Question: Hello Please help Balance Sheet Jay Pembroke started a business. During the first month (April 20--), the following transactions occurred. Invested cash in business, $19,000.

Hello

Please help

Balance Sheet

Jay Pembroke started a business. During the first month (April 20--), the following transactions occurred.

- Invested cash in business, $19,000.

- Bought office supplies for $4,800: $2,000 in cash and $2,800 on account.

- Paid one-year insurance premium, $1,200.

- Earned revenues totaling $3,200: $1,200 in cash and $2,000 on account.

- Paid cash on account to the company that supplied the office supplies in transaction (b), $2,500.

- Paid office rent for the month, $900.

- Withdrew cash for personal use, $100.

The effect of each transaction is shown in the individual accounts of the expanded accounting equation.

| Assets | = | Liabilities | + | Owner's Equity | |||||||||||||||

| (Items Owned) | (Amts. Owed) | (Owner's Investment) | (Earnings) | ||||||||||||||||

| Cash | + | Accounts Receivable | + | Office Supplies | + | Prepaid Insurance | = | Accounts Payable | + | J. Pembroke, Capital | - | J. Pembroke, Drawing | + | Revenues | - | Expenses | Description | ||

| a. | 19,000 | 19,000 | |||||||||||||||||

| b. | (2,000) | 4,800 | 2,800 | ||||||||||||||||

| c. | (1,200) | 1,200 | |||||||||||||||||

| d. | 1,200 | 2,000 | 3,200 | Service fees | |||||||||||||||

| e. | (2,500) | (2,500) | |||||||||||||||||

| f. | (900) | 900 | Rent expense | ||||||||||||||||

| g. | (100) | 100 | |||||||||||||||||

| Bal. | 13,500 | + | 2,000 | + | 4,800 | + | 1,200 | = | 300 | + | 19,000 | - | 100 | + | 3,200 | - | 900 | ||

The income statement and statement of owner's equity for Jay Pembroke for the month ended April 30, 20-- are shown.

| Jay Pembroke Income Statement For Month Ended April 30, 20-- | |

| Revenues: | |

| Service fees | $3,200 |

| Expenses: | |

| Rent expense | 900 |

| Net income | $2,300 |

| Jay Pembroke Statement of Owners Equity For Month Ended April 30, 20-- | ||

| Jay Pembroke, capital, April 1, 20-- | $ - | |

| Investment during April | 19,000 | |

| Total investment | $19,000 | |

| Net income for April | $2,300 | |

| Less withdrawals for April | 100 | |

| Increase in capital | 2,200 | |

| Jay Pembroke, capital, April 30, 20-- | $21,200 | |

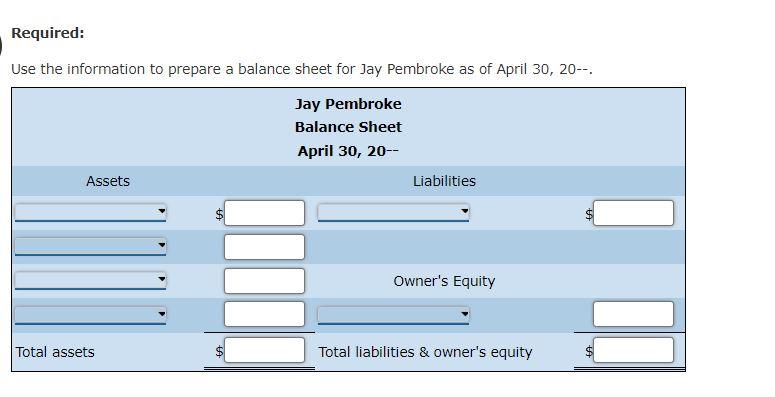

Required:

Use the information to prepare a balance sheet for Jay Pembroke as of April 30, 20--.

Required: Use the information to prepare a balance sheet for Jay Pembroke as of April 30, 20-- Jay Pembroke Balance Sheet April 30, 20-- Assets Liabilities Owner's Equity Total assets $ Total liabilities & owner's equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts