Question: PLEASE SHOW EQUATIONS. I AM HAVING TROUBLE The instructions for the case (20 points) are on the Excel sheet that I am providing. Your work

PLEASE SHOW EQUATIONS. I AM HAVING TROUBLE

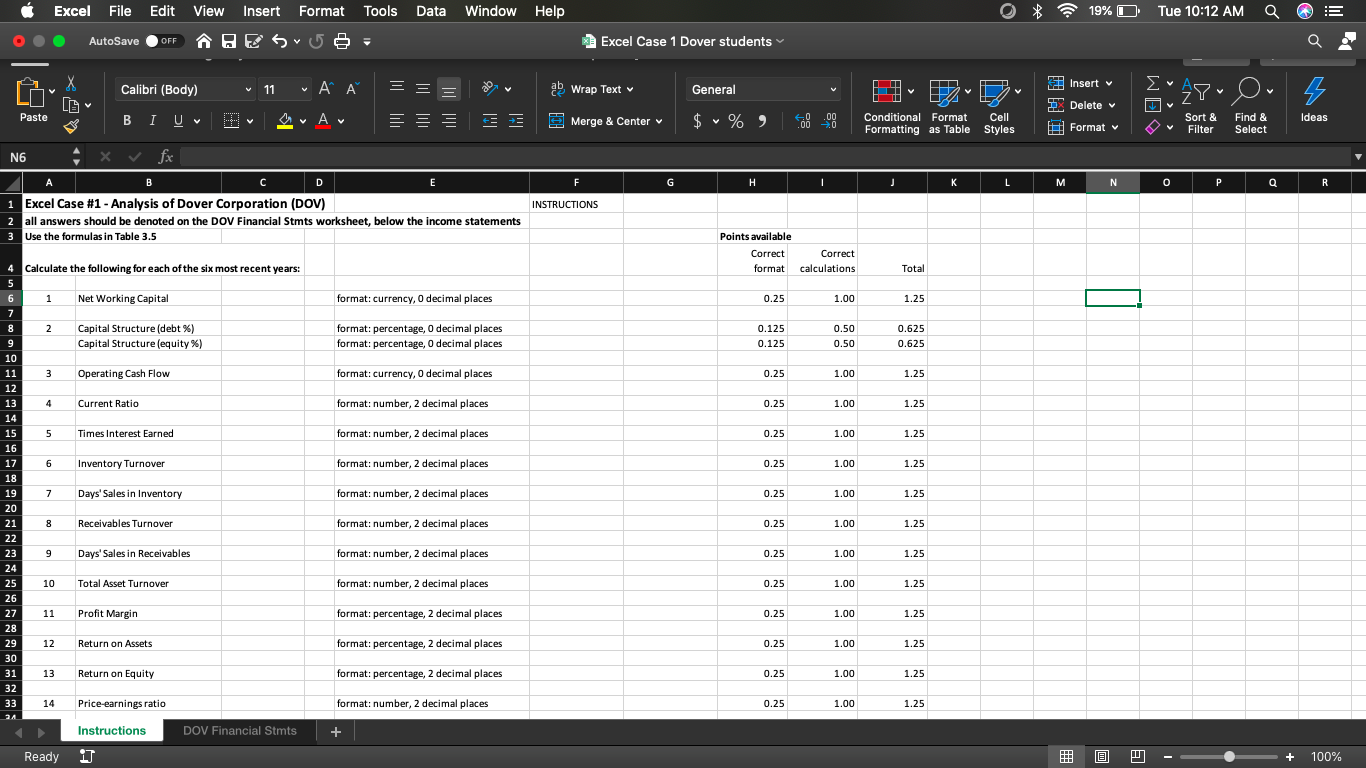

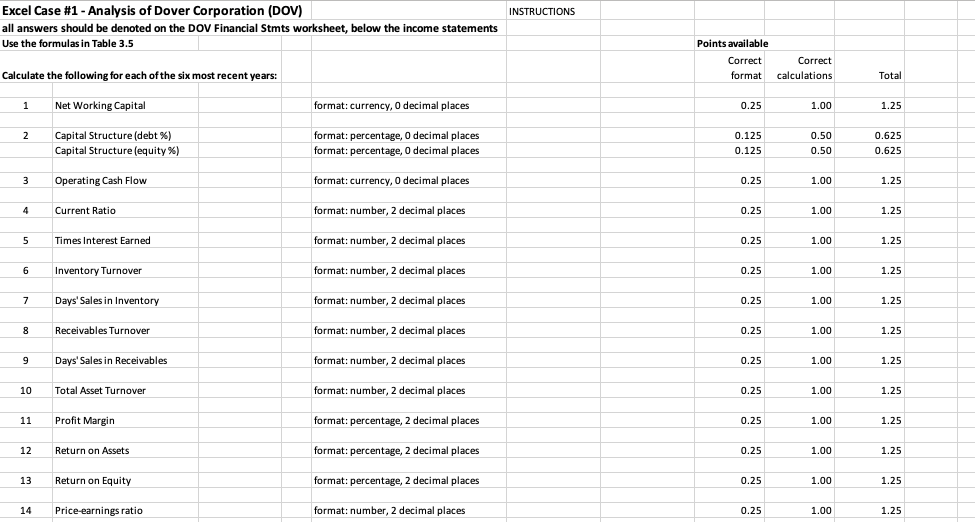

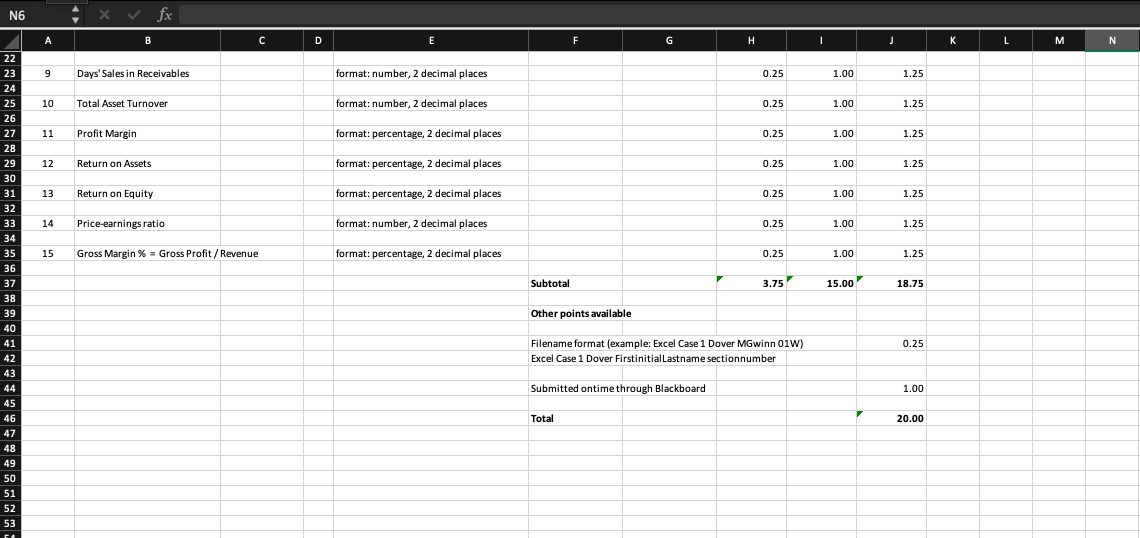

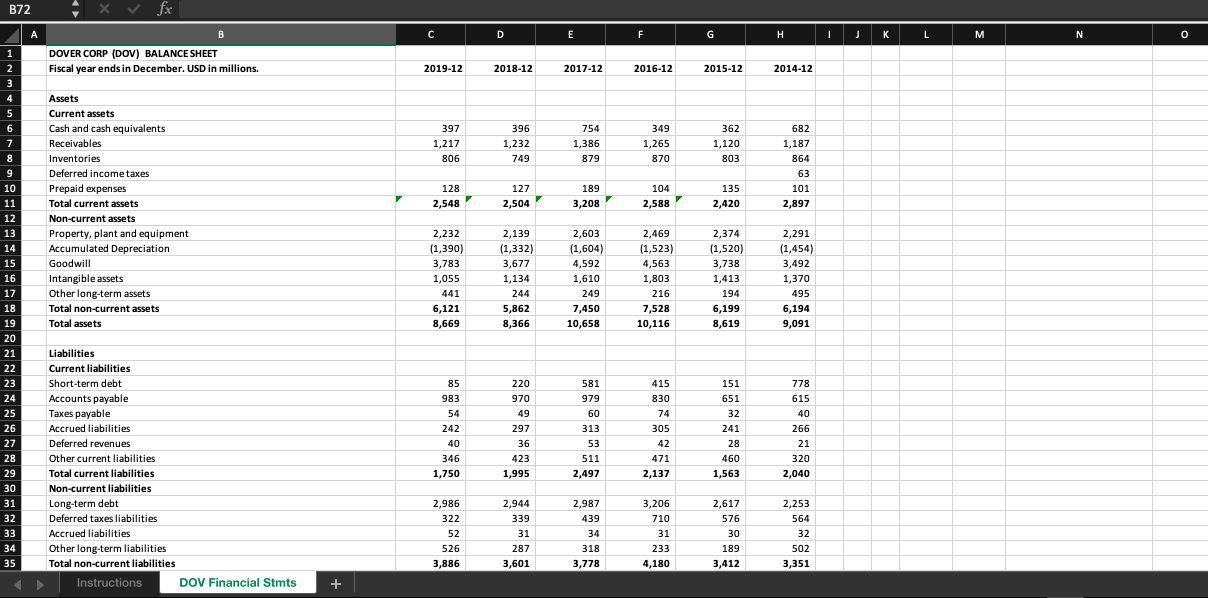

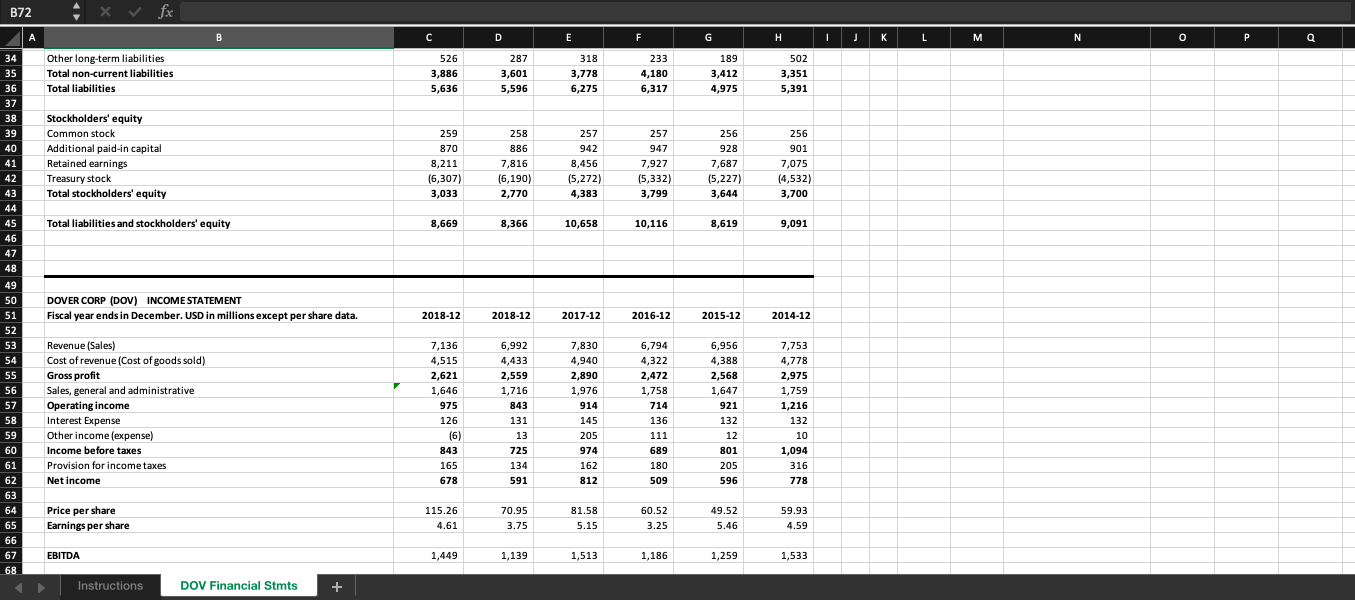

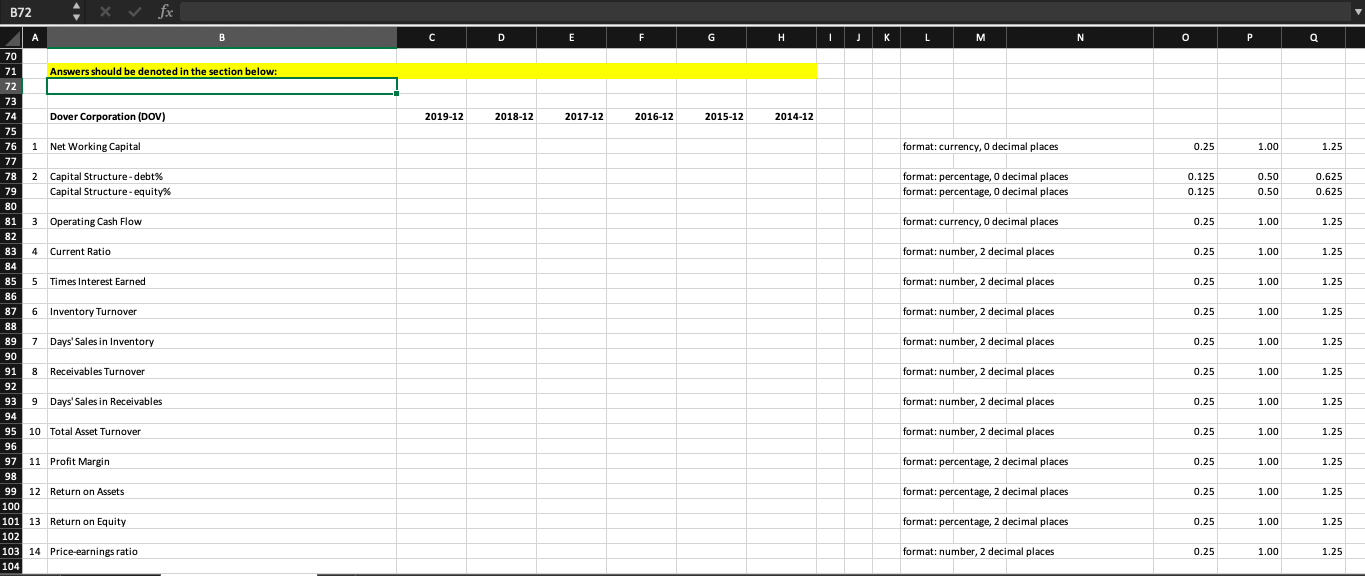

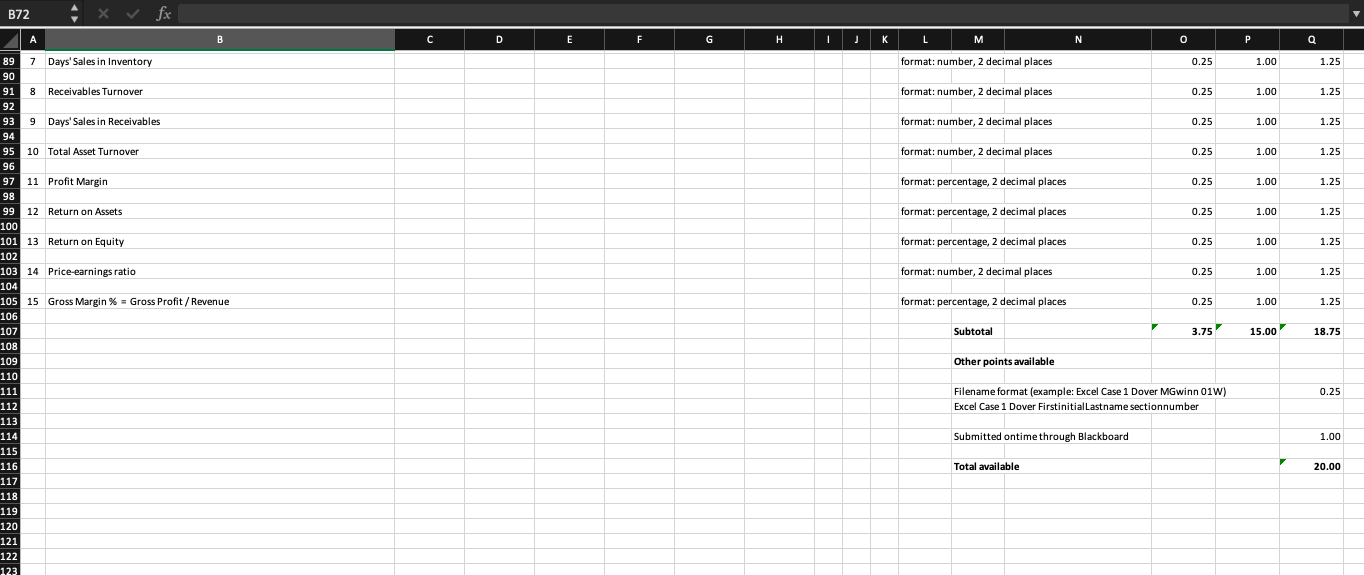

The instructions for the case (20 points) are on the Excel sheet that I am providing. Your work must be done with Excel formulas and cell references. You will not earn points by simply typing in the answers. You are allowed two submissions, but I will only grade the last attempt. Thanks. Here is a profile of the company: Dover Corp. (ticker symbol DOV) is in the industrials sector of the S&P 500. The company engages in the manufacture of equipment, components, and specialty systems. It also provides supporting engineering, testing, and other similar services. It operates through the following segments: Engineered Systems, Fluids, and Refrigeration and Food Equipment. The Engineered Systems segment focuses on the design, manufacture, and service of critical equipment and components serving the fast-moving consumer goods, digital textile printing, vehicle service, environmental solutions, and industrial end markets. The Fluids segment focuses on the safe handling of critical fluids and gases the retail fueling, chemical, hygienic, and industrial end markets. The Refrigeration and Food Equipment segment provides innovative and energy-efficient equipment and systems serving the commercial refrigeration and food equipment end markets. The company was founded by George L. Ohrstrom in 1947 and is headquartered in Downers Grove, IL. Excel File Edit View View Insert Format Tools Data Window Help O * 19% O Tue 10:12 AM E 000 AutoSave OFF HES 5 = Excel Case 1 Dover students X Calibri (Body) Co- v 11 ' Insert v = = General ab Wrap Text Ayu O 5 Delete v Paste A BI V Ideas Merge & Center v .00 .00 0 $ %) Conditional Format Cell Formatting as Table Styles Format v Sort & Filter Find & Select N6 fx B D E F . J L M N O P Q R INSTRUCTIONS 1 Excel Case #1 - Analysis of Dover Corporation (DOV) 2 all answers should be denoted on the DOV Financial Stmts worksheet, below the income statements 3 Use the formulas in Table 3.5 Points available Correct format Correct calculations Total format: currency, O decimal places : , 0.25 1.00 1.25 format: percentage, 0 decimal places format: percentage, 0 decimal places 0.125 0.125 0.50 0.50 0.625 0.625 format: currency, O decimal places 0.25 1.00 1.25 format: number, 2 decimal places 0.25 1.00 1.25 format: number, 2 decimal places 0.25 1.00 1.25 4 Calculate the following for each of the six most recent years: 5 6 1 Net Working Capital 7 8 2 Capital Structure (debt %) 9 Capital Structure (equity %) 10 11 3 Operating Cash Flow 12 13 4 Current Ratio 14 15 5 Times Interest Earned 16 17 6 Inventory Turnover 18 19 7 Days' Sales in Inventory 20 21 8 Receivables Turnover 22 23 9 Days' Sales in Receivables 24 25 10 Total Asset Turnover 26 27 11 Profit Margin format: number, 2 decimal places 0.25 1.00 1.25 format:number, 2 decimal places 0.25 1.00 1.25 format: number, 2 decimal places : 2 0.25 1.00 1.25 format: number, 2 decimal places 0.25 1.00 1.25 format: number, 2 decimal places 0.25 1.00 1.25 format: percentage, 2 decimal places 0.25 1.00 1.25 28 12 Return on Assets format: percentage, 2 decimal places 0.25 1.00 29 30 1.25 13 Return on Equity format: percentage, 2 decimal places 0.25 1.00 1.25 31 32 33 14 Price-earnings ratio format: number, 2 decimal places 0.25 1.00 1.25 Instructions DOV Financial Stmts + Ready IT 3 + 100% INSTRUCTIONS Excel Case #1 - Analysis of Dover Corporation (DOV) all answers should be denoted on the DOV Financial Stmts worksheet, below the income statements Use the formulas in Table 3.5 Points available Correct format Correct calculations Calculate the following for each of the six most recent years: Total 1 Net Working Capital format: currency, o decimal places 0.25 1.00 1.25 2 Capital Structure (debt %) Capital Structure (equity %) ) format: percentage, 0 decimal places format: percentage, 0 decimal places 0.125 0.125 0.50 0.50 0.625 0.625 3 Operating Cash Flow format: currency, o decimal places : O 0.25 1.00 1.25 4 Current Ratio format: number, 2 decimal places 0.25 1.00 1.25 5 Times Interest Earned format: number, 2 decimal places 0.25 1.00 1.25 6 6 Inventory Turnover format: number, 2 decimal places 0.25 1.00 1.25 7 Days' Sales in Inventory format: number, 2 decimal places 0.25 1.00 1.25 8 Receivables Turnover format: number, 2 decimal places 0.25 1.00 1.25 9 Days' Sales in Receivables format: number, 2 decimal places 0.25 1.00 1.25 10 Total Asset Turnover format: number, 2 decimal places : , 0.25 1.00 1.25 11 Profit Margin format: percentage, 2 decimal places 0.25 1.00 1.25 12 Return on Assets format: percentage, 2 decimal places 0.25 1.00 1.25 13 Return on Equity format: percentage, 2 decimal places 0.25 1.00 1.25 14 Price-earnings ratio format: number, 2 decimal places 0.25 1.00 1.25 N6 B C D E F G K L M N 9 Days' Sales in Receivables format: number, 2 decimal places 0.25 1.00 1.25 10 Total Asset Turnover format: number, 2 decimal places 0.25 1.00 1.25 11 Profit Margin format: percentage, 2 decimal places 0.25 1.00 1.25 12 Return on Assets format: percentage, 2 decimal places 0.25 1.00 1.25 13 Return on Equity format: percentage, 2 decimal places 0.25 1.00 1.25 14 Price-earnings ratio format: number, 2 decimal places 0.25 1.00 1.25 15 Gross Margin % = Gross Profit/ Revenue format: percentage, 2 decimal places 0.25 1.00 1.25 Subtotal 3.75 15.00 18.75 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 Other points available 0.25 Filename format (example: Excel Case 1 Dover MGwinn 01W) Excel Case 1 Dover FirstinitialLastname sectionnumber Submitted ontime through Blackboard 1.00 Total 20.00 FA B72 X A B D E F G . I J K L M N 0 DOVER CORP (DOV) BALANCE SHEET Fiscal year ends in December. USD in millions 2019-12 2018-12 2017-12 2016-12 2015-12 2015-12 2014-12 397 1,217 806 396 1,232 749 754 1,386 879 349 1,265 870 362 1,120 803 682 1,187 864 63 101 2,897 128 2,548 127 2,504 189 3,208 104 2,588 135 2,420 1 2 3 4 5 6 7 8 9 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 Assets Current assets Cash and cash equivalents Receivables Inventories Deferred income taxes Prepaid expenses Total current assets Non-current assets Property, plant and equipment Accumulated Depreciation Goodwill Intangible assets Other long-term assets Total non-current assets Total assets 2,232 (1,390) 3,783 1,055 441 6,121 8,669 2,139 (1,332) 3,677 1,134 244 5,862 8,366 2,603 (1,604) 4,592 1,610 249 7,450 10,658 2,469 (1,523) 4,563 1,803 216 7,528 10,116 2,374 (1,520) 3,738 1,413 194 6,199 8,619 2,291 (1,454) 3,492 1,370 495 6,194 9,091 220 970 49 Liabilities Current liabilities Short-term debt Accounts payable Taxes payable Accrued liabilities Deferred revenues Other current liabilities Total current liabilities Non-current liabilities Long-term debt Deferred taxes liabilities Accrued liabilities Other long-term liabilities Total non-current liabilities Instructions DOV Financial Stmts 85 983 54 242 40 346 1,750 297 36 423 581 979 60 313 53 511 2,497 415 830 74 305 42 471 2,137 151 651 32 241 28 460 1,563 778 615 40 266 21 320 2,040 1,995 2,986 322 52 526 3,886 2,944 339 31 287 3,601 2,987 439 34 318 3,778 3,206 710 31 233 4,180 2,617 576 30 189 3,412 2,253 564 32 502 3,351 + B72 fx A B C D E F G H T J L M N O P Q 34 35 36 37 Other long-term liabilities Total non-current liabilities Total liabilities 526 3,886 287 3,601 5,596 318 3,778 6,275 233 4,180 6,317 189 3,412 4,975 502 3,351 5,391 5,636 38 39 40 Stockholders' equity Common stock Additional paid-in capital Retained earnings Treasury stock Total stockholders' equity 259 870 8,211 (6,307) 3,033 258 886 7,816 (6,190) 2,770 257 942 8,456 (5,272) 4,383 257 947 7,927 (5,332) 3,799 256 928 7,687 (5,227) 3,644 256 901 7,075 (4,532) 3,700 41 42 43 44 45 46 47 48 Total liabilities and stockholders' equity 8,669 8,366 10,658 10,116 8,619 9,091 DOVER CORP (DOV) INCOME STATEMENT Fiscal year ends in December. USD in millions except per share data. 2018-12 2018-12 2017-12 2016-12 2015-12 2014-12 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 Revenue (Sales) Cost of revenue (Cost of goods sold) Gross profit Sales, general and administrative Operating income Interest Expense Other income (expense) Income before taxes Provision for income taxes Net income 7,136 4,515 2,621 1,646 975 126 (6) 843 165 678 6,992 4,433 2,559 1,716 843 131 13 7,830 4,940 2,890 1,976 914 145 205 974 162 812 6,794 4,322 2,472 1,758 714 136 6,956 4,388 2,568 1,647 921 132 12 801 7,753 4,778 2,975 1,759 1,216 132 10 1,094 316 778 725 134 591 111 689 180 509 205 596 Price per share Earnings per share 115.26 4.61 70.95 3.75 81.58 5.15 60.52 3.25 49.52 5.46 59.93 4.59 EBITDA 1,449 1,139 1,513 1,186 1,259 1,533 Instructions DOV Financial Stmts + B72 fx A B C D E F G . I J K L M N O Q 2019-12 2018-12 2017-12 2016-12 2015-12 2014-12 format: currency, o decimal places 0.25 1.00 1.25 format: percentage, 0 decimal places format: percentage, 0 decimal places 0.125 0.125 0.50 0.50 0.625 0.625 format: currency, o decimal places 0.25 1.00 1.25 format: number, 2 decimal places 0.25 1.00 1.25 format: number, 2 decimal places 0.25 1.00 1.25 70 71 Answers should be denoted in the section below: 72 73 74 Dover Corporation (DOV) 75 76 1 Net Working Capital 77 78 2 Capital Structure-debt% 79 Capital Structure-equity% 80 81 3 Operating Cash Flow 82 83 4 Current Ratio 84 85 5 Times Interest Earned 86 87 6 Inventory Turnover 88 89 7 Days' Sales in Inventory 90 91 8 Receivables Turnover 92 93 9 Days' Sales in Receivables 94 95 10 Total Asset Turnover 96 97 11 Profit Margin 98 99 12 Return on Assets 100 101 13 Return on Equity 102 103 14 Price-earnings ratio 104 format: number, 2 decimal places 0.25 1.00 1.25 format: number, 2 decimal places : 0.25 1.00 1.25 format: number, 2 decimal places 0.25 1.00 1.25 format: number, 2 decimal places 0.25 1.00 1.25 format: number, 2 decimal places 0.25 1.00 1.25 format: percentage, 2 decimal places 0.25 1.00 1.25 format: percentage, 2 decimal places 0.25 1.00 1.25 format: percentage, 2 decimal places 0.25 1.00 1.25 format: number, 2 decimal places 0.25 1.00 1.25 B72 fx B D E F G . I K L M N 0 P P Q format: number, 2 decimal places 0.25 1.00 1.25 format: number, 2 decimal places 0.25 1.00 1.25 format: number, 2 decimal places 0.25 1.00 1.25 format: number, 2 decimal places 0.25 1.00 1.25 format: percentage, 2 decimal places 0.25 1.00 1.25 format: percentage, 2 decimal places 0.25 1.00 1.25 format: percentage, 2 decimal places 0.25 1.00 1.25 format: number, 2 decimal places 0.25 1.00 1.25 format: percentage, 2 decimal places 0.25 1.00 1.25 89 7 Days' Sales in Inventory 90 91 8 Receivables Turnover 92 93 9 Days' Sales in Receivables 94 95 10 Total Asset Turnover 96 97 11 Profit Margin 98 99 12 Return on Assets 100 101 13 Return on Equity 102 103 14 Price-earnings ratio 104 105 15 Gross Margin % - Gross Profit/ Revenue 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 Subtotal 3.75 15.00 18.75 Other points available 0.25 Filename format (example: Excel Case 1 Dover MGwinn 01W) Excel Case 1 Dover FirstinitialLastname sectionnumber Submitted ontime through Blackboard 1.00 Total available 20.00 The instructions for the case (20 points) are on the Excel sheet that I am providing. Your work must be done with Excel formulas and cell references. You will not earn points by simply typing in the answers. You are allowed two submissions, but I will only grade the last attempt. Thanks. Here is a profile of the company: Dover Corp. (ticker symbol DOV) is in the industrials sector of the S&P 500. The company engages in the manufacture of equipment, components, and specialty systems. It also provides supporting engineering, testing, and other similar services. It operates through the following segments: Engineered Systems, Fluids, and Refrigeration and Food Equipment. The Engineered Systems segment focuses on the design, manufacture, and service of critical equipment and components serving the fast-moving consumer goods, digital textile printing, vehicle service, environmental solutions, and industrial end markets. The Fluids segment focuses on the safe handling of critical fluids and gases the retail fueling, chemical, hygienic, and industrial end markets. The Refrigeration and Food Equipment segment provides innovative and energy-efficient equipment and systems serving the commercial refrigeration and food equipment end markets. The company was founded by George L. Ohrstrom in 1947 and is headquartered in Downers Grove, IL. Excel File Edit View View Insert Format Tools Data Window Help O * 19% O Tue 10:12 AM E 000 AutoSave OFF HES 5 = Excel Case 1 Dover students X Calibri (Body) Co- v 11 ' Insert v = = General ab Wrap Text Ayu O 5 Delete v Paste A BI V Ideas Merge & Center v .00 .00 0 $ %) Conditional Format Cell Formatting as Table Styles Format v Sort & Filter Find & Select N6 fx B D E F . J L M N O P Q R INSTRUCTIONS 1 Excel Case #1 - Analysis of Dover Corporation (DOV) 2 all answers should be denoted on the DOV Financial Stmts worksheet, below the income statements 3 Use the formulas in Table 3.5 Points available Correct format Correct calculations Total format: currency, O decimal places : , 0.25 1.00 1.25 format: percentage, 0 decimal places format: percentage, 0 decimal places 0.125 0.125 0.50 0.50 0.625 0.625 format: currency, O decimal places 0.25 1.00 1.25 format: number, 2 decimal places 0.25 1.00 1.25 format: number, 2 decimal places 0.25 1.00 1.25 4 Calculate the following for each of the six most recent years: 5 6 1 Net Working Capital 7 8 2 Capital Structure (debt %) 9 Capital Structure (equity %) 10 11 3 Operating Cash Flow 12 13 4 Current Ratio 14 15 5 Times Interest Earned 16 17 6 Inventory Turnover 18 19 7 Days' Sales in Inventory 20 21 8 Receivables Turnover 22 23 9 Days' Sales in Receivables 24 25 10 Total Asset Turnover 26 27 11 Profit Margin format: number, 2 decimal places 0.25 1.00 1.25 format:number, 2 decimal places 0.25 1.00 1.25 format: number, 2 decimal places : 2 0.25 1.00 1.25 format: number, 2 decimal places 0.25 1.00 1.25 format: number, 2 decimal places 0.25 1.00 1.25 format: percentage, 2 decimal places 0.25 1.00 1.25 28 12 Return on Assets format: percentage, 2 decimal places 0.25 1.00 29 30 1.25 13 Return on Equity format: percentage, 2 decimal places 0.25 1.00 1.25 31 32 33 14 Price-earnings ratio format: number, 2 decimal places 0.25 1.00 1.25 Instructions DOV Financial Stmts + Ready IT 3 + 100% INSTRUCTIONS Excel Case #1 - Analysis of Dover Corporation (DOV) all answers should be denoted on the DOV Financial Stmts worksheet, below the income statements Use the formulas in Table 3.5 Points available Correct format Correct calculations Calculate the following for each of the six most recent years: Total 1 Net Working Capital format: currency, o decimal places 0.25 1.00 1.25 2 Capital Structure (debt %) Capital Structure (equity %) ) format: percentage, 0 decimal places format: percentage, 0 decimal places 0.125 0.125 0.50 0.50 0.625 0.625 3 Operating Cash Flow format: currency, o decimal places : O 0.25 1.00 1.25 4 Current Ratio format: number, 2 decimal places 0.25 1.00 1.25 5 Times Interest Earned format: number, 2 decimal places 0.25 1.00 1.25 6 6 Inventory Turnover format: number, 2 decimal places 0.25 1.00 1.25 7 Days' Sales in Inventory format: number, 2 decimal places 0.25 1.00 1.25 8 Receivables Turnover format: number, 2 decimal places 0.25 1.00 1.25 9 Days' Sales in Receivables format: number, 2 decimal places 0.25 1.00 1.25 10 Total Asset Turnover format: number, 2 decimal places : , 0.25 1.00 1.25 11 Profit Margin format: percentage, 2 decimal places 0.25 1.00 1.25 12 Return on Assets format: percentage, 2 decimal places 0.25 1.00 1.25 13 Return on Equity format: percentage, 2 decimal places 0.25 1.00 1.25 14 Price-earnings ratio format: number, 2 decimal places 0.25 1.00 1.25 N6 B C D E F G K L M N 9 Days' Sales in Receivables format: number, 2 decimal places 0.25 1.00 1.25 10 Total Asset Turnover format: number, 2 decimal places 0.25 1.00 1.25 11 Profit Margin format: percentage, 2 decimal places 0.25 1.00 1.25 12 Return on Assets format: percentage, 2 decimal places 0.25 1.00 1.25 13 Return on Equity format: percentage, 2 decimal places 0.25 1.00 1.25 14 Price-earnings ratio format: number, 2 decimal places 0.25 1.00 1.25 15 Gross Margin % = Gross Profit/ Revenue format: percentage, 2 decimal places 0.25 1.00 1.25 Subtotal 3.75 15.00 18.75 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 Other points available 0.25 Filename format (example: Excel Case 1 Dover MGwinn 01W) Excel Case 1 Dover FirstinitialLastname sectionnumber Submitted ontime through Blackboard 1.00 Total 20.00 FA B72 X A B D E F G . I J K L M N 0 DOVER CORP (DOV) BALANCE SHEET Fiscal year ends in December. USD in millions 2019-12 2018-12 2017-12 2016-12 2015-12 2015-12 2014-12 397 1,217 806 396 1,232 749 754 1,386 879 349 1,265 870 362 1,120 803 682 1,187 864 63 101 2,897 128 2,548 127 2,504 189 3,208 104 2,588 135 2,420 1 2 3 4 5 6 7 8 9 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 Assets Current assets Cash and cash equivalents Receivables Inventories Deferred income taxes Prepaid expenses Total current assets Non-current assets Property, plant and equipment Accumulated Depreciation Goodwill Intangible assets Other long-term assets Total non-current assets Total assets 2,232 (1,390) 3,783 1,055 441 6,121 8,669 2,139 (1,332) 3,677 1,134 244 5,862 8,366 2,603 (1,604) 4,592 1,610 249 7,450 10,658 2,469 (1,523) 4,563 1,803 216 7,528 10,116 2,374 (1,520) 3,738 1,413 194 6,199 8,619 2,291 (1,454) 3,492 1,370 495 6,194 9,091 220 970 49 Liabilities Current liabilities Short-term debt Accounts payable Taxes payable Accrued liabilities Deferred revenues Other current liabilities Total current liabilities Non-current liabilities Long-term debt Deferred taxes liabilities Accrued liabilities Other long-term liabilities Total non-current liabilities Instructions DOV Financial Stmts 85 983 54 242 40 346 1,750 297 36 423 581 979 60 313 53 511 2,497 415 830 74 305 42 471 2,137 151 651 32 241 28 460 1,563 778 615 40 266 21 320 2,040 1,995 2,986 322 52 526 3,886 2,944 339 31 287 3,601 2,987 439 34 318 3,778 3,206 710 31 233 4,180 2,617 576 30 189 3,412 2,253 564 32 502 3,351 + B72 fx A B C D E F G H T J L M N O P Q 34 35 36 37 Other long-term liabilities Total non-current liabilities Total liabilities 526 3,886 287 3,601 5,596 318 3,778 6,275 233 4,180 6,317 189 3,412 4,975 502 3,351 5,391 5,636 38 39 40 Stockholders' equity Common stock Additional paid-in capital Retained earnings Treasury stock Total stockholders' equity 259 870 8,211 (6,307) 3,033 258 886 7,816 (6,190) 2,770 257 942 8,456 (5,272) 4,383 257 947 7,927 (5,332) 3,799 256 928 7,687 (5,227) 3,644 256 901 7,075 (4,532) 3,700 41 42 43 44 45 46 47 48 Total liabilities and stockholders' equity 8,669 8,366 10,658 10,116 8,619 9,091 DOVER CORP (DOV) INCOME STATEMENT Fiscal year ends in December. USD in millions except per share data. 2018-12 2018-12 2017-12 2016-12 2015-12 2014-12 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 Revenue (Sales) Cost of revenue (Cost of goods sold) Gross profit Sales, general and administrative Operating income Interest Expense Other income (expense) Income before taxes Provision for income taxes Net income 7,136 4,515 2,621 1,646 975 126 (6) 843 165 678 6,992 4,433 2,559 1,716 843 131 13 7,830 4,940 2,890 1,976 914 145 205 974 162 812 6,794 4,322 2,472 1,758 714 136 6,956 4,388 2,568 1,647 921 132 12 801 7,753 4,778 2,975 1,759 1,216 132 10 1,094 316 778 725 134 591 111 689 180 509 205 596 Price per share Earnings per share 115.26 4.61 70.95 3.75 81.58 5.15 60.52 3.25 49.52 5.46 59.93 4.59 EBITDA 1,449 1,139 1,513 1,186 1,259 1,533 Instructions DOV Financial Stmts + B72 fx A B C D E F G . I J K L M N O Q 2019-12 2018-12 2017-12 2016-12 2015-12 2014-12 format: currency, o decimal places 0.25 1.00 1.25 format: percentage, 0 decimal places format: percentage, 0 decimal places 0.125 0.125 0.50 0.50 0.625 0.625 format: currency, o decimal places 0.25 1.00 1.25 format: number, 2 decimal places 0.25 1.00 1.25 format: number, 2 decimal places 0.25 1.00 1.25 70 71 Answers should be denoted in the section below: 72 73 74 Dover Corporation (DOV) 75 76 1 Net Working Capital 77 78 2 Capital Structure-debt% 79 Capital Structure-equity% 80 81 3 Operating Cash Flow 82 83 4 Current Ratio 84 85 5 Times Interest Earned 86 87 6 Inventory Turnover 88 89 7 Days' Sales in Inventory 90 91 8 Receivables Turnover 92 93 9 Days' Sales in Receivables 94 95 10 Total Asset Turnover 96 97 11 Profit Margin 98 99 12 Return on Assets 100 101 13 Return on Equity 102 103 14 Price-earnings ratio 104 format: number, 2 decimal places 0.25 1.00 1.25 format: number, 2 decimal places : 0.25 1.00 1.25 format: number, 2 decimal places 0.25 1.00 1.25 format: number, 2 decimal places 0.25 1.00 1.25 format: number, 2 decimal places 0.25 1.00 1.25 format: percentage, 2 decimal places 0.25 1.00 1.25 format: percentage, 2 decimal places 0.25 1.00 1.25 format: percentage, 2 decimal places 0.25 1.00 1.25 format: number, 2 decimal places 0.25 1.00 1.25 B72 fx B D E F G . I K L M N 0 P P Q format: number, 2 decimal places 0.25 1.00 1.25 format: number, 2 decimal places 0.25 1.00 1.25 format: number, 2 decimal places 0.25 1.00 1.25 format: number, 2 decimal places 0.25 1.00 1.25 format: percentage, 2 decimal places 0.25 1.00 1.25 format: percentage, 2 decimal places 0.25 1.00 1.25 format: percentage, 2 decimal places 0.25 1.00 1.25 format: number, 2 decimal places 0.25 1.00 1.25 format: percentage, 2 decimal places 0.25 1.00 1.25 89 7 Days' Sales in Inventory 90 91 8 Receivables Turnover 92 93 9 Days' Sales in Receivables 94 95 10 Total Asset Turnover 96 97 11 Profit Margin 98 99 12 Return on Assets 100 101 13 Return on Equity 102 103 14 Price-earnings ratio 104 105 15 Gross Margin % - Gross Profit/ Revenue 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 Subtotal 3.75 15.00 18.75 Other points available 0.25 Filename format (example: Excel Case 1 Dover MGwinn 01W) Excel Case 1 Dover FirstinitialLastname sectionnumber Submitted ontime through Blackboard 1.00 Total available 20.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts