Question: Hello please answer these two question for me. 5. A company is buying machinery for their manufacturing floor that is worth $355,000. The machinery has

Hello please answer these two question for me.

Hello please answer these two question for me.

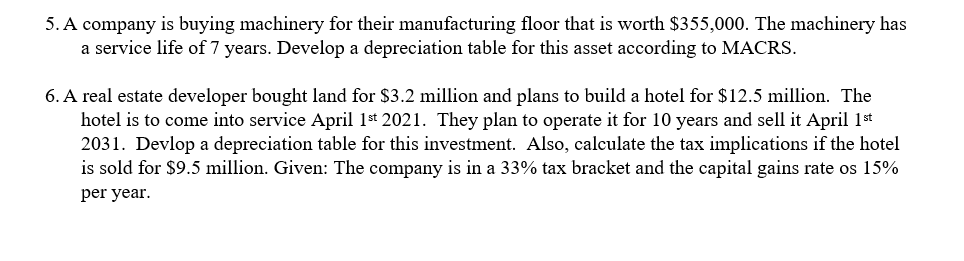

5. A company is buying machinery for their manufacturing floor that is worth $355,000. The machinery has a service life of 7 years. Develop a depreciation table for this asset according to MACRS. 6. A real estate developer bought land for $3.2 million and plans to build a hotel for $12.5 million. The hotel is to come into service April 1st 2021. They plan to operate it for 10 years and sell it April 1st 2031. Devlop a depreciation table for this investment. Also, calculate the tax implications if the hotel is sold for $9.5 million. Given: The company is in a 33% tax bracket and the capital gains rate os 15% per year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts