Question: Hello! I'm having trouble with this practice problem. Any help is greatly appreciated. You are CEO of Rivet Networks, maker of ultra-high performance network cards

Hello! I'm having trouble with this practice problem. Any help is greatly appreciated.

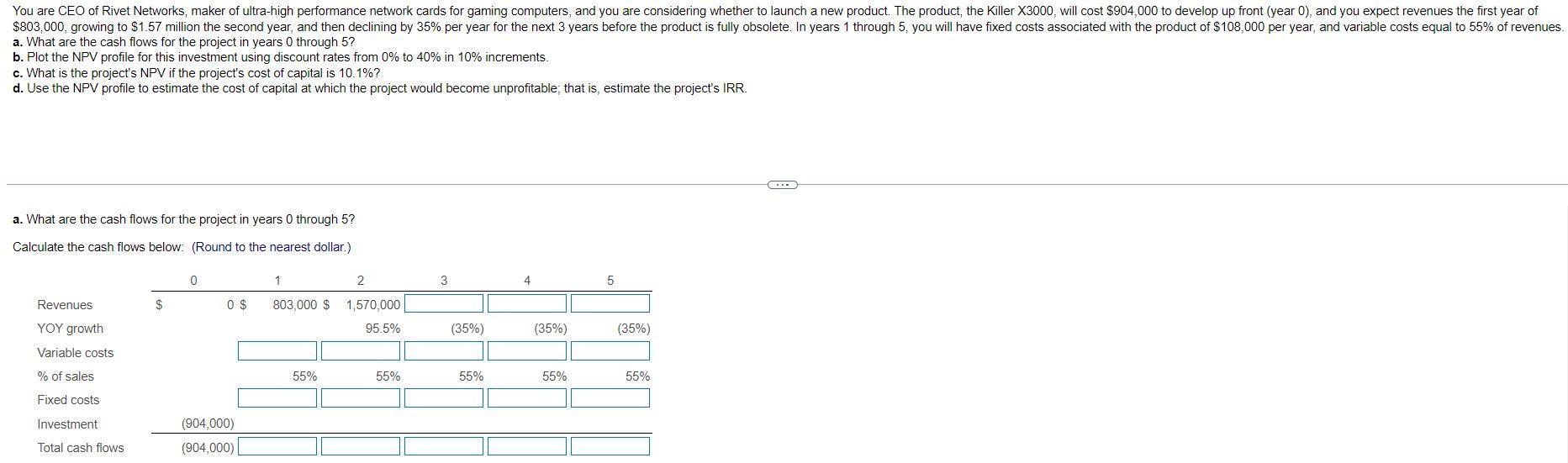

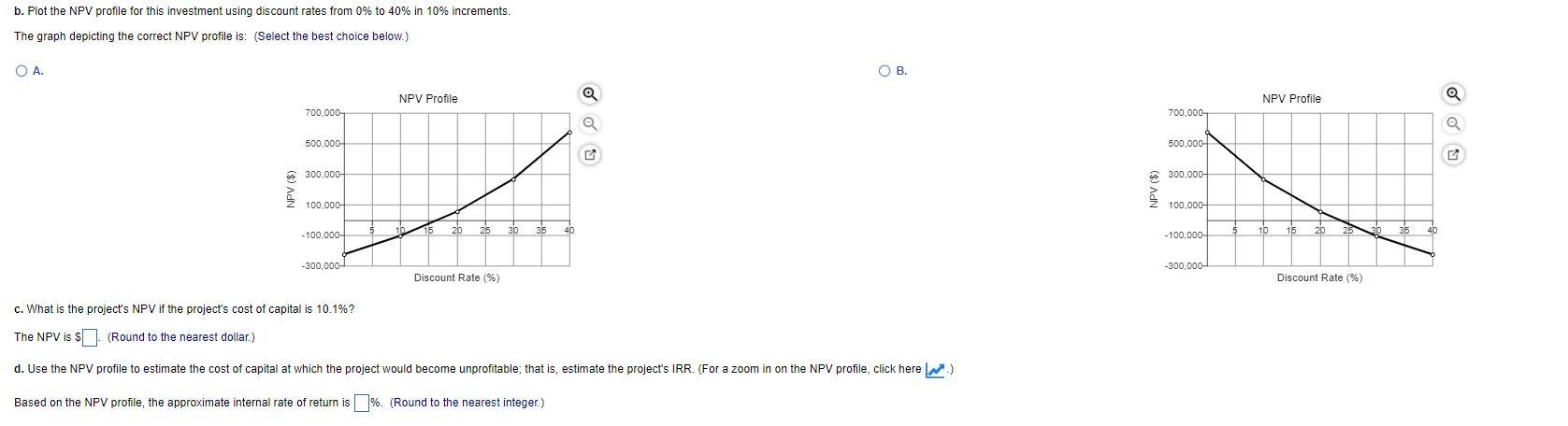

You are CEO of Rivet Networks, maker of ultra-high performance network cards for gaming computers, and you are considering whether to launch a new product. The product, the killer X3000, will cost $904,000 to develop up front (year 0), and you expect revenues the first year of $803,000, growing to $1.57 million the second year, and then declining by 35% per year for the next 3 years before the product is fully obsolete. In years 1 through 5, you will have fixed costs associated with the product of $108,000 per year, and variable costs equal to 55% of revenues. a. What are the cash flows for the project in years 0 through 5? b. Plot the NPV profile for this investment using discount rates from 0% to 40% in 10% increments. c. What is the project's NPV if the project's cost of capital is 10.1%? d. Use the NPV profile to estimate the cost of capital at which the project would become unprofitable that is, estimate the project's IRR. ... a. What are the cash flows for the project in years 0 through 5? Calculate the cash flows below: (Round to the nearest dollar.) 0 1 2 3 4 5 Revenues $ 0 $ 803,000 $ 1,570,000 95.5% YOY growth (35%) (35%) (35%) Variable costs % of sales 55% 55% 55% 55% 55% Fixed costs Investment (904,000) (904,000) Total cash flows b. Plot the NPV profile for this investment using discount rates from 0% to 40% in 10% increments. The graph depicting the correct NPV profile is: (Select the best choice below.) O A. OB. NPV Profile a NPV Profile 700.000 700,000 @ 500.000 500,000 300.000 300,000 NPV ($) NPV ($) 100.000 100.000 20 30 40 10 - 100.000 - 100.000 -300,000 -300.000 Discount Rate (%) Discount Rate (%) c. What is the project's NPV if the project's cost of capital is 10.1%? The NPV is $ (Round to the nearest dollar.) d. Use the NPV profile to estimate the cost of capital at which the project would become unprofitable; that is, estimate the project's IRR. (For a zoom in on the NPV profile, click here ) Based on the NPV profile, the approximate internal rate of return is %. (Round to the nearest integer.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts