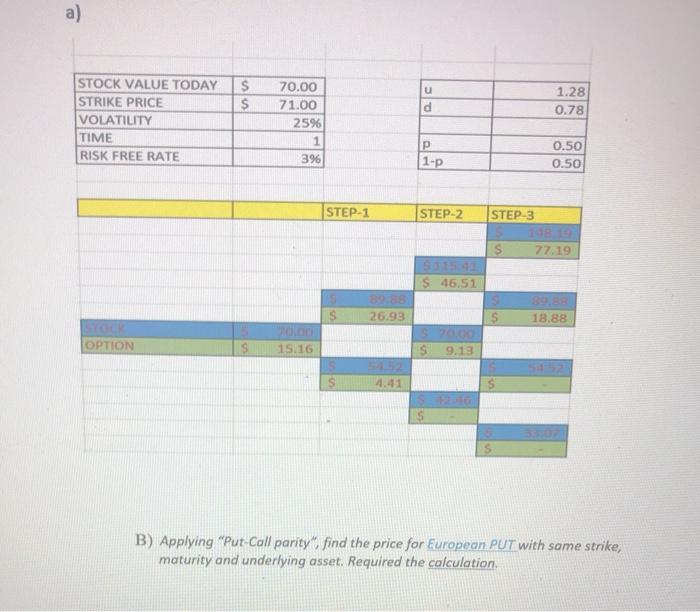

Question: hello part B please given the information in A a) u S $ 1.28 d 0.78 STOCK VALUE TODAY STRIKE PRICE VOLATILITY TIME RISK FREE

a) u S $ 1.28 d 0.78 STOCK VALUE TODAY STRIKE PRICE VOLATILITY TIME RISK FREE RATE 70.00 71.00 2596 1 3% P 1-p 0.50 0.50 STEP.1 STEP-2 STEP-3 77.19 $46.51 S 26.93 S 18.88 OPTION $ 15.16 9.13 B) Applying "Put-Coll parity find the price for European PUT with same strike, maturity and underlying asset. Required the calculation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts