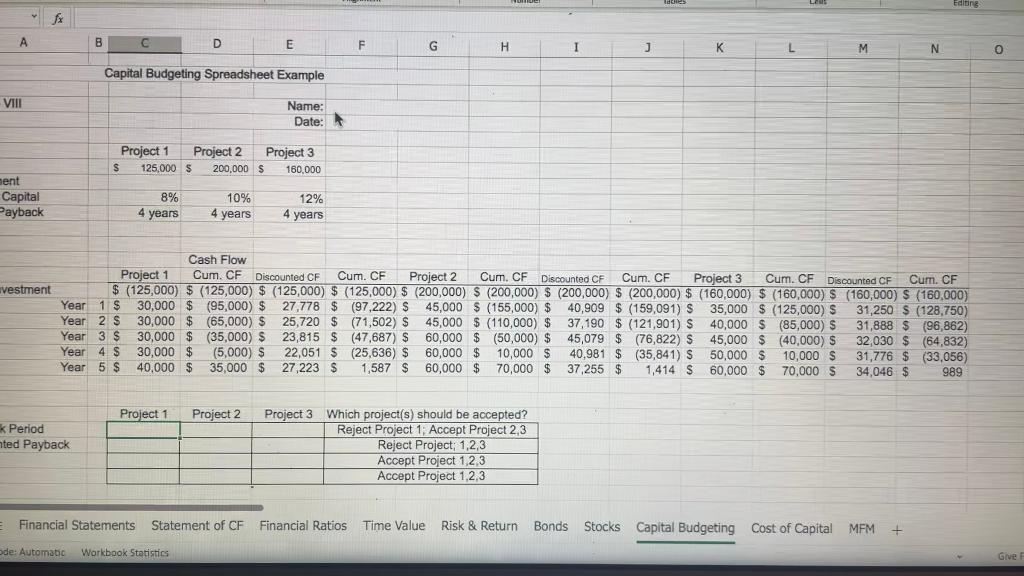

Question: Hello, need help with this. Capital budgeting:Need to find payback period, discounted payback,npv and IRR. Please provide excel formulas will give good rating/ thumbs up

Hello, need help with this. Capital budgeting:Need to find payback period, discounted payback,npv and IRR. Please provide excel formulas will give good rating/ thumbs up

Hello, need help with this. Capital budgeting:Need to find payback period, discounted payback,npv and IRR. Please provide excel formulas will give good rating/ thumbs up

dies Les Editing B D E F G H I J L M N 0 Capital Budgeting Spreadsheet Example VIII Name: Date: Project 1 Project 2 Project 3 $ 125,000 $ 200,000 $ 160.000 bent Capital Payback 8% 4 years 10% 4 years 12% 4 years vestment Cash Flow Project 1 Cum. CF Discounted CF Cum. CF Project 2 Cum. CF Discounted CH Cum. CF Project 3 Cum. CF Discounted CF Cum. CF $ (125,000) $ (125,000) $ (125,000) $ (125,000) $ (200,000) $ (200,000) $ (200,000) $ (200,000) $ (160,000) $ (160,000) $ (160,000) $ (160,000) Year 1 $ 30,000 $ (95,000) $ 27,778 $ (97,222) $ 45,000 $ (155,000) $ 40,909 $ (159,091) $ 35,000 $ (125,000) $ 31,250 S (128,750) Year 2 s 30,000 $ (65,000) $ 25,720 $ (71,502) S 45,000 $ (110,000) $ 37,190 $ (121,901) $ 40,000 $ (85,000) S 31,888 $ (96,862) Year 3 $ 30,000 $ (35,000) $ 23,815 $ (47,687) $ 60,000 $ (50,000) $ 45,079 $ (76,822) $ 45,000 $ (40,000) $ 32,030 $ (64,832) Year 4 $ 30,000 $ (5,000) $ 22,051 $ (25,636) $ 60,000 $ 10,000 $ 40,981 $ (35,841) S (35,841) S 50,000 $10,000 $ 31,776 $ (33,056) Year 5 S 40,000 $ 35,000 $ 27,223 $ 1,587 $ 60,000 $ 70,000 $ 37,255 $ 1,414 S 60,000 $ 70,000 $ 34,046 $ 989 Project 1 Project 2 k Period ated Payback Project 3 Which project(s) should be accepted? Reject Project 1: Accept Project 2,3 Reject Project; 1,2,3 Accept Project 1,2,3 Accept Project 1,2,3 Financial Statements Statement of CF Financial Ratios Time Value Risk & Return Bonds Stocks Capital Budgeting Cost of Capital MFM de: Automatic Workbook Statistics Give dies Les Editing B D E F G H I J L M N 0 Capital Budgeting Spreadsheet Example VIII Name: Date: Project 1 Project 2 Project 3 $ 125,000 $ 200,000 $ 160.000 bent Capital Payback 8% 4 years 10% 4 years 12% 4 years vestment Cash Flow Project 1 Cum. CF Discounted CF Cum. CF Project 2 Cum. CF Discounted CH Cum. CF Project 3 Cum. CF Discounted CF Cum. CF $ (125,000) $ (125,000) $ (125,000) $ (125,000) $ (200,000) $ (200,000) $ (200,000) $ (200,000) $ (160,000) $ (160,000) $ (160,000) $ (160,000) Year 1 $ 30,000 $ (95,000) $ 27,778 $ (97,222) $ 45,000 $ (155,000) $ 40,909 $ (159,091) $ 35,000 $ (125,000) $ 31,250 S (128,750) Year 2 s 30,000 $ (65,000) $ 25,720 $ (71,502) S 45,000 $ (110,000) $ 37,190 $ (121,901) $ 40,000 $ (85,000) S 31,888 $ (96,862) Year 3 $ 30,000 $ (35,000) $ 23,815 $ (47,687) $ 60,000 $ (50,000) $ 45,079 $ (76,822) $ 45,000 $ (40,000) $ 32,030 $ (64,832) Year 4 $ 30,000 $ (5,000) $ 22,051 $ (25,636) $ 60,000 $ 10,000 $ 40,981 $ (35,841) S (35,841) S 50,000 $10,000 $ 31,776 $ (33,056) Year 5 S 40,000 $ 35,000 $ 27,223 $ 1,587 $ 60,000 $ 70,000 $ 37,255 $ 1,414 S 60,000 $ 70,000 $ 34,046 $ 989 Project 1 Project 2 k Period ated Payback Project 3 Which project(s) should be accepted? Reject Project 1: Accept Project 2,3 Reject Project; 1,2,3 Accept Project 1,2,3 Accept Project 1,2,3 Financial Statements Statement of CF Financial Ratios Time Value Risk & Return Bonds Stocks Capital Budgeting Cost of Capital MFM de: Automatic Workbook Statistics Give

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts