Question: hello may i have help This is a conceptual question. Please IDENTIFY which the following statements is/are INCORRECT. Accordingly, please MAKE CORRECTIONS to the incorrect

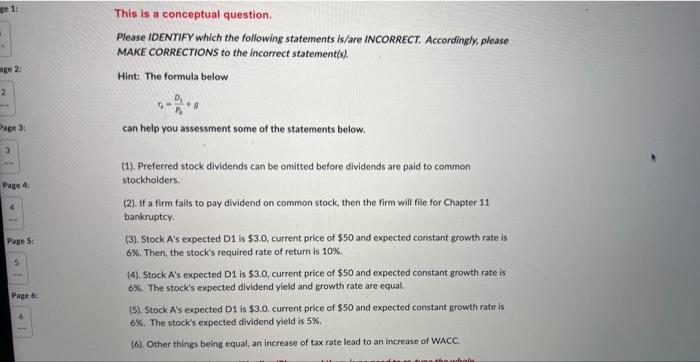

This is a conceptual question. Please IDENTIFY which the following statements is/are INCORRECT. Accordingly, please MAKE CORRECTIONS to the incorrect statement(s). Hint: The formula below p=Pdb3+g can help you assessment some of the statements below. (1). Preferred stock dividends can be omitted before dividends are paid to common stockholders. (2). If a firm fails to pay dividend on common stock, then the firm will file for Chapter 11 bankruptcy. page 5: (3). Stock A5 expected D1 is $3.0, current price of $50 and expected constant growth rate is 6%. Then, the stock's required rate of return is 10%. (4). Stock A's expected D1 is $3.0, current price of $50 and expected constant growth rate is 6%. The stock's expected dividend yield and growth rate are equal. Page 6: (5). Stock A 's expected D1 is $3.0. current price of $50 and expected constant growth rate is 6. The stock's expected dividend yield is 5%. (6). Other things being equal, an increase of tax rate lead to an increase of WACC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts