Question: hello, please answer question 7. I guarantee a upvote for correct answer along with correct working please. thank you. A proposed cost saving device has

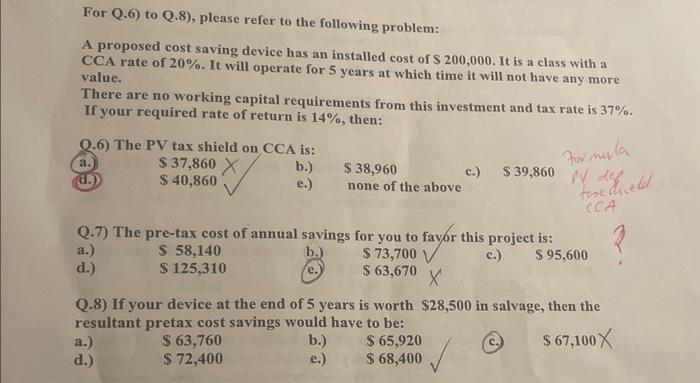

A proposed cost saving device has an installed cost of \\( \\$ 200,000 \\). It is a class with a CCA rate of \20. It will operate for 5 years at which time it will not have any more value. There are no working capital requirements from this investment and tax rate is \37. If your required rate of return is \14, then: Q.6) The PV tax shield on CCA is: a. \\$ 37,860 \\( \\$ 40,860 \\) b.) \\( \\$ 38,960 \\) c.) \\( \\$ 39,860 \\) (a.) e.) none of the above Q.7) The pre-tax cost of annual savings for you to fayor this project is: a.) s 58,140 b.) d.) \\$ 125,310 \\( \\$ 73,700 \\) c.) \\( \\$ 95,600 \\) Q.8) If your device at the end of 5 years is worth \\( \\$ 28,500 \\) in salvage, then the resultant pretax cost savings would have to be: a.) \\( \\$ 63,760 \\) b.) \\( \\$ 65,920 \\) c. \\( \\$ 67,100 \\) d.) \\( \\$ \\mathbf{7 2 , 4 0 0} \\) e.) \\( \\$ 68,400 \\) \\( \\sqrt{1} \\)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts