Question: hello! please help i just need help with the indirect and direct statement of cash flows 3 Use the following financial statements and additional information.

hello! please help i just need help with the indirect and direct statement of cash flows

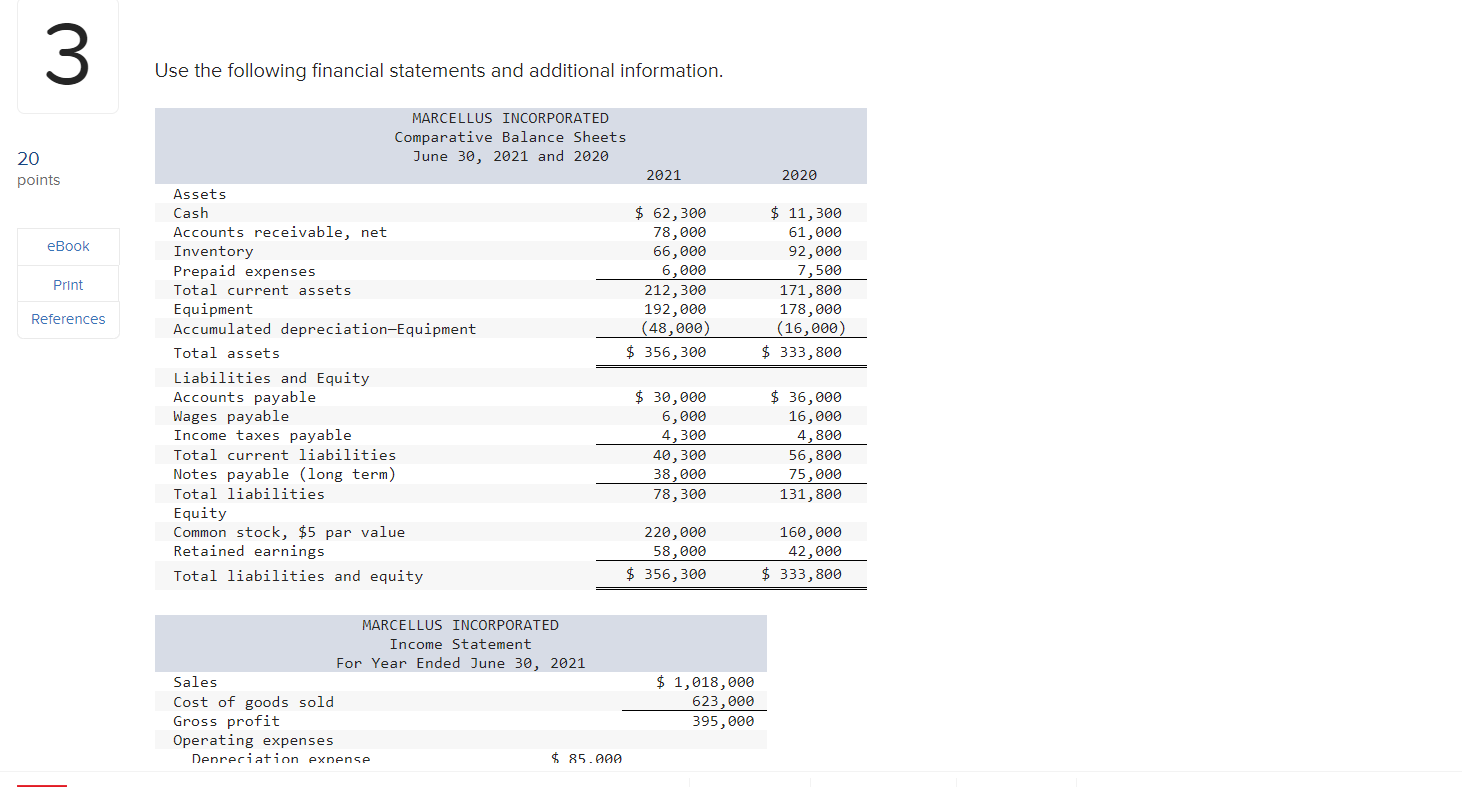

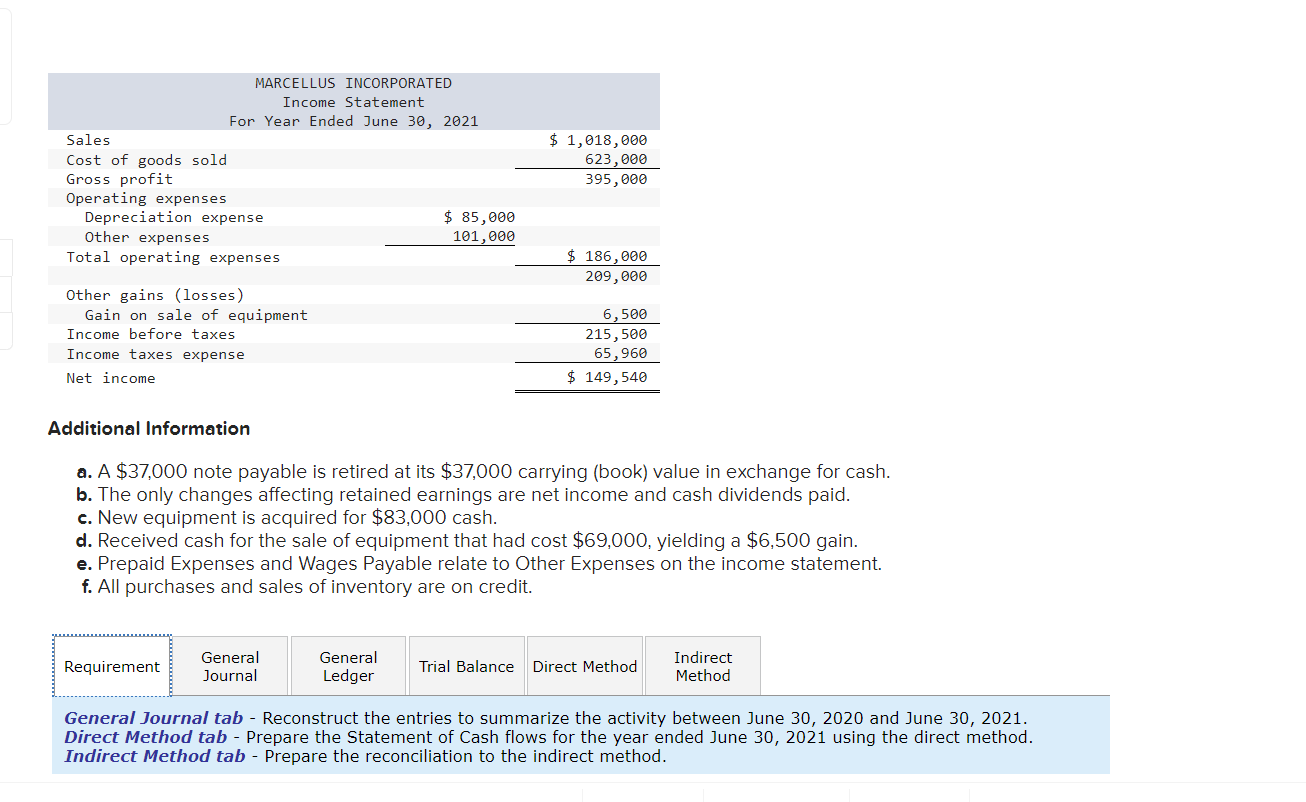

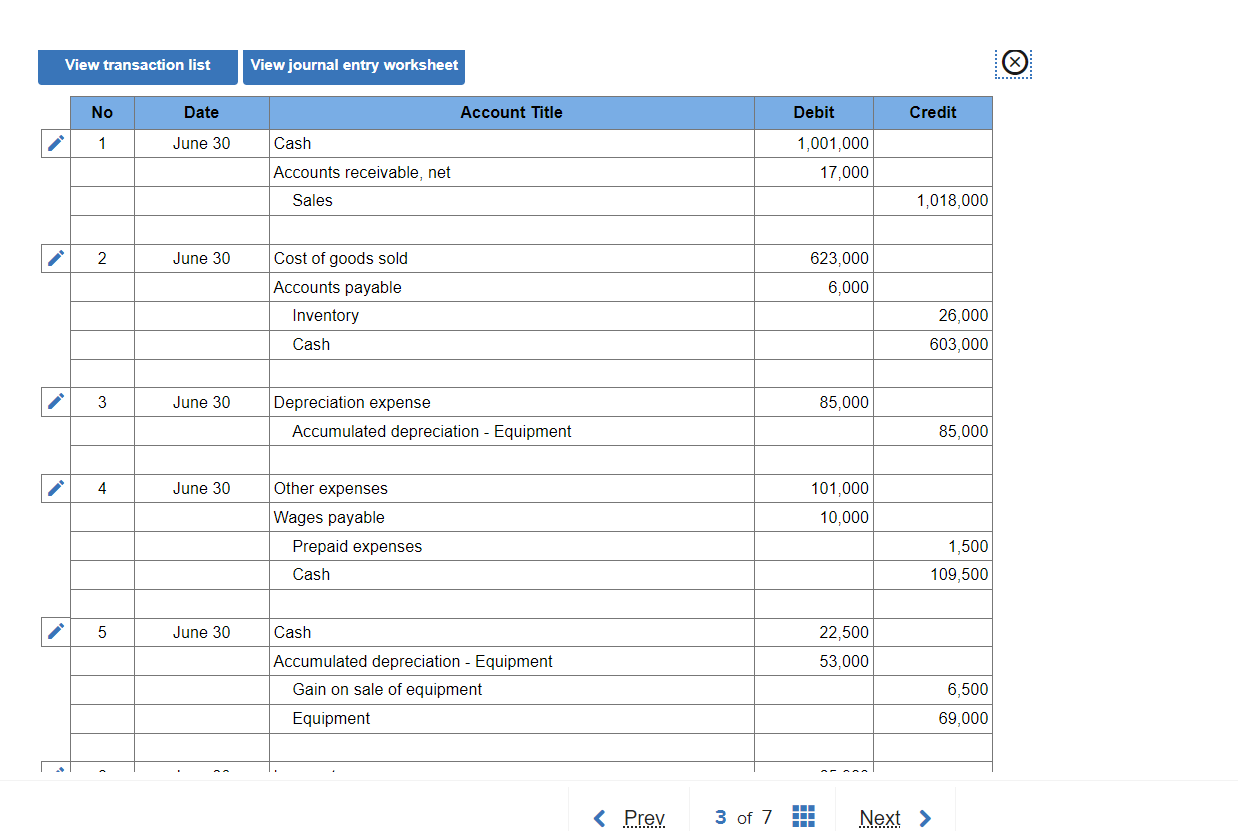

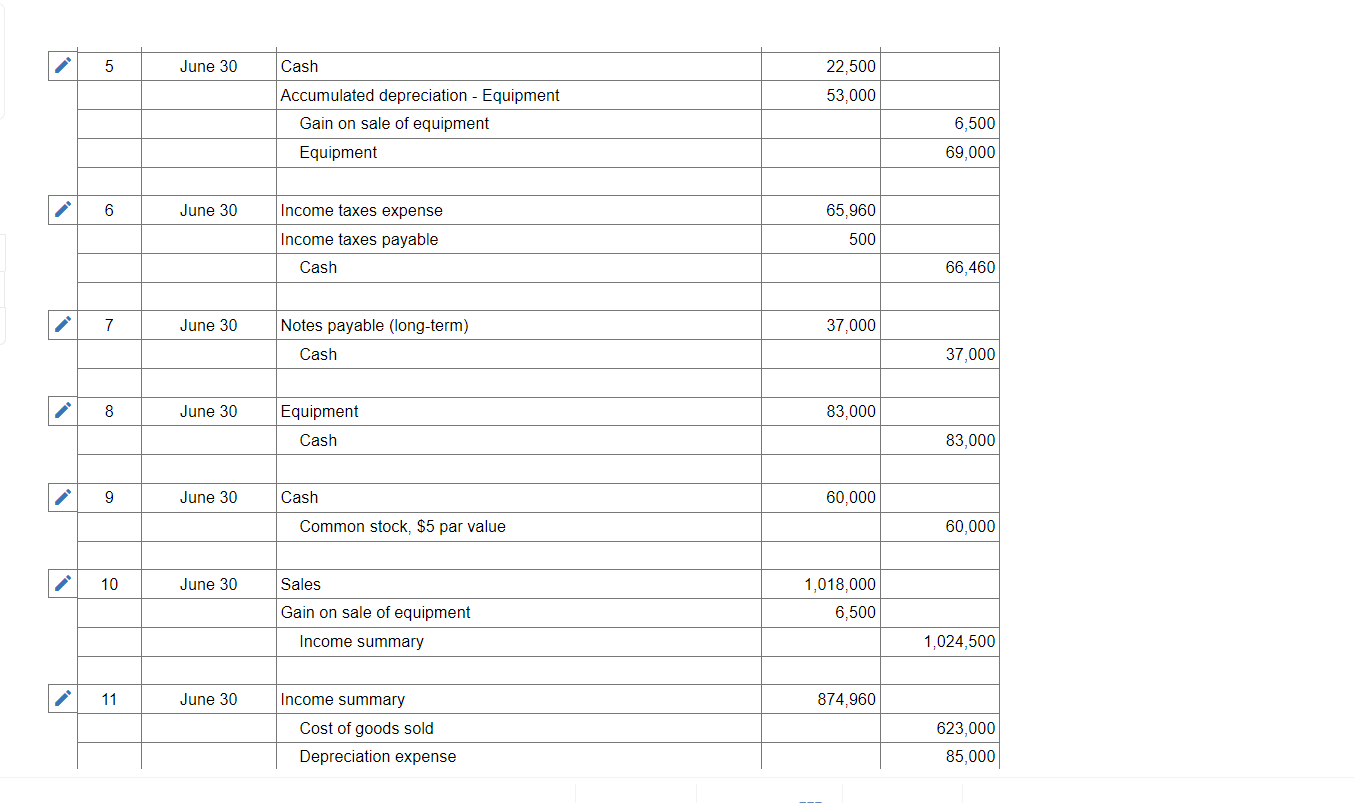

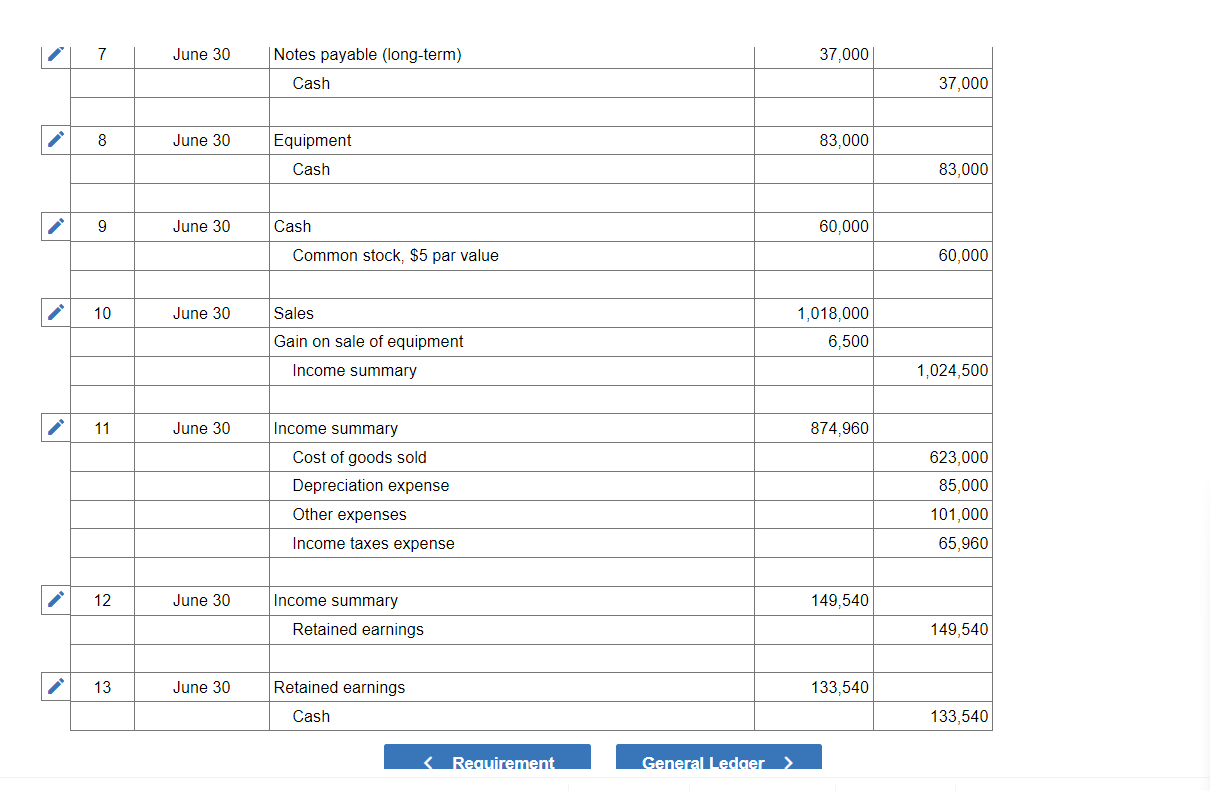

3 Use the following financial statements and additional information. MARCELLUS INCORPORATED Comparative Balance Sheets 20 June 30, 2021 and 2020 points 2021 2020 Assets Cash $ 62,300 $ 11, 306 Accounts receivable, net 78, 000 61, 006 eBook Inventory 66, 000 92, 000 Prepaid expenses 6,000 7,500 Print Total current assets 212, 300 171, 806 References Equipment 192, 000 178, 000 Accumulated depreciation-Equipment (48, 000) (16, 000) Total assets $ 356, 300 $ 333, 800 Liabilities and Equity Accounts payable $ 30,000 $ 36,000 Wages payable 6,000 16,000 Income taxes payable 4, 300 4, 800 Total current liabilities 40, 300 56, 800 Notes payable (long term) 38,000 75, 000 Total liabilities 78,300 131, 800 Equity Common stock, $5 par value 220, 000 160, 000 Retained earnings 58, 000 42,000 Total liabilities and equity $ 356, 300 $ 333, 800 MARCELLUS INCORPORATED Income Statement For Year Ended June 30, 2021 Sales $ 1, 018,000 Cost of goods sold 523, 000 Gross profit 395, 000 Operating expenses Depreciation expense $ 85. AAAMARCELLUS INCORPORATED Income Statement For Year Ended June 36J 2621 Sales $ 1,613,666 Cost of goods sold 623,666 Gross protit 395,966 Operating expenses Depreciation expense $ 85J666 Other expenses 161,666 Total operating expenses $ 186,666 269,666 Other gains (losses) Gain on sale of equipment 6,506 Income before taxes 215,566 Income taxes expense 65,966 Net income $ 149,546 Additional Information 6.13. $37,000 note payable is retired at its $37,000 carrying (book) value in exchange for cash. b. The only changes affecting retained earnings are net income and cash dividends paid. 1:. New equipment is acquired for $83,000 cash. d. Received cash for the sale of equipment that had cost $69,000, yielding a $6,500 gain. e. Prepaid Expenses and Wages Payable relate to Other Expenses on the income statement. f. All purchases and sales of inventory are on credit. Indirect Method General General Trial Balance Direct Method Journal Ledger Requirement GeneralI Journal tab Reconstruct the entries to summarize the activity between June 30, 2020 and June 30, 2021. Direct Method tab Prepare the Statement of Cash flows for the year ended June 30, 2021 using the direct method. Indirect Method tab Prepare the reconciliation to the indirect method. View transaction list View journal entry worksheet X No Date Account Title Debit Credit 1 June 30 Cash 1,001,000 Accounts receivable, net 17,000 Sales 1,018,000 2 June 30 Cost of goods sold 623,000 Accounts payable 6,000 Inventory 26,000 Cash 603,000 3 June 30 Depreciation expense 85,000 Accumulated depreciation - Equipment 85,000 4 June 30 Other expenses 101,000 Wages payable 10,000 Prepaid expenses 1,500 Cash 109,500 5 June 30 Cash 22,500 Accumulated depreciation - Equipment 53,000 Gain on sale of equipment 6,500 Equipment 69.000 5 June 30 Cash 22,500 Accumulated depreciation - Equipment 53,000 Gain on sale of equipment 6,500 Equipment 69,000 6 June 30 Income taxes expense 65,960 Income taxes payable 500 Cash 66,460 7 June 30 Notes payable (long-term) 37,000 Cash 37,000 8 June 30 Equipment 83,000 Cash 83,000 9 June 30 Cash 60.000 Common stock, $5 par value 60,000 10 June 30 Sales 1,018,000 Gain on sale of equipment 6,500 Income summary 1,024,500 11 June 30 Income summary 874,960 Cost of goods sold 623,000 Depreciation expense 85,0007 June 30 Notes payable (long-term) 37,000 Cash 37,000 8 June 30 Equipment 83,000 Cash 83,000 9 June 30 Cash 60,000 Common stock, $5 par value 60.000 10 June 30 Sales 1,018,000 Gain on sale of equipment 6,500 Income summary 1,024,500 11 June 30 Income summary 874,960 Cost of goods sold 623,000 Depreciation expense 85,000 Other expenses 101,000 Income taxes expense 65,960 12 June 30 Income summary 149,540 Retained earnings 149,540 13 June 30 Retained earnings 133,540 Cash 133,540 rust-LIVSIny MARCELLUS INCORPORATED Statement of Cash Flows (Direct Method) For Year Ended June 30, 2021 Cash flows from operating activities: Cash flows from investing activities: Cash flows from financing activities:Postsclosing v Cash ows from operating activities: Net income 53 149,540 Adjustments to reconcile net income to net cash provided by operating activities: Income statement items not affecting cash Changes in current operating assets and liabilities

3 Use the following financial statements and additional information. MARCELLUS INCORPORATED Comparative Balance Sheets 20 June 30, 2021 and 2020 points 2021 2020 Assets Cash $ 62,300 $ 11, 306 Accounts receivable, net 78, 000 61, 006 eBook Inventory 66, 000 92, 000 Prepaid expenses 6,000 7,500 Print Total current assets 212, 300 171, 806 References Equipment 192, 000 178, 000 Accumulated depreciation-Equipment (48, 000) (16, 000) Total assets $ 356, 300 $ 333, 800 Liabilities and Equity Accounts payable $ 30,000 $ 36,000 Wages payable 6,000 16,000 Income taxes payable 4, 300 4, 800 Total current liabilities 40, 300 56, 800 Notes payable (long term) 38,000 75, 000 Total liabilities 78,300 131, 800 Equity Common stock, $5 par value 220, 000 160, 000 Retained earnings 58, 000 42,000 Total liabilities and equity $ 356, 300 $ 333, 800 MARCELLUS INCORPORATED Income Statement For Year Ended June 30, 2021 Sales $ 1, 018,000 Cost of goods sold 523, 000 Gross profit 395, 000 Operating expenses Depreciation expense $ 85. AAAMARCELLUS INCORPORATED Income Statement For Year Ended June 36J 2621 Sales $ 1,613,666 Cost of goods sold 623,666 Gross protit 395,966 Operating expenses Depreciation expense $ 85J666 Other expenses 161,666 Total operating expenses $ 186,666 269,666 Other gains (losses) Gain on sale of equipment 6,506 Income before taxes 215,566 Income taxes expense 65,966 Net income $ 149,546 Additional Information 6.13. $37,000 note payable is retired at its $37,000 carrying (book) value in exchange for cash. b. The only changes affecting retained earnings are net income and cash dividends paid. 1:. New equipment is acquired for $83,000 cash. d. Received cash for the sale of equipment that had cost $69,000, yielding a $6,500 gain. e. Prepaid Expenses and Wages Payable relate to Other Expenses on the income statement. f. All purchases and sales of inventory are on credit. Indirect Method General General Trial Balance Direct Method Journal Ledger Requirement GeneralI Journal tab Reconstruct the entries to summarize the activity between June 30, 2020 and June 30, 2021. Direct Method tab Prepare the Statement of Cash flows for the year ended June 30, 2021 using the direct method. Indirect Method tab Prepare the reconciliation to the indirect method. View transaction list View journal entry worksheet X No Date Account Title Debit Credit 1 June 30 Cash 1,001,000 Accounts receivable, net 17,000 Sales 1,018,000 2 June 30 Cost of goods sold 623,000 Accounts payable 6,000 Inventory 26,000 Cash 603,000 3 June 30 Depreciation expense 85,000 Accumulated depreciation - Equipment 85,000 4 June 30 Other expenses 101,000 Wages payable 10,000 Prepaid expenses 1,500 Cash 109,500 5 June 30 Cash 22,500 Accumulated depreciation - Equipment 53,000 Gain on sale of equipment 6,500 Equipment 69.000 5 June 30 Cash 22,500 Accumulated depreciation - Equipment 53,000 Gain on sale of equipment 6,500 Equipment 69,000 6 June 30 Income taxes expense 65,960 Income taxes payable 500 Cash 66,460 7 June 30 Notes payable (long-term) 37,000 Cash 37,000 8 June 30 Equipment 83,000 Cash 83,000 9 June 30 Cash 60.000 Common stock, $5 par value 60,000 10 June 30 Sales 1,018,000 Gain on sale of equipment 6,500 Income summary 1,024,500 11 June 30 Income summary 874,960 Cost of goods sold 623,000 Depreciation expense 85,0007 June 30 Notes payable (long-term) 37,000 Cash 37,000 8 June 30 Equipment 83,000 Cash 83,000 9 June 30 Cash 60,000 Common stock, $5 par value 60.000 10 June 30 Sales 1,018,000 Gain on sale of equipment 6,500 Income summary 1,024,500 11 June 30 Income summary 874,960 Cost of goods sold 623,000 Depreciation expense 85,000 Other expenses 101,000 Income taxes expense 65,960 12 June 30 Income summary 149,540 Retained earnings 149,540 13 June 30 Retained earnings 133,540 Cash 133,540 rust-LIVSIny MARCELLUS INCORPORATED Statement of Cash Flows (Direct Method) For Year Ended June 30, 2021 Cash flows from operating activities: Cash flows from investing activities: Cash flows from financing activities:Postsclosing v Cash ows from operating activities: Net income 53 149,540 Adjustments to reconcile net income to net cash provided by operating activities: Income statement items not affecting cash Changes in current operating assets and liabilities Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock