Question: Hello, please help me answer the questions. Please show work so I can understand the process. Thank you so much! 2 54 401 Use the

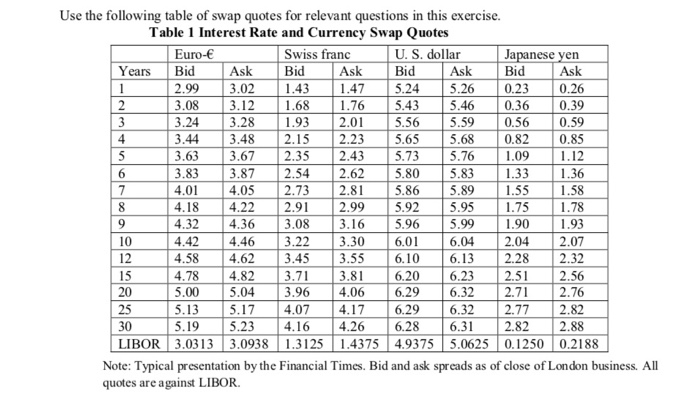

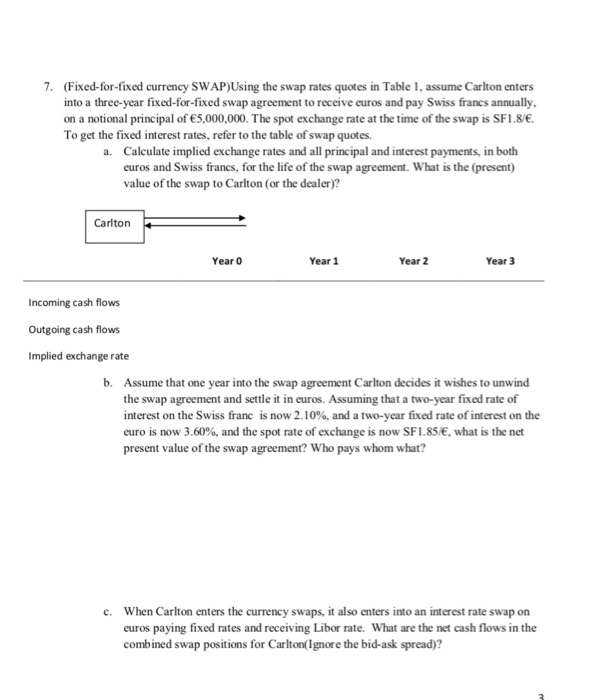

2 54 401 Use the following table of swap quotes for relevant questions in this exercise. Table 1 Interest Rate and Currency Swap Quotes Euro- Swiss franc U.S. dollar Japanese yen Years Bid Ask Bid Ask Bid Ask Bid Ask 2.99 3.021.431.47 5.24 5.26 0.23 0.26 3.08 3.12 1.68 1.76 5.43 5.46 0.36 0.39 3.24 3.28 1.93 2.01 5.56 5.59 0.56 0.59 3.44 3.48 2.15 2.23 5.65 5.68 0.82 0.85 3.63 3.67 2.35 2.43 5.73 5.76 1.09 1.12 3.83 3.87 2.62 5.80 5.83 1.33 1.36 14.05 2.73 2.81 5.89 1.55 1.58 4.18 4.22 2.91 2.99 5.95 1.75 1.78 4.36 3.08 3.16 1.90 3.22 6.04 4.62 3.45 3.55 6.13 4.78 4.82 3.71 3.81 6.20 6.23 56 5.00 5.04 3.96 4.06 6.296.322.71 2.76 5.135.174 .07 4.17 6.296 .32 2.77 2.82 30 5.195 .23 4.16 4.26 6.28 6.31 2.82 2.88 LIBOR 3.0313 3.0938 1.3125 1.4375 4.9375 5.0625 0.1250 0.2188 Note: Typical presentation by the Financial Times. Bid and ask spreads as of close of London business. All quotes are against LIBOR. 32 4 42 446 2.04 4.58 2.28 25 7. (Fixed-for-fixed currency SWAP) Using the swap rates quotes in Table 1, assume Carlton enters into a three-year fixed-for-fixed swap agreement to receive euros and pay Swiss francs annually, on a notional principal of 5,000,000. The spot exchange rate at the time of the swap is SF1.8/. To get the fixed interest rates, refer to the table of swap quotes. a. Calculate implied exchange rates and all principal and interest payments in both euros and Swiss francs, for the life of the swap agreement. What is the (present) value of the swap to Carlton (or the dealer)? Carlton Year 0 Year 1 Year 2 Year 3 Incoming cash flows Outgoing cash flows Implied exchange rate b. Assume that one year into the swap agreement Carlton decides it wishes to unwind the swap agreement and settle it in euros. Assuming that a two-year fixed rate of interest on the Swiss franc is now 2.10%, and a two-year fixed rate of interest on the curo is now 3.60%, and the spot rate of exchange is now SF1.85/, what is the net present value of the swap agreement? Who pays whom what? c. When Carlton enters the currency swaps, it also enters into an interest rate swap on euros paying fixed rates and receiving Libor rate. What are the net cash flows in the combined swap positions for Carlton Ignore the bid-ask spread)? 2 54 401 Use the following table of swap quotes for relevant questions in this exercise. Table 1 Interest Rate and Currency Swap Quotes Euro- Swiss franc U.S. dollar Japanese yen Years Bid Ask Bid Ask Bid Ask Bid Ask 2.99 3.021.431.47 5.24 5.26 0.23 0.26 3.08 3.12 1.68 1.76 5.43 5.46 0.36 0.39 3.24 3.28 1.93 2.01 5.56 5.59 0.56 0.59 3.44 3.48 2.15 2.23 5.65 5.68 0.82 0.85 3.63 3.67 2.35 2.43 5.73 5.76 1.09 1.12 3.83 3.87 2.62 5.80 5.83 1.33 1.36 14.05 2.73 2.81 5.89 1.55 1.58 4.18 4.22 2.91 2.99 5.95 1.75 1.78 4.36 3.08 3.16 1.90 3.22 6.04 4.62 3.45 3.55 6.13 4.78 4.82 3.71 3.81 6.20 6.23 56 5.00 5.04 3.96 4.06 6.296.322.71 2.76 5.135.174 .07 4.17 6.296 .32 2.77 2.82 30 5.195 .23 4.16 4.26 6.28 6.31 2.82 2.88 LIBOR 3.0313 3.0938 1.3125 1.4375 4.9375 5.0625 0.1250 0.2188 Note: Typical presentation by the Financial Times. Bid and ask spreads as of close of London business. All quotes are against LIBOR. 32 4 42 446 2.04 4.58 2.28 25 7. (Fixed-for-fixed currency SWAP) Using the swap rates quotes in Table 1, assume Carlton enters into a three-year fixed-for-fixed swap agreement to receive euros and pay Swiss francs annually, on a notional principal of 5,000,000. The spot exchange rate at the time of the swap is SF1.8/. To get the fixed interest rates, refer to the table of swap quotes. a. Calculate implied exchange rates and all principal and interest payments in both euros and Swiss francs, for the life of the swap agreement. What is the (present) value of the swap to Carlton (or the dealer)? Carlton Year 0 Year 1 Year 2 Year 3 Incoming cash flows Outgoing cash flows Implied exchange rate b. Assume that one year into the swap agreement Carlton decides it wishes to unwind the swap agreement and settle it in euros. Assuming that a two-year fixed rate of interest on the Swiss franc is now 2.10%, and a two-year fixed rate of interest on the curo is now 3.60%, and the spot rate of exchange is now SF1.85/, what is the net present value of the swap agreement? Who pays whom what? c. When Carlton enters the currency swaps, it also enters into an interest rate swap on euros paying fixed rates and receiving Libor rate. What are the net cash flows in the combined swap positions for Carlton Ignore the bid-ask spread)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts