Question: hello, please answer question 2. I guarantee a thumps up/ upvote for corrwct answe with working. thank you. Given the following information for the Format

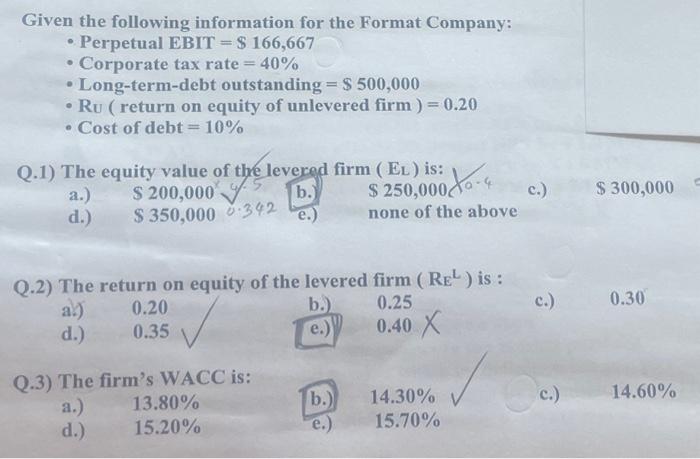

Given the following information for the Format Company: - Perpetual EBIT \\( =\\$ 166,667 \\) - Corporate tax rate \=40 - Long-term-debt outstanding \\( =\\$ 500,000 \\) - Ru (return on equity of unlevered firm) \\( =\\mathbf{0 . 2 0} \\) - Cost of debt \=10 Q.1) The equity value of the levered firm ( \\( \\left.E_{L}\ ight) \\) is: a.) \\( \\$ 200,000 \\) y. b. \\( \\$ 250,000 \\) c.) \\( \\$ 300,000 \\) d.) \\$ 350,000 e.) none of the above Q.2) The return on equity of the levered firm \\( \\left(R_{E}^{L}\ ight) \\) is : a.) 0.20 b.) 0.25 c.) 0.30 d.) 0.35 e.) 0.40 Q.3) The firm's WACC is: a.) \13.80 b.) \14.30 c.) \14.60 d.) \15.20 e.) \15.70

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts