Question: Hello, I'm having trouble with these problems. I would greatly appreciate any help! The first three screenshots are all the same problem. For each of

Hello, I'm having trouble with these problems. I would greatly appreciate any help! The first three screenshots are all the same problem.

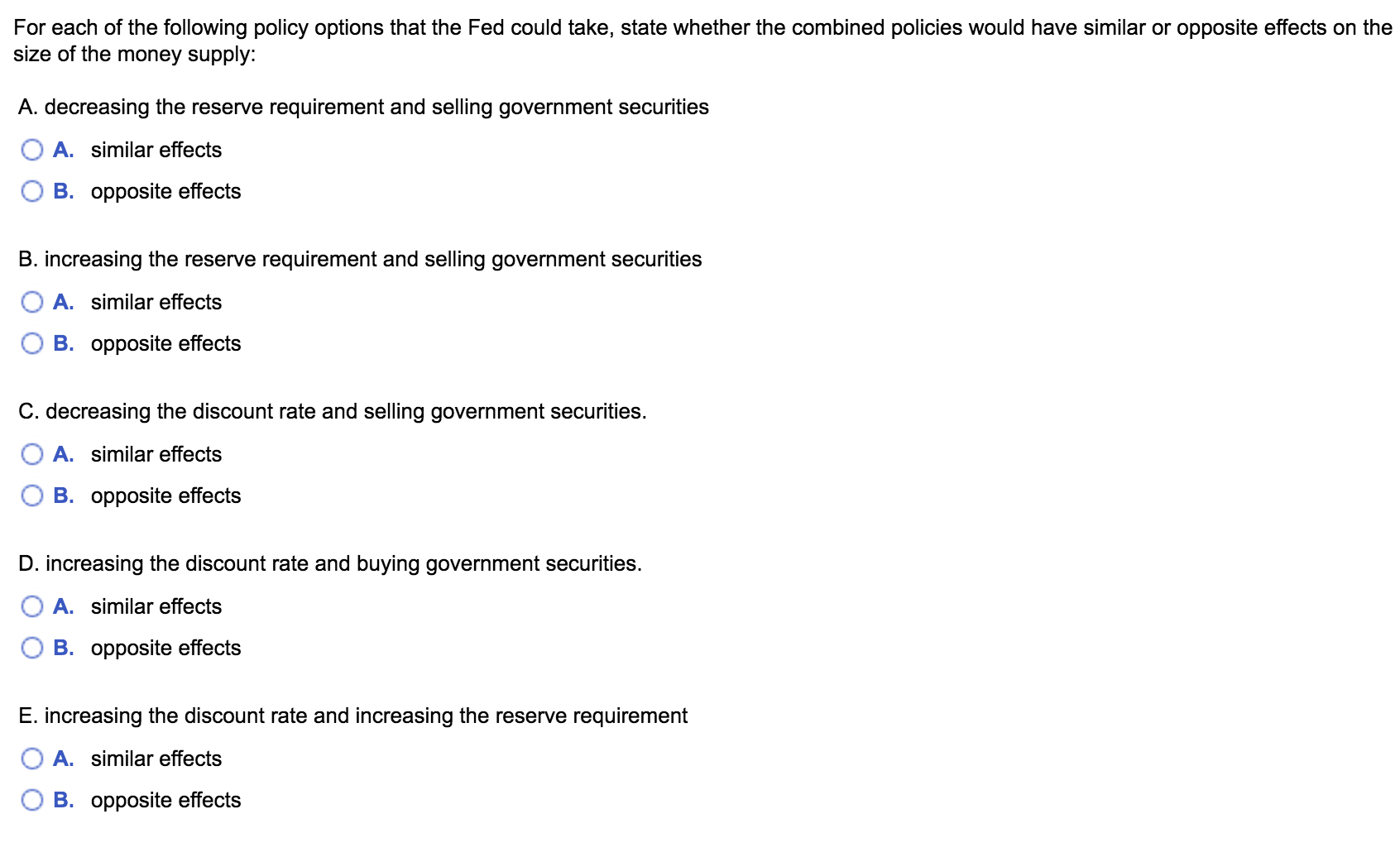

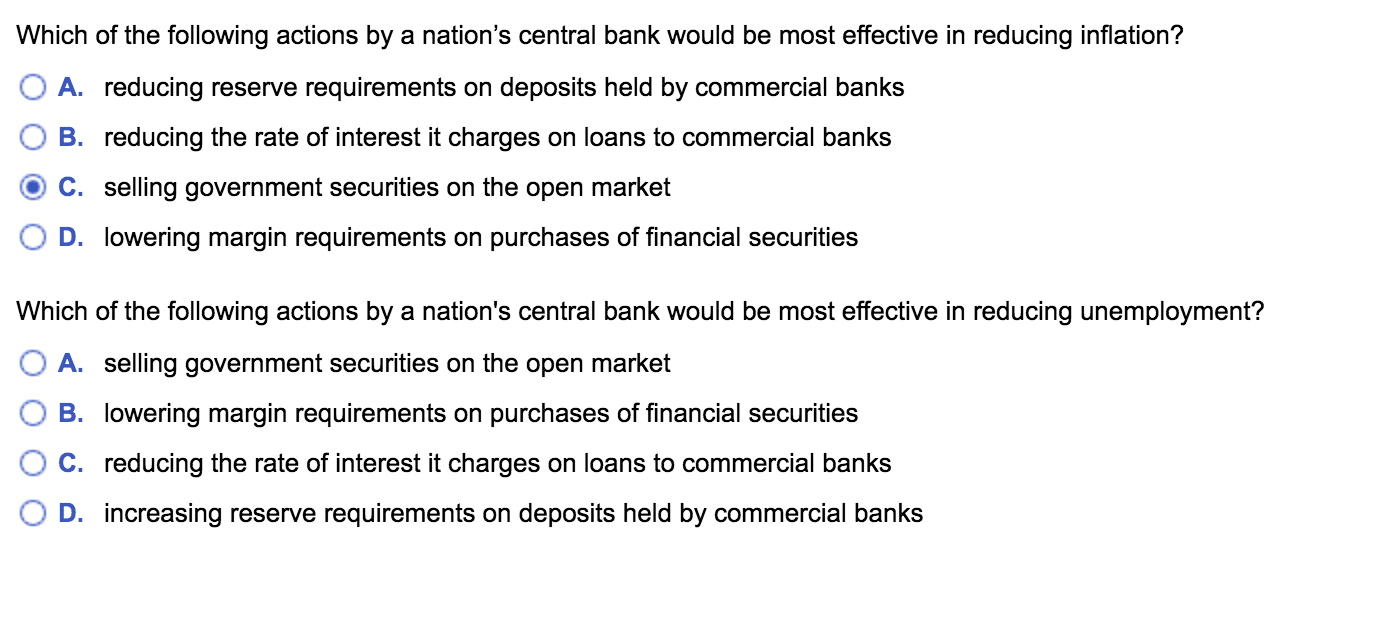

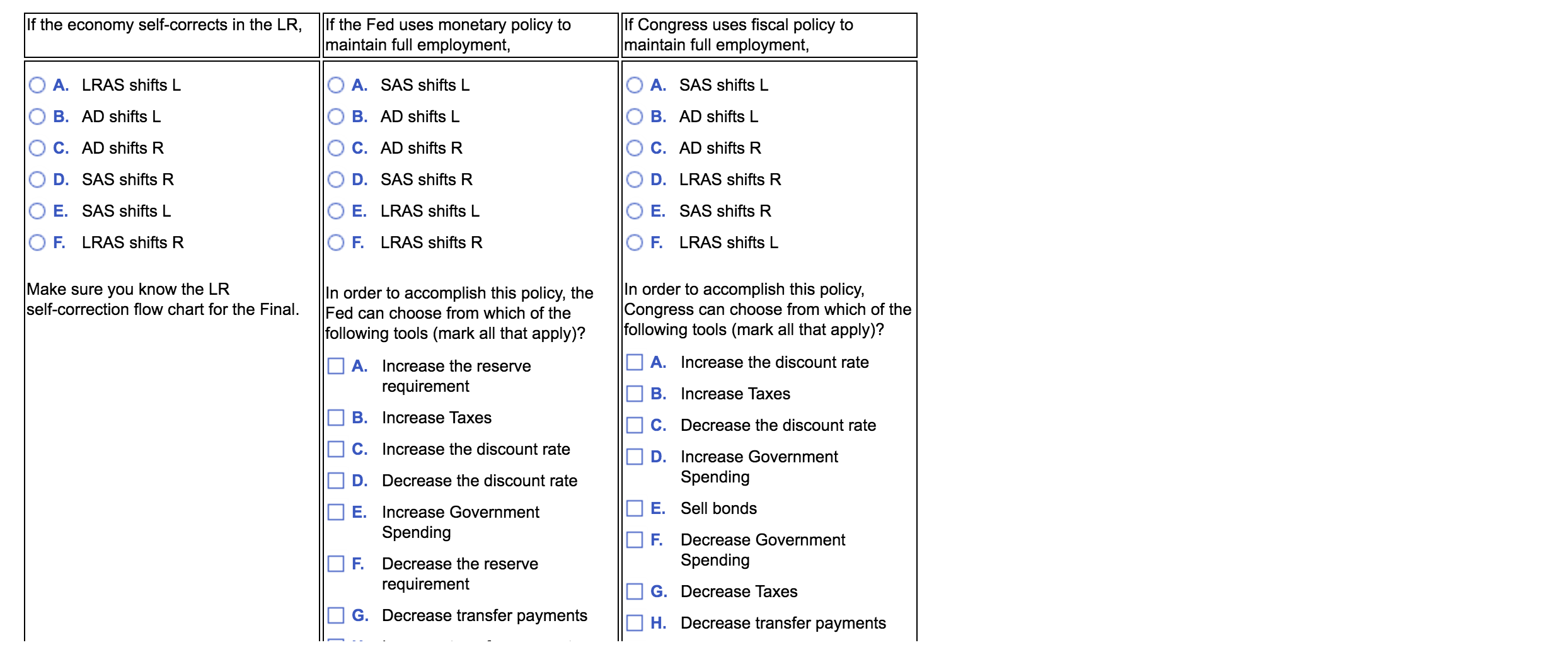

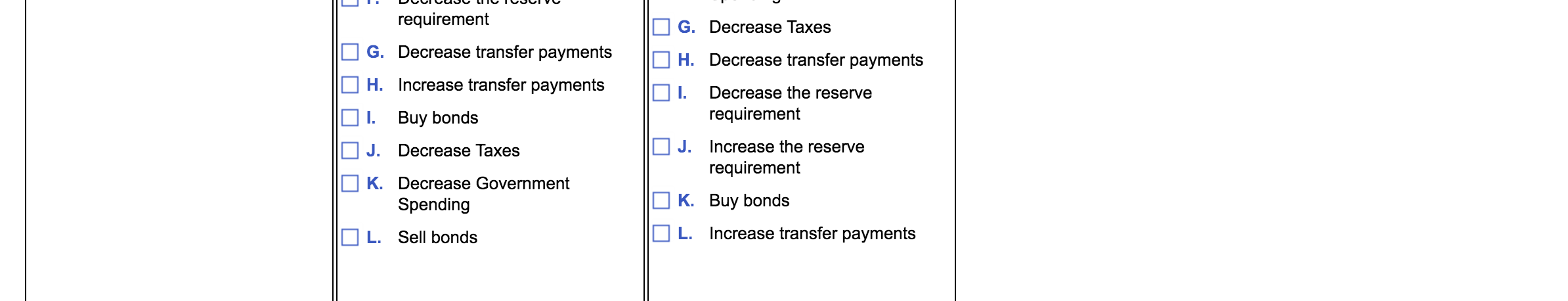

For each of the following policy options that the Fed could take, state whether the combined policies would have similar or opposite effects on the size of the money supply: A. decreasing the reserve requirement and selling government securities O A. similar effects O B. opposite effects B. increasing the reserve requirement and selling government securities O A. similar effects O B. opposite effects C. decreasing the discount rate and selling government securities. O A. similar effects O B. opposite effects D. increasing the discount rate and buying government securities. O A. similar effects O B. opposite effects E. increasing the discount rate and increasing the reserve requirement O A. similar effects O B. opposite effectsWhich of the following actions by a nation's central bank would be most effective in reducing ination? O A. reducing reserve requirements on deposits held by commercial banks 0 B. reducing the rate of interest it charges on loans to commercial banks Q) C. selling government securities on the open market 0 D. lowering margin requirements on purchases of nancial securities Which of the following actions by a nation's central bank would be most effective in reducing unemployment? O A. selling government securities on the open market 0 B. lowering margin requirements on purchases of nancial securities 0 C. reducing the rate of interest it charges on loans to commercial banks 0 D. increasing reserve requirements on deposits held by commercial banks \fIf the economy self-corrects in the LR, If the Fed uses monetary policy to If Congress uses fiscal policy to maintain full employment maintain full employment O A. LRAS shifts L O A. SAS shifts L O A. SAS shifts L O B. AD shifts L O B. AD shifts L O B. AD shifts L O C. AD shifts R O C. AD shifts R O C. AD shifts R O D. SAS shifts R O D. SAS shifts R O D. LRAS shifts R O E. SAS shifts L O E. LRAS shifts L O E. SAS shifts R OF. LRAS shifts R OF. LRAS shifts R OF. LRAS shifts L Make sure you know the LR In order to accomplish this policy, self-correction flow chart for the Final. In order to accomplish this policy, the Fed can choose from which of the Congress can choose from which of the following tools (mark all that apply)? following tools (mark all that apply)? A. Increase the reserve A. Increase the discount rate requirement B. Increase Taxes B. Increase Taxes C. Decrease the discount rate C. Increase the discount rate D. Increase Government D. Decrease the discount rate Spending E. Increase Government E. Sell bonds Spending F. Decrease Government F. Decrease the reserve Spending requirement G. Decrease Taxes G. Decrease transfer payments OH. Decrease transfer paymentsrequirement G. Decrease Taxes G. Decrease transfer payments H. Decrease transfer payments H. Increase transfer payments 1. Decrease the reserve 1. Buy bonds requirement J. Decrease Taxes J. Increase the reserve OK. Decrease Government requirement Spending K. Buy bonds L. Sell bonds L. Increase transfer paymentsUsing the money demand and money supply model (the money market), an open market sale of U.S. govemment securities by the Federal Reserve would cause the equilibrium interest rate to O A. decrease. O B. increase. 0 C. remain the same

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts