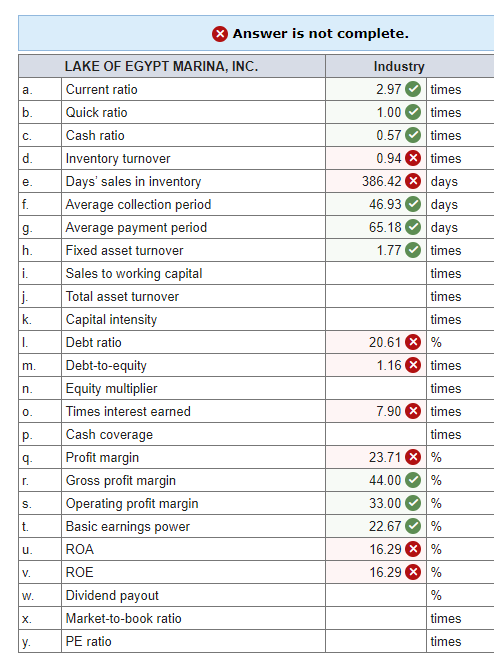

Question: Hello! Please answer D, E, I, J Answer is not complete. a. b. C. d! Industry 2.97 times 1.00 times 0.57 times 0.94 X times

Hello! Please answer D, E, I, J

Hello! Please answer D, E, I, J

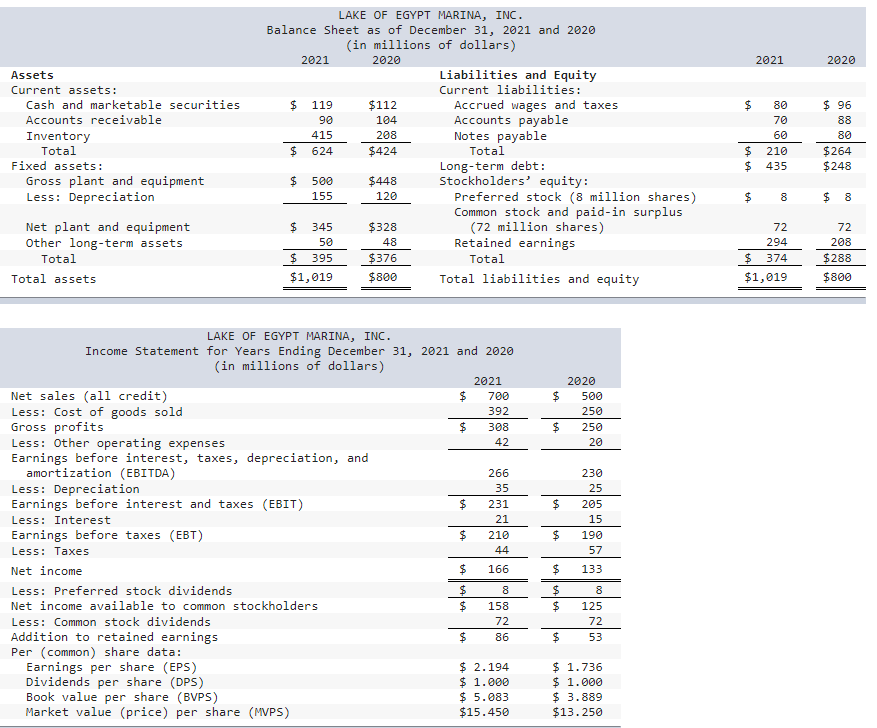

Answer is not complete. a. b. C. d! Industry 2.97 times 1.00 times 0.57 times 0.94 X times 386.42 days 46.93 days 65.18 days 1.77 times times e. f. g h. i. k. I. LAKE OF EGYPT MARINA, INC. Current ratio Quick ratio Cash ratio Inventory turnover Days' sales in inventory Average collection period Average payment period Fixed asset turnover Sales to working capital Total asset turnover Capital intensity Debt ratio Debt-to-equity Equity multiplier Times interest earned Cash coverage Profit margin Gross profit margin Operating profit margin Basic earnings power ROA ROE Dividend payout Market-to-book ratio PE ratio m. n. 0. times times 20.61 % 1.16 times times 7.90 times times 23.71 % % 44.00 % 33.00 % 22.67 % 16.29% 16.29 % % 9. r. S. t. u. V. W. X times times y. 2021 2020 $ Assets Current assets: Cash and marketable securities Accounts receivable Inventory Total Fixed assets: Gross plant and equipment Less: Depreciation LAKE OF EGYPT MARINA, INC. Balance Sheet as of December 31, 2021 and 2020 (in millions of dollars) 2021 2020 Liabilities and Equity Current liabilities: $ 119 $112 Accrued wages and taxes 90 104 Accounts payable 415 208 Notes payable $ 624 $424 Total Long-term debt: 500 $448 Stockholders' equity: 155 120 Preferred stock (8 million shares) Common stock and paid-in surplus $ 345 $328 (72 million shares) 50 48 Retained earnings $ 395 $376 Total $1,019 $800 Total liabilities and equity 80 70 60 210 435 $ 96 88 80 $264 $248 $ $ $ $ 8 $ 8 Net plant and equipment Other long-term assets Total Total assets 72 294 374 $ 72 208 $288 $800 $1,019 $ 2020 500 250 250 20 $ $ LAKE OF EGYPT MARINA, INC. Income Statement for Years Ending December 31, 2021 and 2020 (in millions of dollars) 2021 Net sales (all credit) $ 700 Less: Cost of goods sold 392 Gross profits $ 308 Less: Other operating expenses 42 Earnings before interest, taxes, depreciation, and amortization (EBITDA) 266 Less: Depreciation 35 Earnings before interest and taxes (EBIT) $ 231 Less: Interest 21 Earnings before taxes (EBT) $ 210 Less: Taxes 44 Net income $ 166 Less: Preferred stock dividends $ 8 Net income available to common stockholders $ 158 Less: Common stock dividends Addition to retained earnings $ Per (common) share data: Earnings per share (EPS) $ 2.194 Dividends per share (DPS) $ 1.000 Book value per share (BVPS) $ 5.083 Market value (price) per share (MVPS) $15.450 230 25 205 15 190 57 $ $ 133 $ $ 8 125 72 53 72 86 $ $ 1.736 $ 1.000 $ 3.889 $13.250

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts