Question: Hello! please answer all parts to the question clearly please its sometimes hard to understand the experts please thank you! provide the answer TO EACH

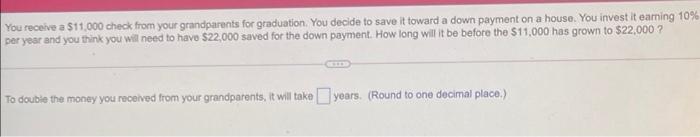

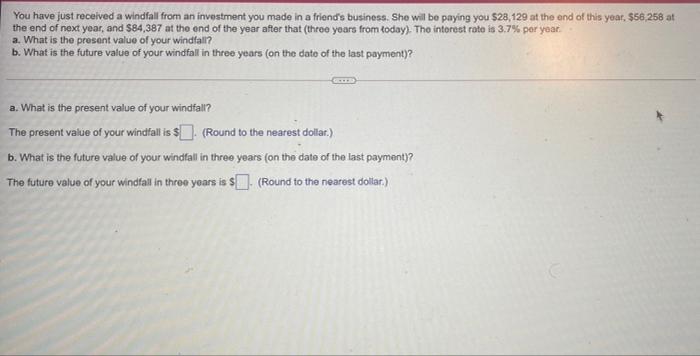

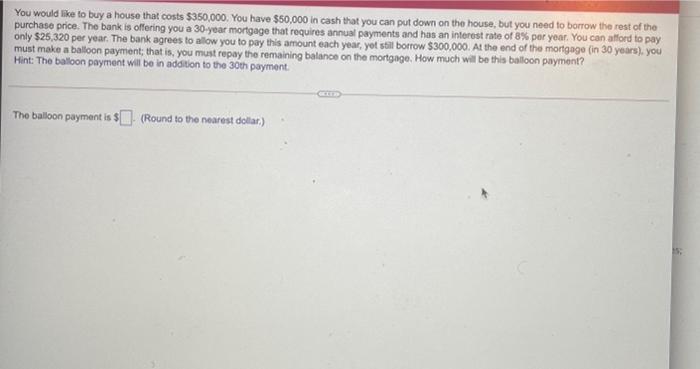

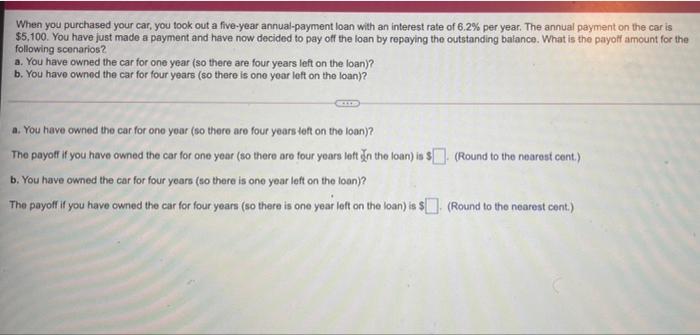

You receive a $11,000 check from your grandparents for graduation. You decide to save it toward a down payment on a house. You invest it earing 10% per year and you think you will need to have $22,000 saved for the down payment. How long will it be before the $11,000 has grown to $22,000 ? To double the money you received from your grandparents, it will take years. (Round to one decimal place) You have just received a windfall from an investment you made in a friend's business. She will be paying you $28,129 at the end of this year. $56 258 at the end of next year, and $84,387 at the end of the year after that three years from today). The interest rate is 3.7% per year. a. What is the present value of your windfall? b. What is the future value of your windfall in three years (on the date of the last payment)? a. What is the present value of your windfall? The present value of your windfall is $. (Round to the nearest dollar.) b. What is the future value of your windfall in three years (on the date of the last payment)? The future value of your windfall in three years is $(Round to the nearest dollar:) You would like to buy a house that costs $350,000. You have $50,000 in cash that you can put down on the house, but you need to borrow the rest of the purchase price. The bank is offering you a 30-year mortgage that requires annual payments and has an interest rate of 8% per year. You can afford to pay only $25,320 per year. The bank agrees to allow you to pay this amount each year, yot still borrow $300,000. At the end of the mortgage (in 30 years), you must make a balloon payment, that is, you must repay the remaining balance on the mortgage. How much will be this balloon payment? Hint: The balloon payment will be in addition to the 30th payment The balloon payment is $(Round to the nearest dollar) a When you purchased your car, you took out a five-year annual-payment loan with an interest rate of 6.2% per year. The annual payment on the car is $5,100. You have just made a payment and have now decided to pay off the loan by repaying the outstanding balance. What is the payoff amount for the following scenarios 2 a. You have owned the car for one year (so there are four years left on the loan)? b. You have owned the car for four years (so there is one year loft on the loan)? a. You have owned the car for one year (so there are four years toft on the loan)? The payoff If you have owned the car for one year (so there are four years left in the loan) in s ). (Round to the nearest cont.) b. You have owned the car for four years (no there is one year left on the loon)? The payoff if you have owned the car for four years (so there is one year left on the loan) is $ ). (Round to the nearest cont.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts