Question: Hello just need some assitance with some homework Golden State Bakers, Inc. (GSB) has an opportunity to invest in a new bread-making machine. GS needs

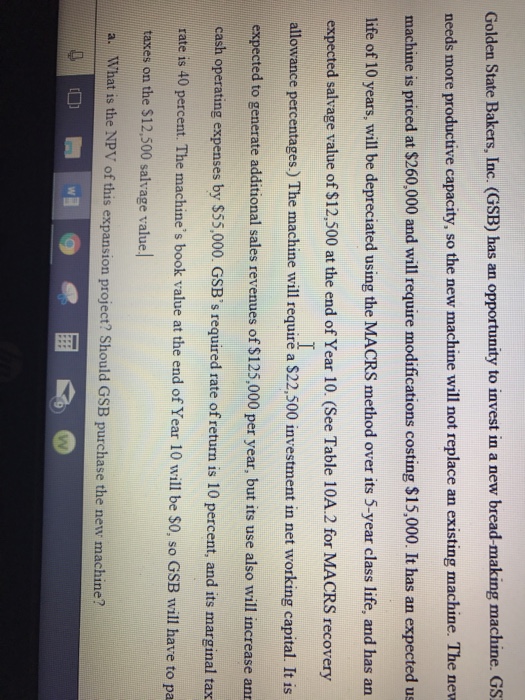

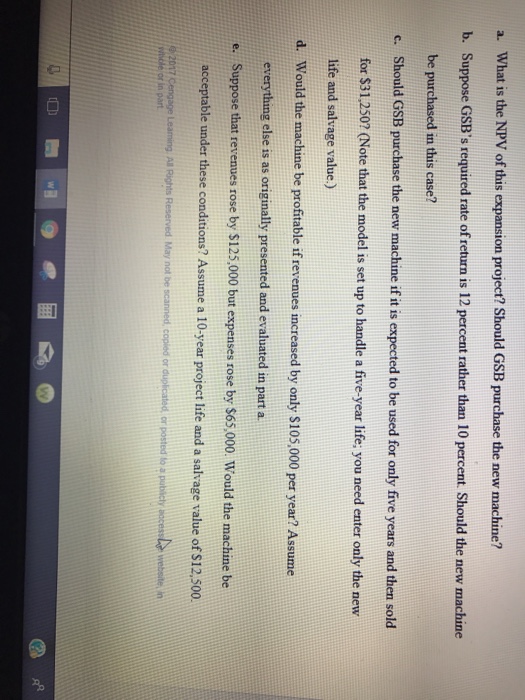

Golden State Bakers, Inc. (GSB) has an opportunity to invest in a new bread-making machine. GS needs more productive capacity, so the new machine will not replace an existing machine. The new machine is priced at $260,000 and will require modifications costing $15,000. It has an expected us life of 10 years, will be depreciated using the MACRS method over its 5-year class life, and has arn expected salvage value of $12,500 at the end of Year 10. (See Table 10A.2 for MACRS recovery allowance percentages.) The machine will require a $22,500 investment in net working capital. It is per year, but its use also will increase ann cash operating expenses by $55,000. GSB's required rate of return is 10 percent, and its marginal tax rate is 40 percent. The machine's book value at the end of Year 10 will be S0, so GSB will have to pa taxes on the $12,500 salvage value a. What is the NPV of this expansion project? Should GSB purchase the new machine? Golden State Bakers, Inc. (GSB) has an opportunity to invest in a new bread-making machine. GS needs more productive capacity, so the new machine will not replace an existing machine. The new machine is priced at $260,000 and will require modifications costing $15,000. It has an expected us life of 10 years, will be depreciated using the MACRS method over its 5-year class life, and has arn expected salvage value of $12,500 at the end of Year 10. (See Table 10A.2 for MACRS recovery allowance percentages.) The machine will require a $22,500 investment in net working capital. It is per year, but its use also will increase ann cash operating expenses by $55,000. GSB's required rate of return is 10 percent, and its marginal tax rate is 40 percent. The machine's book value at the end of Year 10 will be S0, so GSB will have to pa taxes on the $12,500 salvage value a. What is the NPV of this expansion project? Should GSB purchase the new machine

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts