complete, these seven OA's would join the other two in the CIFing and posting part of the process. Hadley MacDonald had tried to estimate the mailroom capacity for preparation and processing of new and existing accounts. He knew that delays were not currently tracked, although there was a factor built into average process times to account for delays at each step. As a result, total available staff hours were an approximation based on the following calculations, Nine OAs worked 6.5 hours, for a total of 58.5 hours per day. However, only five of these associates worked in the preparation, including extracting, sorting and checking, and scanning and encoding. The remaining four OAs worked in another area of the operations group until some applications were ready for CIFing and posting, Mail was received at 8:30 a.m., and CIFing and posting were scheduled to begin at 10:30a.m. As a result, eight hours were subtracted from $8.5 hours, giving an approximate total of 50.5 hours available for preparation and processing of new and existing accounts Hadley MacDonald learned that the batch size for the various mailroom processes had been set by a previous mailroom supervisor and had not been changed since 1997 Page 12 0020011 Exhibit 1 PRODUCTS OFFERED BY ING DIRECT Products Rates as at March 1, 2000 4.5% 5.0% 5.4% 6,1% Savings Investment Savings Account (ISA) Canadian Dollar U.S. Dollar Guaranteed Investment Confirmation (GIC) One year . Five year Registered Savings Plan (RSP) RSPISA RSP GIC Mutual Funds ING Canadian Fund ING American Fund ING Global Brand Names Fund Loans Loan Account Mortgages One year Five year RSP Loans 8.1% 7.0% 5.3%