Question: Hello, please calculated step by step with explanation and show exactly what to fill in the boxes in b and c. my confusion is if

Hello, please calculated step by step with explanation and show exactly what to fill in the boxes in b and c. my confusion is if NOL originated in 2020 offsets 100% or 80% of taxable income and to calculate book-tax differences in c ! Thank you

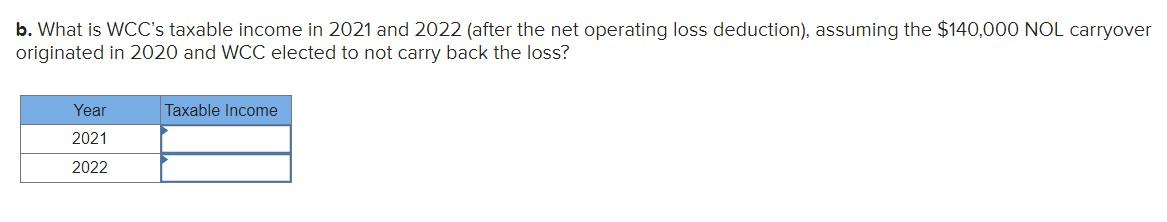

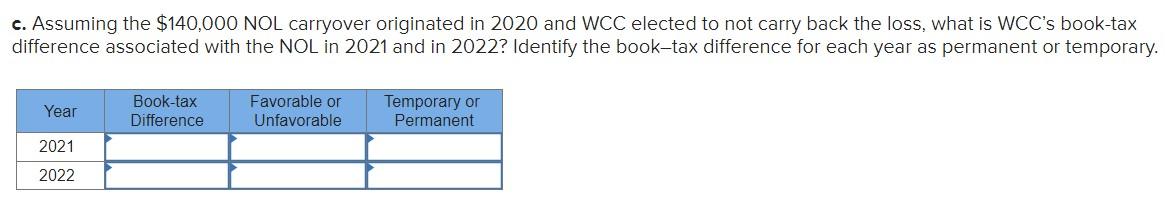

b. What is WCC's taxable income in 2021 and 2022 (after the net operating loss deduction), assuming the $140,000 NOL carryover originated in 2020 and WCC elected to not carry back the loss? c. Assuming the $140,000NOL carryover originated in 2020 and WCC elected to not carry back the loss, what is WCC's book-tax difference associated with the NOL in 2021 and in 2022 ? Identify the book-tax difference for each year as permanent or temporary

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts