Question: Hello, please calculated step by step with explanation and show exactly what to fill in the boxes in b and c. my confusion is if

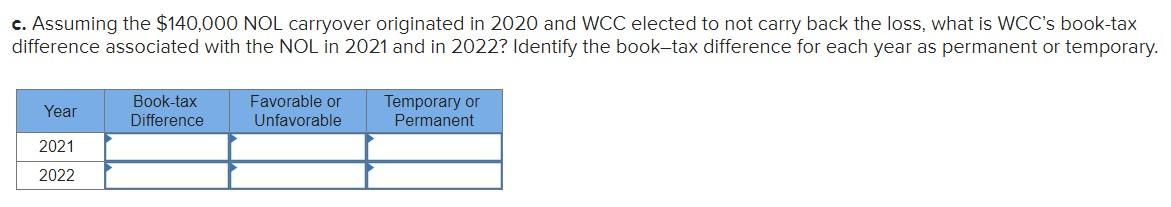

Hello, please calculated step by step with explanation and show exactly what to fill in the boxes in b and c. my confusion is if NOL originated in 2020 offsets 100% or 80% of taxable income and to calculate book-tax differences in c and please show temp or not and favorable or not. Thank you

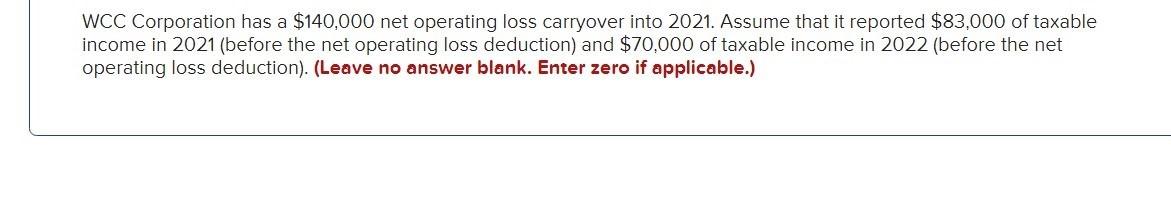

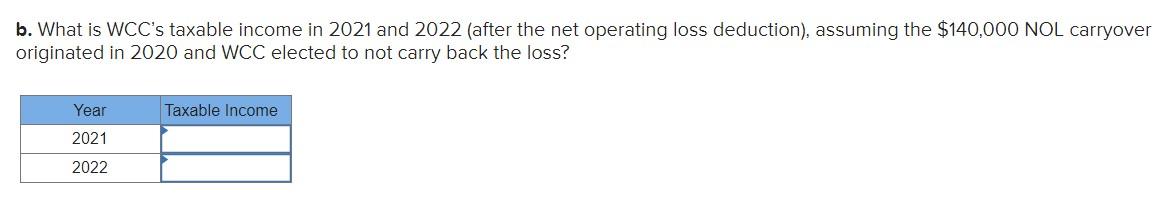

WCC Corporation has a $140,000 net operating loss carryover into 2021 . Assume that it reported $83,000 of taxable income in 2021 (before the net operating loss deduction) and $70,000 of taxable income in 2022 (before the net operating loss deduction). (Leave no answer blank. Enter zero if applicable.) b. What is WCC's taxable income in 2021 and 2022 (after the net operating loss deduction), assuming the $140,000 NOL carryover originated in 2020 and WCC elected to not carry back the loss? c. Assuming the $140,000NOL carryover originated in 2020 and WCC elected to not carry back the loss, what is WCC's book-tax difference associated with the NOL in 2021 and in 2022 ? Identify the book-tax difference for each year as permanent or temporary

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts