Question: Hello! I'm looking for detailed solution methods for all parts of this problem. The answers shown are correct, but because I didn't get them, the

Hello!

I'm looking for detailed solution methods for all parts of this problem. The answers shown are correct, but because I didn't get them, the next attempt will have new numbers. I need detailed solutions so I can re-attempt the question by following your solution steps. Thank you for your help!

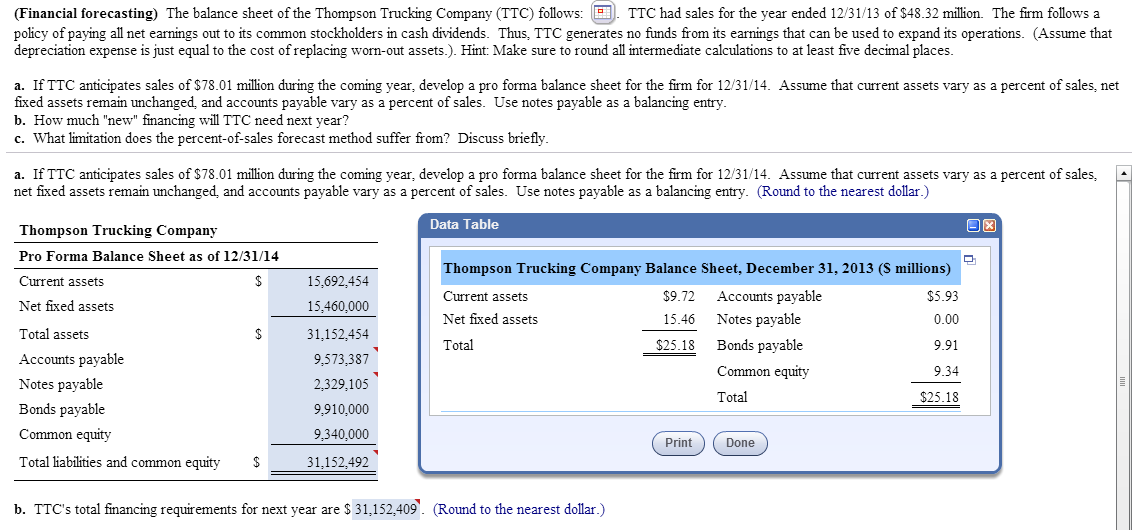

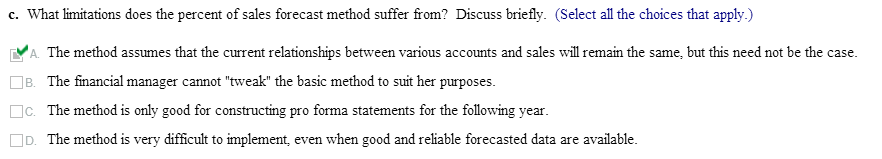

(Financial forecasting) The balance sheet of the Thompson Truck ng Company TTC follows: TTC had sales for the year ended 12/31/13 of $48.32 million. The firm follows a policy of paying all net earnings out to its common stockholders in cash dividends. Thus, TTC generates no funds from its earnings that can be used to expand its operations. (Assume that depreciation expense is just equal to the cost of replacing worn-out assets.). Hint: Make sure to round all intermediate calculations to at least five decimal places a. If TTC anticipates sales of $78.01 million during the coming year, develop a pro forma balance sheet for the firm for 12/31/14. Assume that current assets vary as a percent of sales, net fixed assets remamn unchanged, and accounts payable vary as a percent of sales. Use notes payable as a balancng entry b. How much "new" financing will TTC need next year? c. What limitation does the percent-of-sales forecast method suffer from? Discuss briefly as a percent of sales, a. If TTC anticipates sales of $78.01 million during the coming year, develop a pro or na balance sheet or the m or 1231 14 Assume that current assets var net fixed assets remain unchanged, and accounts payable vary as a percent of sales. Use notes payable as a balancing entry. (Round to the nearest dollar.) Data Table Thompson Trucking Company Pro Forma Balance Sheet as of 12/31/14 Thompson Trucking Company Balance Sheet, December 31, 2013 (S millions) Current assets Net fixed assets Total Current assets Net fixed assets Total assets Accounts payable Notes payable Bonds payable Common equity Total liabilities and common equity 15,692,454 15.460.,000 31,152,454 9,573,387 2,329,105 9,910,000 9,340,000 31,152,492 $5.93 0.00 9.91 9.34 $25.18 $9.72 Accounts payable 15.46 Notes payable $25.18 Bonds payable Common equity Total Print Done $ b. TTC's total financing requirements for next year are S 31,152,409. (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts